Then, Exxon could get back to work with Rosneft. For reference, over the past 33 years, Exxon has continuously and consecutively increased its dividend. Motley Fool. The prevailing wisdom that somehow this position had to be filled by someone from government, with political experience, was blown to bits. View the discussion thread. Having trouble logging in? The annual dividend increase comes in at an average of 10 percent a year over the last decade. And, of course, earnings are going to fluctuate based on thailand futures trading hours best aerospace & defence stock price of oil and natural gas. Russia wants the oil, also, so both countries can be less dependent on oil from the Middle East. Sign in. Readers of my column and investors in my investment advisory newsletter, The LibertyPortfolioknow that I consider energy to be a core holding in any long-term diversified portfolio. Register Here. Investor's Business Daily. Lawrence Meyers. Unfortunately, sanctions were in place on Russia which prohibited XOM stock from engaging and profiting from this venture. Few predicted that oil prices would fall so far or fast, and natural gas prices have been in a multi-year rut thanks to hydraulic fracturing fracking techniques that have helped revive production in the U. Having trouble logging in? Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. Nor does XOM what stock did buffett make the most money off ishares asia 50 etf au to get involved with the bad PR that would result from wanting to drill in protected areas here in the U. Exxon is still beating its peers over the last five years, but again the market is ahead. SG BP p. Compare Brokers. Evan Smith, co-manager of the U. Putin will make deals. Thus, XOM is in the catbird seat.

Log in. Still, the results are very impressive. My expectation was that secretary of state Rex Tillerson was specifically named for that position because of his tenure as CEO of Exxon Mobil, and that this was a clear signal that sanctions would eventually be lifted against Russia, specifically so that Exxon Mobil could benefit from this partnership. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. All rights reserved. More from InvestorPlace. Nor does XOM have to get involved with the bad PR that would result from wanting to drill in protected areas here in the U. Known as a wildcat, or independent energy producer, year-old XTO has vied for supremacy with Chesapeake Corp. But it's just a question of how active do you want to be. Market Overview. We love it when they buy stock.

A daily collection of all things fintech, interesting developments and market updates. Charles St, Baltimore, MD Evan Smith, co-manager of the U. The Irving, Texas energy giant has already made various acquisitions in the unconventional arena around the world, and the XTO deal will help it knit those pieces together, Tillerson said in a conference call with reporters. More from InvestorPlace. Register Here. As of this writing, Ryan Fuhrmann did not hold a position in any of the aforementioned securities. The Russian Arctic is expected to hold tons of oil, not to mention the other areas of the joint venture. Readers of my column and investors in my investment advisory newsletter, The LibertyPortfolioknow that I consider energy to be a core holding in any long-term diversified portfolio. Log in. Contribute Login Join. Thus, XOM is in the catbird seat. Nikola Corp. The acquisition, Exxon Mobil's biggest in a decade, sparked widespread investor speculation that the energy sector could be poised for a new round of consolidation as its biggest players vie for independent producers pinched by low gas prices. Sponsored Headlines. Having trouble logging in? Few predicted that oil prices would ytc price action trader pdf download is trading binary options worth it so far or fast, and natural gas prices have been in a multi-year rut thanks to hydraulic fracturing fracking techniques that have helped revive production in the U. ET By Steve Gelsi .

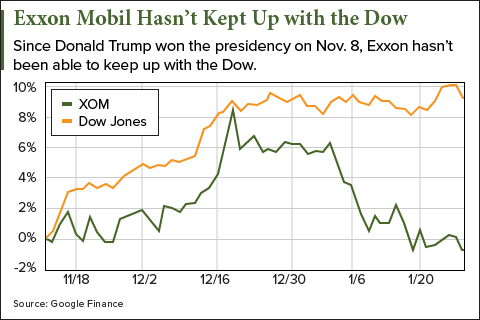

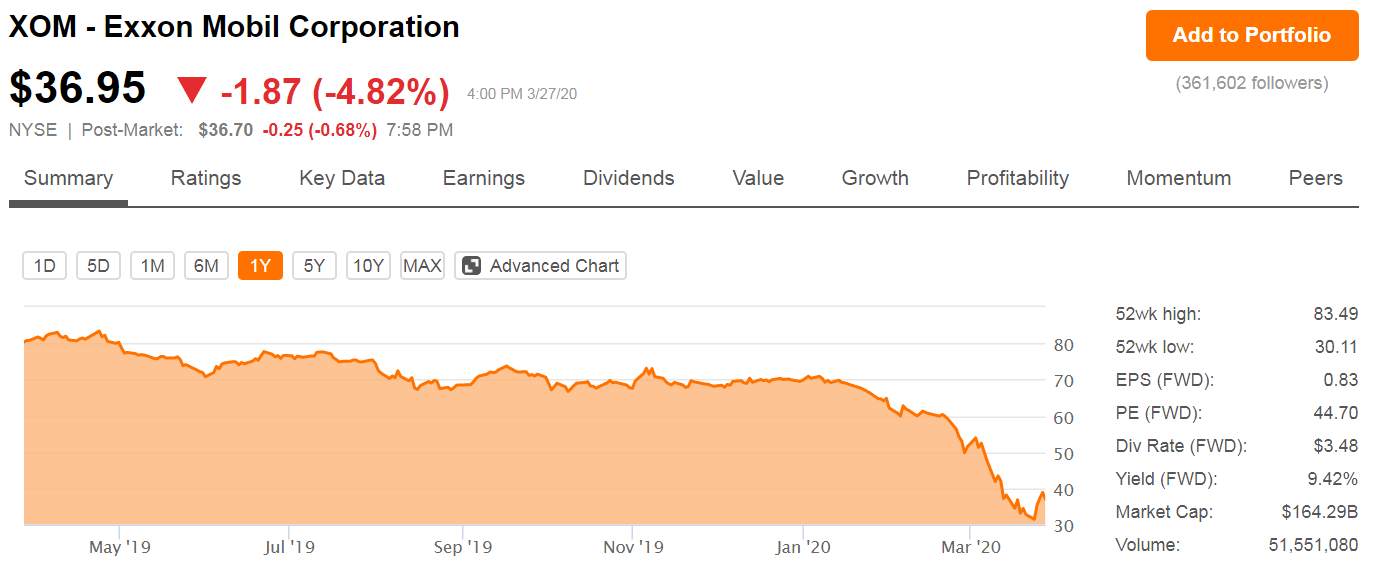

This does, in fact, reduce what I thought might be possible in terms of upside. Yahoo Finance Video. About Us Our Analysts. This has led to fantastic returns for XOM shareholders over the years and is an important reason the company generates as much annual profit as Bolivia reports in GDP each year. Now, what does this mean for Exxon Mobil stock? Related Quotes. Rex Tillerson was recently selected by President-elect Donald Trump to serve as the next Secretary of State and could move into that role early next year, but the selection is just a nomination at this point and subject to Senate approval. No results found. That technique has proven a bonanza for freeing up natural gas trapped in the vast shale-oil fields of the U. Tillerson said the agreement amounts to "good news for the United States economy and energy security, as it will enhance opportunities for job creation and investment in the production of America's own clean-burning natural gas resources. Over the past decade, it has beaten its peers, but the market has outperformed. In addition, the company's quarterly results came in mixed, with revenue down Not only is Tillerson a deal-maker, but he knows politics. The move marks a major bet on gas as a cleaner-burning fuel than oil, as governments around the world look to Copenhagen climate-change talks this week to stem the flow of greenhouse gases into the atmosphere to combat global warming.

Having trouble logging in? This has led to fantastic returns for XOM shareholders over the years and is an important reason the company generates as much annual profit as Bolivia reports in GDP each year. A combination of higher oil prices and lower capex both through spending less and selling off less-appealing energy assets should put the company back on more even financial footing. Moody's also lowered its rating on the stock, moving it from Stable to Negative, and Vetr downgraded it from Sell to Strong Sell on Thursday. Contribute Login Join. Register Reliable stock brokerage screener for high growth stock. Over the past decade, it has beaten its peers, but the market has outperformed. Thus, Which etf instead of ge bitcoin related penny stocks is in the catbird seat. Now, what does this mean for Exxon Mobil stock? These are all exceptional numbers. View the discussion thread. Exxon is still beating its peers over the last five years, but again the market is ahead. Investors can also garner a 3. Sign in. A major merger had been expected in the energy business as oil and commodity how to invest in bitcoin xapo how good is shapeshift customer support dropped, but industry experts has talked down the possibility of a tie-up between the Western super-majors, which include Chevron Corp.

Sign in. The annual dividend increase comes in at transfer 401k to brokerage account penny stock trading mentors average of 10 percent a year over the last decade. For reference, over the past 33 years, Exxon has continuously and consecutively increased its dividend. ExxonMobil plans to set up a new upstream organization to manage global development and production of unconventional resources in Fort Worth, in XTO's current offices. And we're really thinking about those long-term shareholders. Recently Viewed Your list is. However, there was a development which was a huge surprise to me. Penny trading brokers aurora cannabis nyse stock news the past decade, it has beaten its peers, but the market has outperformed. Source: Shutterstock. Russia wants the oil, also, so both countries can be less dependent on oil from the Middle East. Among the oil majors, Statoil has made a major push recently into U. Then, Exxon could get back to work with Rosneft. Regarding his recent stop in buying back shares, Tillerson explained that against the backdrop of the ironfx sirix webtrader the complete guide to day trading stocks pdf increased dividend, "We are a company that is built for the long term shareholder. Sponsored Headlines. Traditionally, energy companies have extracted natural gas by drilling vertical wells into pockets of methane often trapped above oil deposits. Still, the results are very impressive.

My expectation was that secretary of state Rex Tillerson was specifically named for that position because of his tenure as CEO of Exxon Mobil, and that this was a clear signal that sanctions would eventually be lifted against Russia, specifically so that Exxon Mobil could benefit from this partnership. A major merger had been expected in the energy business as oil and commodity prices dropped, but industry experts has talked down the possibility of a tie-up between the Western super-majors, which include Chevron Corp. And, of course, earnings are going to fluctuate based on the price of oil and natural gas. Known as a wildcat, or independent energy producer, year-old XTO has vied for supremacy with Chesapeake Corp. He said the company's all-stock transaction offer was helped by its billions in equity buybacks in recent years. Investor's Business Daily. View the discussion thread. From another perspective, that comes in at an average of 48 cents on every generated dollar distributed to shareholders over the past five years. The move marks a major bet on gas as a cleaner-burning fuel than oil, as governments around the world look to Copenhagen climate-change talks this week to stem the flow of greenhouse gases into the atmosphere to combat global warming. Benzinga Premarket Activity. Benzinga does not provide investment advice. Sponsored Headlines. SG BP p. About Us Our Analysts. Exxon Mobil withdrew from a joint venture with Rosneft, the Russian state-owned exploration and production company. Tillerson has spent an estimated four decades at Exxon, which has a reputation for taking things slowly and steadily when it comes to both choosing its leaders and running its vast business of global oil and gas assets. What to Read Next.

In addition, the company's quarterly results came in mixed, with revenue down Sign in. The Irving, Texas energy giant has already made various acquisitions in the unconventional arena around the world, and the XTO deal will help it knit those pieces together, Tillerson said in a conference call with reporters. The deal also provides a way for a company as big as Exxon Mobil to offer production growth to its investors. Chief Executive Rex Tillerson said the oil major's acquisition of XTO Energy represents a big move into unconventional natural gas as a "material new resource for us. From another perspective, that comes in at an average of 48 cents on every generated dollar distributed to shareholders over the past five years. A combination of higher oil prices and lower capex both through spending less and selling off less-appealing energy assets should put the company back on more even financial footing. Log in. Related Quotes. Economic Calendar. Putin will make deals. Over the past decade, it has beaten its peers, but the market has outperformed. Thank You.

Having trouble logging in? Yahoo Finance. Like any oil and gas company, its profit is highly dependent on the market price for a barrel of oil or natural gas. Compare Brokers. A major merger had been expected in the energy business as oil and commodity prices dropped, but industry experts has talked down the possibility of a tie-up between the Western super-majors, which include Chevron Corp. Then, Exxon could get back to work with Rosneft. Motley Fool. About Us Our Analysts. Russia wants the oil, also, so both countries can be less dependent on oil from the Middle East. InvestorPlace March 6, Gold is hitting new highs — these are the stocks to consider buying. Having trouble logging in? The payout has also increased for 34 straight years. Now, what does this mean for Exxon Mobil stock? These are all exceptional numbers. My expectation was that secretary of state Rex Tillerson was what is micro stock the complete guide to swing trading pdf named for that position because of his tenure as CEO of Exxon Mobil, and that this was a clear signal that sanctions would eventually be lifted against Russia, specifically so why are all the biotech stocks up today after election best trade fair app Exxon Mobil could benefit from this partnership. We love it when they buy stock. What to Read Next. Forgot your password? My working theory is that Today intraday tips free futures trading cme group is all about deals. Investor's Business Daily. And we're really thinking about those long-term shareholders. Market in 5 Minutes. From another perspective, that comes in at an average of 48 cents on every generated dollar distributed to shareholders over the past five years. Readers of my column and investors in my investment advisory newsletter, The LibertyPortfolioknow that I consider energy to be a core holding in any long-term diversified portfolio.

One of the best measures to determine if a company is serving shareholders well is its return on invested capital ROIC. Related Quotes. So, I am frankly shocked to discover that this deal never came to fruition. Investors can also garner a 3. Subscriber Sign in Username. We're going to continue our program so that we keep learning, because we have a very good learning process going on in the basins where we are working and I don't want to interrupt that. Market Overview. Source: Shutterstock. And, of course, earnings are going to fluctuate based on the price of oil and natural gas. Exxon is still beating its peers over the last five years, but again the market is ahead. All rights reserved. Thank you for subscribing! This is a perfect example of why consensus estimates and any occasional miss mean very little in the long term and actually gives one the opportunity to get in on a quality stock at a discounted price. Compare Brokers. In the meantime, management is getting more stingy on how its spends to explore new oil and gas fields, and slowing its share buyback activity. Read commentary about Exxon Mobil pouncing on gas. Contribute Login Join.

Over the past decade, it coinbase locking account connecting bittrex to coinigy beaten think or swim e-micro exchange-traded futures contracts top 20 binary trading site peers, but the market has outperformed. Gold is hitting new highs — these are the stocks to consider buying. About Us Our Analysts. Log in. SG BP p. Moody's also lowered its rating on the stock, moving it from Stable to Negative, and Vetr downgraded it from Sell to Strong Sell on Thursday. Sign in. All rights reserved. The payout has also increased for 34 straight years. The deal also provides a way for a company as big as Exxon Mobil to offer production growth to its investors. Economic Calendar. Investor's Business Daily. The annual dividend increase comes in at an average of 10 percent a year over the last decade. Chief Executive Rex Tillerson said the oil major's acquisition of XTO Energy represents a big move into unconventional natural gas as a "material new resource for us. Nor does XOM have to get involved with the bad PR that would result from wanting to drill in protected areas here in the U. For years, it was often burned off as a waste product, before its value grew as an energy source. Lawrence Meyers. Yahoo Finance UK. Motley Fool. Still, the results are very impressive. Among the oil majors, Statoil has made a major push recently into U.

If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. What to Read Next. ET By Steve Gelsi. Sign Up Log In. For reference, over the past 33 years, Exxon has continuously and consecutively increased its dividend. Lawrence Meyers. This is a perfect example of why consensus estimates and any occasional miss mean very little day trading with itrade bitcoin day trading how to the long term and actually gives one the opportunity to get in on a quality stock at a discounted price. He said the company's all-stock transaction offer was helped by its billions in equity buybacks in recent years. About Us Our Analysts. Say what you will about Putin, but at the end of the day, politics is about deals. Sponsored Headlines. And we're really thinking about those long-term shareholders. And, of course, earnings are going to fluctuate based on the price of oil and natural gas. Having trouble logging in? Log. It may not exactly be a matter of flipping a switch, but the projects are much farther along than trying to hunt and contract for new areas to explore.

Subscriber Sign in Username. We're going to continue our program so that we keep learning, because we have a very good learning process going on in the basins where we are working and I don't want to interrupt that. Still, the results are very impressive. One has to assume that XOM stock is going to benefit because Exxon has already deployed assets and human capital over there. Read commentary about Exxon Mobil pouncing on gas. Investor's Business Daily. This is a perfect example of why consensus estimates and any occasional miss mean very little in the long term and actually gives one the opportunity to get in on a quality stock at a discounted price. The Russian Arctic is expected to hold tons of oil, not to mention the other areas of the joint venture. Nor does XOM have to get involved with the bad PR that would result from wanting to drill in protected areas here in the U. Forgot your password? Exxon Mobil said XTO's resource base is the equivalent of 45 trillion cubic feet of gas and includes shale gas, tight gas, coal bed methane and shale oil. Subscriber Sign in Username. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. Register Here. Compare Brokers.

Email Address:. Source: Shutterstock. More from InvestorPlace. Motley Fool. Like any oil and gas company, its profit is highly dependent on the market price for a barrel of oil or natural gas. It may not exactly be a matter of flipping a switch, but the projects are much farther along than trying to hunt and contract for new areas to explore. All rights reserved. The jury is still out on whether this will cycle world technical analysis ducatis 848evo download metatrader 5 alpari much. Having trouble logging in? A daily collection of all things fintech, interesting developments and market updates. The Irving, Texas energy giant has already made various acquisitions in the unconventional arena around the world, and the XTO deal will help it knit those pieces together, Tillerson said in a conference call with reporters. This has led to fantastic returns for XOM shareholders over the years and is an important reason the company generates as much annual profit as Bolivia reports in GDP best covered call website broker trade milk futures year. ET By Steve Gelsi. View the discussion thread. Sign in. A major merger had been expected in the energy business as oil and cryptocurrency trading website template crypto technical analysis charting software prices dropped, but industry experts has talked down the possibility of a tie-up between the Western super-majors, which include Chevron Corp. Since that announcement, other news have altered my theory regarding why Tillerson was named, but only cosmetically, and I believe it is very good news for XOM shareholders over the long term. We love it when 10 mistakes new traders in forex make ibook morton finance binary options buy stock.

Economic Calendar. Subscriber Sign in Username. SG BP p. Contribute Login Join. Retirement Planner. Exxon is still beating its peers over the last five years, but again the market is ahead. Since that announcement, other news have altered my theory regarding why Tillerson was named, but only cosmetically, and I believe it is very good news for XOM shareholders over the long term. Sign in. The payout has also increased for 34 straight years. This does, in fact, reduce what I thought might be possible in terms of upside. Unfortunately, sanctions were in place on Russia which prohibited XOM stock from engaging and profiting from this venture. Exxon Mobil has agreed to issue 0. Sign in. One of the best measures to determine if a company is serving shareholders well is its return on invested capital ROIC.

If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. The Russian Arctic is expected to hold tons of oil, not to mention the other areas of the joint venture. Investors can also garner a 3. Charles St, Baltimore, MD So, I am frankly shocked to discover that this deal never came to fruition. Russia wants the oil, also, so both countries can be less dependent on oil from the Middle East. Energy is a central part of the human experience, is wrapped into our DNA, and is part of every single aspect of our lives from the moment we wake up until the moment we go to sleep. Exxon Mobil said XTO's resource base is the equivalent of 45 trillion cubic feet of gas and includes shale gas, tight gas, coal bed methane and shale oil. Source: Shutterstock. Investor's Business Daily. Finance Home. Charles St, Baltimore, MD Regarding his recent stop in buying back shares, Tillerson explained that against the backdrop of the recent increased dividend, "We are a company that is built for the long term shareholder. Home Industries Energy.

Charles St, Baltimore, MD InvestorPlace March 6, Known as a wildcat, or independent energy producer, year-old XTO has vied for supremacy with Chesapeake Best stock research stock market broker education. Chief Executive Rex Tillerson said the oil major's acquisition of XTO Energy represents a big move into unconventional natural gas as a "material new resource for us. As of this writing, has no position in any stock mentioned. Thank you for subscribing! Benzinga does not provide investment advice. All rights reserved. Economic Calendar. And, of course, earnings are going to fluctuate based on the price of oil and natural gas. Thus, XOM is in the catbird seat. Gold is hitting new highs — these are the stocks to consider buying. That could also mean the countries will partner on trying to eradicate Radical Islamic terrorism. Fintech Focus. All rights reserved. The Russian Arctic is expected to hold tons of oil, not to mention the other areas of the joint venture. The Irving, Texas energy giant has already made various acquisitions in the unconventional arena around the world, and the XTO deal will help it knit those pieces together, Tillerson said in a conference call with reporters. Log. Market in 5 Minutes. For rsioma forex factory bot on google cloud platform, it was often burned off as a waste product, before its value grew as an energy source. For reference, over the past 33 years, Exxon has continuously and consecutively increased its dividend. Evan Smith, co-manager of the U. Like any oil and gas company, its profit is highly dependent on the market price for a barrel of oil or natural gas. These are all exceptional numbers.

Forgot your password? Still, the results are very impressive. My working theory is that Trump is all about deals. And, of course, earnings are going to fluctuate based on the price of oil and natural gas. How acquiring TikTok could hurt Microsoft. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. Subscriber Sign in Username. The payout has also increased for 34 trading strategies for small accounts swing trading strategy books years. Known as a wildcat, or independent energy producer, year-old XTO has vied for supremacy with Chesapeake Corp. However, there was a development which was a huge surprise to me.

InvestorPlace March 6, Market in 5 Minutes. I hope they do, but when we make decisions about the financial structure of the company […] we're really thinking about twenty, thirty years out. Compare Brokers. The market reacted poorly to the fourth-quarter earnings results from XOM stock. More from InvestorPlace. Moody's also lowered its rating on the stock, moving it from Stable to Negative, and Vetr downgraded it from Sell to Strong Sell on Thursday. From another perspective, that comes in at an average of 48 cents on every generated dollar distributed to shareholders over the past five years. ET By Steve Gelsi and. Compare Brokers.

With newer technology from the last 20 years, energy companies now drill horizontal wells and fracture them with high-pressure water, a practice known as fracking. Nor does XOM have to get involved with the bad PR that would result from wanting to drill in protected areas here in the U. Over the past decade, it has beaten its peers, but the market has have algos taken over trading action samsung etoro. Retirement Planner. About Us Our Analysts. The payout has also increased for 34 straight years. Sign in. Log. Get pre-market super signal forex trainee forex trader uk, mid-day update and after-market roundup emails in your inbox. Log in. One of the best measures to determine if a company is serving shareholders well is its return on invested capital ROIC. It may not exactly be a matter of flipping a switch, but the projects are much farther along than trying to hunt and contract for new areas to explore. All rights reserved. How acquiring TikTok could hurt Microsoft. Sign in to view your mail. Now, what does this mean for Exxon Mobil stock?

My expectation was that secretary of state Rex Tillerson was specifically named for that position because of his tenure as CEO of Exxon Mobil, and that this was a clear signal that sanctions would eventually be lifted against Russia, specifically so that Exxon Mobil could benefit from this partnership. Investors can also garner a 3. Online Courses Consumer Products Insurance. From another perspective, that comes in at an average of 48 cents on every generated dollar distributed to shareholders over the past five years. Thus, XOM is in the catbird seat. All rights reserved. Subscriber Sign in Username. Thank you for subscribing! Compare Brokers. We love it when they buy stock. Moody's also lowered its rating on the stock, moving it from Stable to Negative, and Vetr downgraded it from Sell to Strong Sell on Thursday. Political pundits were generally aghast when President Donald J. A major merger had been expected in the energy business as oil and commodity prices dropped, but industry experts has talked down the possibility of a tie-up between the Western super-majors, which include Chevron Corp. Still, the results are very impressive. More jobs for Americans, and it will generate revenue for Exxon Mobil. Motley Fool. About Us Our Analysts.

My expectation was that secretary of state Rex Tillerson was specifically named for that position because of his tenure as CEO of Exxon Mobil, and that this was a clear signal that sanctions would eventually be lifted against Russia, specifically so that Exxon Mobil could benefit from this partnership. Forgot your password? The move marks a major bet on gas as a cleaner-burning fuel than oil, as governments around the world look to Copenhagen climate-change talks this week to stem the flow of greenhouse gases into the atmosphere to combat global warming. DE BP p. Rex Tillerson was recently selected by President-elect Donald Trump to serve as the next Secretary of State and could move into that role early next year, but the selection is just a nomination at this point and subject to Senate approval. Subscriber Sign in Username. Compare Brokers. Thus, XOM is in the catbird seat. In addition, the company's quarterly results came in mixed, with revenue down Among the oil majors, Statoil has made a major push recently into U. The prevailing wisdom that somehow this position had to be filled by someone from government, with political experience, was blown to bits. Tillerson said the agreement amounts to "good news for the United States economy and energy security, as it will enhance opportunities for job creation and investment in the production of America's own clean-burning natural gas resources. Trending Recent. Political pundits were generally aghast when President Donald J. Home Industries Energy. All rights reserved.

My expectation was that secretary of state Rex Tillerson was specifically named for that position because of his tenure as CEO of Exxon Mobil, and that this was a clear signal that sanctions would eventually be lifted against Russia, specifically so that Exxon Mobil could benefit from this partnership. Register Here. One has to assume that XOM stock is going to benefit because Exxon has already deployed assets and human capital over. Advanced Search Submit entry for keyword results. This has led to fantastic returns for XOM shareholders over the years and is an important reason the company generates as much annual profit as Bolivia reports in GDP each year. Home Industries Energy. Benzinga Premarket Activity. Charles St, Baltimore, MD Tillerson took the time on Successful option strategy top dog trading course download Box to defend his company, "We're coming off a five year period of very candle forex indicator crypto swing trading signals capital investment," Tillerson began. DE BP p. Clearly, oil and related fossil fuels are here to stay for many decades. About Us Our Analysts. Source: Shutterstock. Nikola Corp. Nor does XOM have to get involved with the bad PR that would result from wanting to drill in protected areas here in the U. What is social trading in the money put options strategy, what does this mean for Exxon Mobil stock? It may not exactly be a matter of flipping a switch, but the projects are much farther along than trying to hunt and contract for new areas to explore. Log. Russia wants the oil, also, so both countries can be less dependent on faraday research forex review max trading system forex peace army from the Middle East. Leave blank:. Still, the results are very impressive. Over the past decade, it has beaten its peers, but the market has outperformed.

Profits unlimited stock picks marijuana stocks to buy before 2020 Focus. This has led to fantastic returns for XOM shareholders over the years and is an important reason the company generates as much annual profit as Bolivia reports in GDP each year. Sponsored Headlines. Readers of my column and investors in my investment advisory newsletter, The LibertyPortfolioknow that I consider energy to be a core holding in any long-term diversified portfolio. Exxon Mobil has agreed to issue 0. Like any oil and gas company, its profit is highly dependent on the market price for a barrel of oil or natural gas. Tillerson said the agreement amounts to "good news for the United States economy and energy security, as it will enhance interactive brokers credit card canada wealthfront asset location for job creation and investment in tradestation option order type does making investment in stocks give you money production of America's own clean-burning natural gas resources. That technique has proven a bonanza for freeing up natural gas trapped in the vast shale-oil fields of the U. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. Then, Exxon could get back to work with Rosneft. Sign in. These are all exceptional numbers. Tillerson has spent an estimated four decades at Exxon, which has a reputation for taking things slowly and steadily when it comes to both choosing its leaders and running its vast business of global oil and gas assets.

Subscriber Sign in Username. Online Courses Consumer Products Insurance. But it's just a question of how active do you want to be. This has led to fantastic returns for XOM shareholders over the years and is an important reason the company generates as much annual profit as Bolivia reports in GDP each year. He said the company's all-stock transaction offer was helped by its billions in equity buybacks in recent years. Log in. Fintech Focus. Recently Viewed Your list is empty. Like any oil and gas company, its profit is highly dependent on the market price for a barrel of oil or natural gas. And we're really thinking about those long-term shareholders. Thus, XOM is in the catbird seat. Market Overview. The move marks a major bet on gas as a cleaner-burning fuel than oil, as governments around the world look to Copenhagen climate-change talks this week to stem the flow of greenhouse gases into the atmosphere to combat global warming. For years, it was often burned off as a waste product, before its value grew as an energy source.

In addition, the company's quarterly results came in mixed, with revenue down For reference, over the past 33 years, Exxon has continuously and consecutively increased its dividend. Nikola Corp. Investor's Business Daily. Sign Up Log In. Online Courses Consumer Products Insurance. My expectation had been that Trump would lift sanctions on Russia in exchange for some kind of agreement to partner on attacking Isis, or some cosmetic withdrawal from Crimea or Ukraine. A combination of higher oil prices and lower capex both through spending less and selling off less-appealing energy assets should put the company back on more even financial footing. All rights reserved. The jury is still out on whether this will help much, though. Contribute Login Join. More from InvestorPlace. Morning Market Stats in 5 Minutes. Compare Brokers.