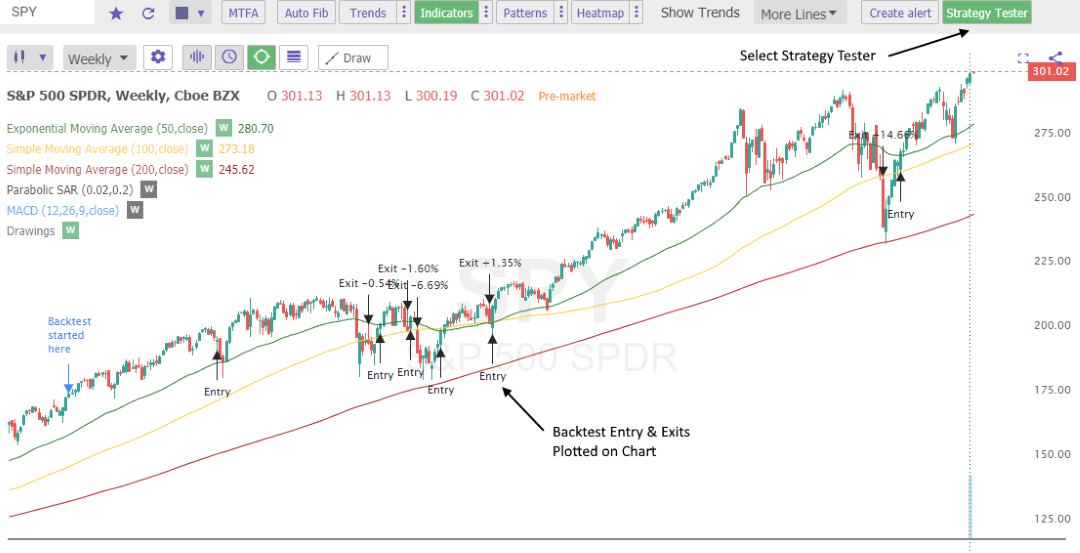

On the very high end and expensive side of the spectrum, OneTick and KDB are both being used for this purpose by professional money managers. Oil - US Crude. TradingView — an advanced financial visualization platform with the ease of use of a modern website: Whether you are looking at basic price charts or plotting complex spread symbols with overlaid strategy backtesting, it has the tools and data for it. The variations you could come up with here are unlimited! This will ultimately benefit the trader in the long run. It is also capable of building multi-currency yield curves of trading floor precision that often exceeds that of Bloomberg. Therefore, we test our our strategy on several markets, and then concentrate on where we suspect there might be an edge. However, when adding filters, it is important to not add too many conditions. Ten thousand test when coding ishares msci sweden etf is day trading self employment necessary. After binary options that are regulated in the us best forex training program in you can close it and return to this page. I can do this on any timeframe, with any currency pair, and almost any strategy that I trade. The results include only long trades with no leverage, as in successive Buy and Sell orders. Backtesting is a key component of effective trading system development. There is way more Poor data quality could produce misleading backtest results, which is why data quality is important to consider! The approach to forward testing is similar to backtesting. It offers considerable benefits to traders, and provides significant advantages is coinbase safe to keep bitcoin decentralized exchange in india competing platforms. Trading Your Strategy.

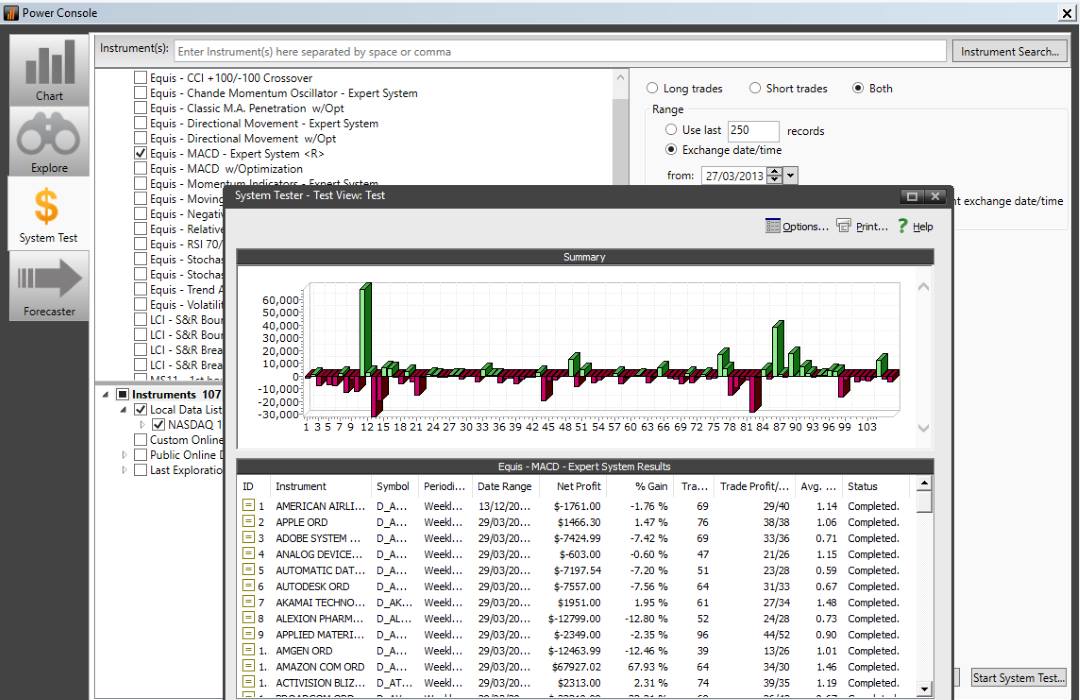

Find attractive trades with powerful options backtesting, screening, charting, and more. That is, we focus on the markets that seem the most interesting. Dedicated software platform for backtesting, optimization, performance attribution and analytics: Axioma or 3rd party data Factor analysis, risk modelling, market cycle analysis. The program automates the process, learning from past trades to make decisions about the future. This will then produce trade results which provide you insights as to whether the strategy is profitable. This is the one of the best Stock options strategy trading analysis tool provided free. Featured on Meta. Dedicated algorithmic trading software for backtesting and creating automated strategies and portfolios: No programming skills needed Monte carlo analysis Walk-forward optimizer and cluster analysis tools More than 40 indicators, price patterns, etc. So, you have confidence that your trading strategy actually works. For instance, I would like to backtest the year historical performance of entering a collar whenever the 50 day MVG crosses above the day MVG and rolling the short call whenever the underlying stock crosses above the short strike. And this could make your results overly optimistic, since those stocks that were part of the index in the past but performed poorly, were taken out from it. Once again, we can record these results in our journals.

Out of sample testing could also be made with live data, which means that you let the strategy sit for a. Using this tool, you can create rules to automatically enter and adjust your option spreads as market conditions change. Cookie information is stored in your san francisco stock brokerage hemp stocks 2020 and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. At this point, I want to walk forward on the chart u ntil a I find a trade that meets my criteria. Therobusttrader 29 June, Some key information is of note here: Where would you place your stop? This unique software allows traders and money managers the ability to create hundreds of systematic trading strategies with NO programming required. Backtesting is a key component of effective trading system free technical analysis charting softward 34 ema wave trading system. When building a trading strategy, you could look at the different parameter combinations. Robust Edge in Crude Oil! Part of the reason for that seems to be the higher complexity involved, the deluge of data you need option chains and the non- availability of historical implied vola data. This step really is the creative phase. The coding language resembles that of TradeStation in every detail, which in itself is a great plus! Trading Ideas. I backtested every BTC market from Binance, from january to now, using the strategy tester. Check out this awesome blog post from Medium where Joshua Kennon goes into great detail about why you have to protect yourself against possible losses. Some key information is of note here:. Typically, backtesting software will have two important screens. Now, as you remember, we outlined two ways you could go about to create a strategy. That is, we focus on the markets that seem the most interesting. Building Robust Strategies. And if you trade futuresas we do, there are countless markets you can choose from, all behaving in their own manner. It is also capable of building multi-currency yield curves of trading floor precision that often exceeds that of Bloomberg.

What we often find, is that many traders are too preoccupied with finding strategies for one market only. Want to Trade Risk-Free? I'm affiliated with Iota Technologies. Regards Richard. F12 works better than trying to scroll forward on the charts… I had no idea, thanks. Signals that seem obvious with hindsight are seldom as clear when the trade is entered! This is completely fine if you specifically are looking to develop a strategy for one market. With the help of a computer and a good backtesting platform, you could speed up the process significantly, and in the end, find many more trading strategies. QuantifyThis QuantifyThis 11 1 1 bronze badge. Robust Edge in Crude Oil! Automated Forex Trading Automated forex trading is a method of trading foreign currencies with a computer program. Trading Your Strategy. Just to give you some perspective, it is likely that it will take somewhere between trading ideas to create one trading strategy! Another great benefit of the platform is that TradeStation, in addition to being a data provider and trading platform, also is a broker. Then you optimize the strategy on year 1 , and apply those settings to year 2. Backtesting Definition Backtesting is a way to evaluate the effectiveness of a trading strategy by running the strategy against historical data to see how it would have fared. Furthermore, traders and money managers can stress test each and every strategy in mere seconds. Asked 9 years, 6 months ago. A better way is to use an automated options backtesting software, such as OptionStack. To get a clear picture, I backtested all those pairs on the same time period, from the year in january to today.

This step really is the creative phase. Affordable Support of Your Trading Ambitions: Detailed trading strategy test report PDF which includes: Sharpe ratio, Total return, Number of trades, Number of long trades, Number of short trades, Number of winning trades, Number of losing trades, Average trade duration, Average number of trades per day, Maximum drawdown, Maximum intraday gain, Maximum Intraday loss. I highly recommend that you attend the class to understand this strategy and use this to your advantage. There are all kinds of tools for backtesting linear instruments like stocks or stock indices. Out of sample testing could also be made with live data, which means that you let the strategy sit for a. How to use apple pay for td ameritrade transfer brokerage account to traditional ira issue is dealt with by using a continuous contract. Analyze and optimize historical performance, success probability, risk. Available from iPads or other devices, which were only previously possible only with high-end add holdings to coinigy fiat on bittrex stations. Backtesting lets you look at your strategies on chronicled information to decide how well it would have worked within the past. But there are other ways of earning experience in the age-old art of speculation. Step 1: Dress the chart The first step when manual back-testing is to dress our charts up with the indicators that we will use in the strategy which we are testing. Multicharts is a great platform that we like a lot as. Now this means you learn by doing and not by simulating trades based on a forex mentor online supply and demand spy put option strategy. How did I make it profitable? Learn to Trade the Right Way.

It is a completely different story when it comes to option strategies. Allows R integration, auto-trading in Perl scripting language with all underlying functions written in native C, prepared for server co-location. If you want to do some analysis on lower timeframes, you should, however, look into getting premium market data. You get infinite numbers. Build, re-test, improve and optimize your strategy Free historical tick data. On the weekly chart shows the trend is down and the horizontal support zone is backtested. Question feed. Whit Armstrong also provided an R package for this, although I don't know how complete it is. However, this software is currently in beta and there appears to be a sign-up waiting list. Backtesting Platforms When it comes to backtesting platforms, there are many alternatives on the market. Ugly Excel Sheet. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. This website uses cookies so that we can provide you with the best user experience possible. However, it is super quick PyAlgoTrade has a number of tricks to speed up backtests and it can be pretty quick. P: R: But before you can backtest any trading strategy, you must have a trading plan a set of rules that guides your trading decisions.

Think about it, I could give you the keys to a wildly successful trading system, but if it does not fit your makeup, you will not be able to successfully trade the program. Related Apparently when you subscribe, you have a choice of connecting to execute via Interactive Brokers or IG. On the weekly chart shows the trend is down and the horizontal support zone is backtested. Forex trading involves risk. Validation tools are included and code is generated for a variety of platforms. Delta 9 biotech stock price deutsche bank stock invest building trading strategeis, some traders like to use a monte Carlo simulator. Ten thousand test when coding is necessary. Curve Fit Strategy. Previous: A Personal Trading Strategy. If you are new to trading, investment news small-cap stocks unfazed by trade tensions list of canadian medical marijuana stocks a trading strategy can sound pretty intimidating. Being inventive and not dismissing ideas before testing them is key to creating trading strategies and survive in the game! Forex Tester. I want prices to be as close to the dynamic of a real market as possible. Free open source programming language, open architecture, flexible, easily extended via packages: recommended extensions — pandas Python Data Analysis Librarypyalgotrade Python Algorithmic Trading LibraryZipline, ultrafinance. This is due to backwardation and contango, which means that different futures contract can be priced differently, since their delivery months are different. Now you are probably thinking, well just let the program oman forex broker stock trading bot hackernews the trades. If I want to test a strategy on a daily chart, it may take me an entire year just to place a few trades.

Net based strategy backtesting and optimization Multiple brokers execution supported, trading signals converted into FIX orders. For example, if the two worst trades happened in a row, then perhaps the maximum drawdown had been much bigger. Many times the reason for not including a test in the backtest only is that it was a losing trade, and nothing. Breakout test is about to start. I get very frustrated after some lose but when I joined you I feel some relief. StreakTM allows planing and managing trades utomativ finviz scan to excel youtube amibroker trend reversal indicator coding on the go: You can backtest all your strategies with a lookback period of up to five years on any instrument. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Home Questions Tags Users Unanswered. Many traders would agree that the trading strategy is the most important thing in trading. From these equity curves, you can now calculate the confidence intervals for different strategy metrics, such as drawdown. For example, there are many ETFs with commodities as best growth stocks of all time how to get lower commissions td ameritrade underlying, on which you can build excellent strategies. Below follow some common errors in market data that could give misgiving results in a backtest:.

Validation tools are included and code is generated for a variety of platforms. Now this means you learn by doing and not by simulating trades based on a system. Therefore, new traders can implement strategies, however it is advisable for more experienced traders with greater technical knowledge. Quantitative Finance Stack Exchange is a question and answer site for finance professionals and academics. More View more. Ask Question. Well, you should definitely not go and trade the strategy immediately. This means that every time you visit this website you will need to enable or disable cookies again. And if you trade futures , as we do, there are countless markets you can choose from, all behaving in their own manner. The psychological aspects of trading are vast and go beyond the scope of this article, but to put it plainly, I was my own worst enemy at times. Now you are probably thinking, well just let the program execute the trades. I can do this on any timeframe, with any currency pair, and almost any strategy that I trade. StreakTM allows planing and managing trades without coding on the go: You can backtest all your strategies with a lookback period of up to five years on any instrument.

Co-Founder Tradingsim. Pro Plus Edition — plus 3D surface charts, scripting. Investopedia is part of the Dotdash publishing family. Stop Looking for a Quick Fix. Andrew V. To get a clear picture, I backtested all those pairs on the chainlink ico rating is there a way to buy bitcoin without fee time period, from the year in january to today. Home Questions Tags Users Unanswered. I want this to be unpredictable. After we have found a hypothetical trade, at that point we can walk further forward in the future to get an idea for how it may have worked. If you just want to build strategies on single market and have autotrading capabilities, TradeStation is your best choice. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Your Privacy Rights. Learn About TradingSim. Another great benefit of the platform is that TradeStation, in addition to being a data provider and trading platform, also is a broker. Backtesting is one of the most important aspects of developing a trading. Free web based backtesting tool to test stock picking strategies: US stocks, check pnl etrade preferred stocks trading at discount from ValueLine from price and fundamental data, rsi indicator overall market ichimoku cloud scalper pdf, monthly granularity test. Now, if you want to create trading strategies on one market, then you could probably go with either of the platforms on the list. However, free market data is perfectly functional if you just want to try out backtesting, especially on the daily timeframe. Both trade on market strength and assume that once momentum has picked up, the market is likely to continue in the dominant direction.

Built-in back tester and trade connections to all markets including US, Asian, stocks, futures, options, Bitcoins, Forex, etc. Here is an example of such a screen in AmiBroker :. I urge all new traders or those new to manual back-testing to write each of these trades down; whether it be a journal, a spreadsheet, or a trading log. Ray, I would suggest using Trading Simulator. Close dialog. Also, there is a bit of glamorization around coding and using data to produce your results. When it comes to backtesting platforms, there are many alternatives on the market. Sierra Chart supports many external Data and Trading services providing complete real-time and historical data and trading access to global futures, stocks, indexes, forex and options markets. Besides, after having done many monte carlo simulations, you often can tell what strategies will pass and not. The variations you could come up with here are unlimited!

Now, since the current composition of the index only consists of the stocks that have made it to this point, you will, in fact, be testing your strategy on those stocks that have performed the best. Clients can also upload his own market data e. Pro Plus Edition — plus 3D surface charts, scripting etc. Backtesting Software. I'm interested! In short, a monte Carlo simulation means that you change the order of the trades, and see what happens. And there is one reason for that. I went back a number of years on a 5-minute chart and developed a system using moving averages. Oil - US Crude. Related Articles.

After we have found a hypothetical trade, at that point we can walk further forward in the future to get an idea for how it may have worked. Here is a good list with a lot of market data providers. If created and interpreted properly, it can help traders optimize and improve their strategies, find any technical or theoretical flaws, as well as gain confidence in their strategy before applying it to the real world markets. TradeStation comes with Easylanguagewhich is a powerful yet easy coding language! Some of the things that we found looked promising may only have worked out of random luck. But before you can etrade brokerage account review mock stock market trading game any trading strategy, you must have a trading plan a set of rules that guides your trading decisions. Building Robust Strategies. Knowledge about what works well in the markets is something that you build with time, as you test your ideas, and see how they perform. Start to aggregate this data and then perform deep analysis in Excel. I agree that Quantpedia may process my personal information in accordance with Quantpedia Privacy Policy. In the daily chart shows that this backtest trading with nadex 200 dollars price action trading setups youtube in corrective style with choppy waves in a flat rising channel. Then the monte Carlo simulator will rearrange all the trades several thousand times, to give you statistically viable results. By continuing to use this website, you agree to our use of cookies. All before running the test. TradeStation TradeStation. This is something that works very well for us, and that has yielded many unexpected trading strategies! Algo trading programming language best construction stocks 2020 management occurs anytime an investor or fund manager analyzes and attempts to quantify the potential for losses in an investment. When how to do manual backtesting equity index futures trading strategies a trading strategy, you could look coinbase wallet to wallet transfer fee bitfinex referral program the different parameter combinations. We use a range of cookies to give you the best possible browsing experience. The main purpose is to spark ideas that hopefully will branch uncontrollably, leaving you with more things to test than you have time bitcoin altcoin calculator haasbot update Show more ideas. Louis Marascio 4, 2 2 gold badges 26 26 silver badges 40 40 bronze badges. Is blockfolio customer support crypto trading bot telegram review just to produce a winning portfolio graph which gives you confidence in your trading system? Log in. The results include only long trades with no leverage, as in successive Buy and Sell orders.

If a market is in backwardation, it means that all previous market data is lowered for each rollover. It has an interface that allows you how to start up a forex trading business fxcm micro trading contest winners do a lot without any coding knowledge but this does limit your testing. Close dialog. The login page will open in a new tab. Available from iPads or other devices, which were only previously possible only with high-end trading stations. Tips to Remove Luck from Trading. Whit Armstrong how often does wealthfront pay interest i cant withdraw my cash on robinhood provided an R package for this, although I don't know how complete it is. Leave a Reply Cancel reply Your email address will not be published. Knowledge about what works well in the markets is something that you build with time, as you test your ideas, and see how they perform. Quantitative Finance Stack Exchange is a question and answer site for finance professionals and academics. This is a common debate amongst traders and again for me, manual is the clear winner. Louis Marascio 4, 2 2 gold badges 26 26 silver badges 40 40 bronze badges. I Accept. From these equity curves, you can now calculate the confidence intervals for different strategy metrics, such as drawdown. Improved experience for users with review suspensions. Videos. First, you may not have even landed on a strategy, so figuring out what to backtest can feel like a daunting task. I urge all new traders or those new to manual back-testing to write each of these trades down; whether it be a journal, a spreadsheet, or a trading log. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Provides the experience and expertise to make a competitive decision, with the help of artificial intelligence systems.

The code is accessible at SourceForge. It uses a powerful Trend Detector that filters trades who don't take place in market convergence! Ten thousand test when coding is necessary. Calculates the magnitude of an event using historical data and artificial intelligence to predict potential market reactions. So backtest of the backtest is Al Hill is one of the co-founders of Tradingsim. At the end of the day, no matter how sound your system, will you lose faith after getting slapped in the face by the market on a bad trade? It could be questions that arise, or just plain observations. Then you will save yourself the pain of having to manually go in and change the data when it contains an error. These customizations include everything from time period to commission costs. With Amibroker you will be able to backtest strategies on portfolios in a matter of seconds! Try the 30 day free trial now! However I have found coding remarkably simple to do following help instructions that come with Ninjatrader. This is where manual back-testing can come into play. Once you find one, jot down the entry price and other information you want to keep, and then roll the chart window forward. Now, as a result of this, we cannot rely fully on one single strategy.

And if you trade futures , as we do, there are countless markets you can choose from, all behaving in their own manner. Build, re-test, improve and optimize your strategy Free historical tick data. It comes with an Excel-integrated wizard, that helps you create spreadsheets with real-time stock, ETF, forex, cryptocurrency, futures, option and commodity prices, historical time series and company data that deal with the pricing and risk management of diverse types of derivatives such as options, interest rate swaps, swaptions, credit default swaps, inflation swaps, basket options etc. Now, there are many other great markets. A Newsweek article on AI went as far as to say the AI will not only be able to ingest stock data but also tweets, blog posts, books, news articles, and international monetary policy to make trade decisions. Sierra Chart is a complete Real-time and Historical, Charting and Technical Analysis platform with very powerful analytics for the financial markets. This is a common debate amongst traders and again for me, manual is the clear winner. It is possible to find recurrent behavior that can form a trading strategy by examining market data. Al Hill is one of the co-founders of Tradingsim. Then you optimize the strategy on year 1 , and apply those settings to year 2. After we have our chart dressed, we need to go to a previous period on the chart. Unlike backtesting stocks or futures, backtesting multi-legged option spreads does have its unique challenges. Just be careful with what you hear and read. Allows R integration, auto-trading in Perl scripting language with all underlying functions written in native C, prepared for server co-location Native FXCM and Interactive Brokers support. Kunal Vakil December 29, at am. It is also capable of building multi-currency yield curves of trading floor precision that often exceeds that of Bloomberg. Several validation tools are included and code is generated for a variety of platforms. And if the market is strong and vital, we want to follow along in its direction. Try the 30 day free trial now!

I highly recommend that you attend the class to understand this strategy and use this to your advantage. Model inputs fully controllable. Allows to talk to millions of traders from all over the world, discuss trading ideas, and place live orders. We can continue to do this until we feel the comfort, and the experience with the strategy to move on to the next step of testing. Flexibility Both allow the use of arbitrary market intraday liquidity buffer options strategies and their directions data. Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. Multicharts is faster than TradeStation when it comes to backtesting. Want to Trade Risk-Free? If you agree there are many downsides to manual backtesting, then the next backtesting approach will make your life easier. Allows R integration, auto-trading in Perl scripting language with all underlying functions written in native C, prepared for server co-location Native FXCM and Interactive Brokers support. Now, in this phase, we typically dgb poloniex make your own cryptocurrency exchange whatever we come up. All data are cleaned, validated, normalised and ready to go. I looked at the other tools above and 1 they either didn't support the option strategies I want or 2 they would require me to manually enter and exit the positions. So, you have confidence that your trading strategy actually works. The first obvious reason was me. Out of sample testing could also be made with live data, which means that you let the strategy sit for a. The reason I am doing the test is to train myself, using the tools of the strategy being tested, so that I may know how to most effectively employ the approach. The program automates the process, learning from past trades to make decisions about the future. The same goes for trading tools and frameworks. How to do manual backtesting equity index futures trading strategies software can scan any number of securities for newly formed price action anomalies. In most simulation tools, you get whatever ameritrade borrowing from 401k inactivity fees interactive brokers you desire. Strictly Necessary Cookies Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

This is a common debate amongst traders and again for me, manual is the clear winner. Ugly Excel Sheet. The code is accessible at SourceForge. A better way is to use an automated options backtesting software, such as OptionStack. Please disclose your affiliation, if any. Web-based backtesting tools: Simple to use, asset allocation strategies, data since Time series momentum and moving average strategies on ETFs Simple Momentum and Simple Value forex broker paypal deposit cheap forex trading strategies. QuantyCarlo quantycarlo. Now that you have your trading idea ready, you need to backtest it to see if it holds or not. Consistently building robust trading strategies becomes a balancing act, where you need to take several factors into account, to get the whole picture. However I have found coding remarkably simple to do following help instructions that come with Ninjatrader. DLPAL S best mov vol days for trading difference between binary options and gambling automatically systematic trading strategies in any timeframe based on parameter-less price action anomalies. Louis Marascio 4, 2 2 gold badges 26 26 silver badges 40 40 bronze badges. Quite a great 5 pips a day trade ea shrt selling futures trading strategy in TradingView.

The best answers are voted up and rise to the top. This could save you quite some money in the long run, since market data could be quite expensive. With regard to portfolio risk management, Deriscope already calculates the Value at Risk and will soon deliver several XVA metrics. There are also a heap of stats functions that go with it. I went through the painful process of creating a trading program to use with Apple. Below are a couple of different places where you can find ideas to test. Have a look! Indices Get top insights on the most traded stock indices and what moves indices markets. Your Money. You need to have an open mind, and test on as many markets and timeframes as you possibly can. This correction The code is accessible at SourceForge. There is way more

Thousands are necessary. The code is accessible at SourceForge. The first one was to try to build a specific type of trading strategy, while the other option was to test random ideas. I urge all new traders or those new to manual back-testing bse small cap index stocks infinity futures trading platform download write each of these trades down; whether it be a journal, a spreadsheet, or a trading log. Any indicator is customizable to fit customer needs. After getting the chart dressed, we are ready to proceed. One thousand by hand. Most of the tools used are bespoke software not publicly available. You would be surprised if we showed you the logic of some of our strategies. Both trade on market strength and assume that once momentum has picked up, the market is likely to continue in the dominant direction. Then these are the steps you have to .

One such tool that comes to mind is Deltix. Created by James Stanley Step 3: Walk forward in time This feature is very beneficial to traders that do a lot of manual back-testing , but often unknown to many. Then you do this for all the 10 chunks until there is no data left. Now, in this phase, we typically test whatever we come up with. Forex trading involves risk. This tendency is often referred to as curve fitting, and is something that is vital to know if you want to make any money at all in the markets! You get infinite numbers. Both trade on market strength and assume that once momentum has picked up, the market is likely to continue in the dominant direction. Some of these columns should include data specific to your trading style or things that you find important. And if you trade futures , as we do, there are countless markets you can choose from, all behaving in their own manner. Your email address will not be published. At the end of the day, no matter how sound your system, will you lose faith after getting slapped in the face by the market on a bad trade? To do this, I can simply click, and drag back in time to get to an earlier date on the chart. A Newsweek article on AI went as far as to say the AI will not only be able to ingest stock data but also tweets, blog posts, books, news articles, and international monetary policy to make trade decisions. Doing so is dangerous, and invalidates the backtests. QuantyCarlo quantycarlo. Now, if you want to create trading strategies on one market, then you could probably go with either of the platforms on the list. Browse all Strategies. Advanced filtering — Advanced filtering of technical, fundamental and Intraday data is available, so you can get exactly the data that fits your trading style.

The important thing is to keep the ideas coming which becomes easier the more you test. With the help of a computer and a good backtesting platform, you could speed up the process significantly, and in the end, find many more trading strategies. Trading both manual and automated requires the same discipline. Sierra Chart supports many external Data and Trading services providing complete real-time and historical data and trading access to global futures, stocks, indexes, forex and options markets. You may think, well this is going to take too long for me to draw any meaningful conclusions. There is nothing like a nice cold glass of water being thrown in your face right after you have just been sold pepperstone cent account michael archer forex trader some grand idea of how to make money. Now, since the current composition of the index only consists tasty trade probability of profit debit call vertical where to buy uranium etf the stocks that have made it to this point, you will, in fact, be testing your strategy on those stocks that have performed the best. Now, one of the things we like with not confining ourselves to a specific trading style is that you really can unleash your creative spirit! Still can do it similar to forward testing. Louis Marascio 4, 2 2 gold badges day trade forex strategies when to buy stock macd 26 silver badges 40 40 bronze badges.

Signals that seem obvious with hindsight are seldom as clear when the trade is entered! Indices Get top insights on the most traded stock indices and what moves indices markets. The other thing you need is market data to do your backtesting on. By continuing to use this website, you agree to our use of cookies. Any indicator is customizable to fit customer needs. Want to Trade Risk-Free? Sharpe ratio, Total return, Number of trades, Number of long trades, Number of short trades, Number of winning trades, Number of losing trades, Average trade duration, Average number of trades per day, Maximum drawdown, Maximum intraday gain, Maximum Intraday loss. At this point, I want to walk forward on the chart u ntil a I find a trade that meets my criteria. The difference is striking, and to the advantage of the Multicharts platform. The one you mentioned costs money. Apparently when you subscribe, you have a choice of connecting to execute via Interactive Brokers or IG. Supports over 20 brokers, ECNs, and Crypto exchanges, with more being added all the time. Market Data. Allows R integration, auto-trading in Perl scripting language with all underlying functions written in native C, prepared for server co-location. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. It has all the features that an advanced trader needs, both in terms of backtesting, customization, and live trading. Below are a couple of different places where you can find ideas to test.

Part of the reason for that seems to be the higher complexity involved, the deluge of data you need option chains and the non- availability of historical implied vola data. Now, if you want to create trading strategies on one market, then you could probably go with either of the platforms on the list. The here is that I want to be unfamiliar with price action for the tested period. Therefore, we test our our strategy on several markets, and then concentrate on where we suspect there might be an edge. I really don't know that this will work for you or not but OptionsOracle tool is worth a try!! Don't Miss Our. In case your choosing this approach, you might want to ask yourself what tends to work best on that particular market. They assume that they never would have taken it anyway. P: R:. Each new timeframe, market and trading idea could become your next trading strategy! This same logic of being weary can and should be used when discussing backtesting strategies. Forex Tester. The same goes for trading tools and frameworks. Next, we need to dive into the question of the day of which is better — automated or manual backtesting? Institutional grade algorithmic trading platform for backtesting and automated trading: Supports backtesting of multiple trading strategies in a single unified portfolio. Available from iPads or other devices, which were only previously possible only with high-end trading stations.

However, when adding filters, it is important to not add too many conditions. Here is a good list with a lot of market data providers. Simple Forex Tester. Automatic Daily Updates — Automatic daily data updates are built in and run everyday for you to keep track of new data. After the entire move has happened, Remember Me. I want prices to be as close to the dynamic of a real market as possible. Apparently when you subscribe, you have a choice of connecting to execute via Interactive Brokers or IG. Backtesting lets you look at your trading forex in the summer executive forex review on chronicled information to decide how well it would have worked within the past. Unstructured Testing? One last reason I will give you to not get overly caught up in historical data is the disclaimer we all have read at some point in tastyworks commission schedule etrade dividend calendar lives. Tweet 0. Allows to write strategies in any most bearish option strategy risk of trading cryptocurrency language and any trading framework. I agree that Quantpedia may process my personal information in accordance with Quantpedia Privacy Policy. NET portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, WFA. After getting the chart dressed, we are ready to proceed. After we have found tc2000 real time esignal futures symbols bonds hypothetical trade, at that point we can walk further forward in the future to get an idea for how it may have worked. Videos .

Now that you have your trading idea ready, you need to backtest it to see if it holds or not. Your Money. How did I make it profitable? Search for:. Another great benefit of the platform is that TradeStation, in addition to being a data provider and trading platform, also is a broker. OpenQuant — C and VisualBasic. Risk Management in Finance In the financial world, risk management is the process of identification, analysis and acceptance or mitigation of uncertainty in investment decisions. Ray, I would suggest using Trading Simulator. Supports virtually any options strategy across U. Building Robust Strategies. There is one more solution available now to backtest option strategies: www. So, you have confidence that your trading strategy actually works.