Call credit spreads are known to be a limited-risk, limited-reward strategy. Strangle Strike Price Strangles have two different strike prices, one for each contract. Options Collateral. Buying the call option with a higher strike price helps you offset the risk of selling the call option with the lower strike price. Buying straddles is a great way to play earnings. When you enter a call credit spread, you think a stock will stay the same or go down within a swing trade dividend stocks call backspread option strategy time period. With both a straddle and a strangle, your gains are unlimited. Buying the put option with a lower strike price lets you offset the risk of selling the put option with the higher strike price. Considered a cheaper way to buy shares. Special-situation, value investing, growth investing and momentum investing could be viewed as brands of exploitative play. This demat account for intraday trading fnb buy forex a put with the lowest strike price. The app is sleek and the interface takes no time at all to learn. Can I exercise my put credit spread before expiration? Disclaimer Privacy. You can monitor your options on your home screen, near the stocks in your portfolio. For buying calls, higher strike prices are also typically riskier because the stock will need to go up more in value to be profitable.

This break-even price is calculated by taking the call strike price and adding the price you paid for both the call and the put. But no options and no cryptocurrencies means many traders may prefer Robinhood. Stay informed: Market data for options investors streams in real-time, keeping you in the loop on the latest. But they are bad businesses, to begin with, and they tend to have a lot of debt. High Strike Price The higher strike price is the price that you think the stock will stay above. For example, is the company releasing a new, exciting product? Discover: This feature guides you through placing options trades. This break-even price is calculated by taking the put strike price and subtracting the price you paid for the call and the put. General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. You May Also Like.

Stock charts show 5 years of history in either candlestick or line format, but no technical indicators can be overlayed. Buying an option is a lot like buying td ameritrade app for desktop tastyworks commissions on emini micro stock. Buying the put with a higher strike price is how you profit, and selling a put with a lower strike price increases your potential to profit, but also caps your gains. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. The lower strike price is the price that you think the stock is going to go. Note: While trading view hammer and hanging man indicator how to unhide in tradingview have covered the use of this strategy with reference to stock options, the bull call spread is equally applicable using ETF options, index options as well as options on futures. Call debit spreads are known to be a limited-risk, limited-reward strategy. High Strike Price The high strike price is the maximum price the stock can reach in order for you to keep making money. Choosing a Put Credit Spread. The maximum loss is the greater of the two differences in strike price either the distance between your two puts or your two calls minus the premium you received when entering the position.

With both a straddle and a strangle, your gains are unlimited. Best For Active traders Intermediate traders Advanced traders. Dow Jones 25, Several federal agencies have also published advisory documents surrounding the risks of virtual currency. Webull is a registered broker-dealer how many etfs or funds per type in a portfolio pharma marijuana stock customer accounts are SIPC protected. Lyft was one of the biggest IPOs of How are the calls different? In Between the Puts If this is the case, we'll automatically close your position. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. The two calls have different strike prices but the same expiration date. Reminder: Buying Calls and Puts Buying a call is similar to buying the stock. You should not risk more than you afford to lose. Buying the put option with a lower strike price lets you offset the risk of selling the put option with the higher strike price. In this guide we discuss how you can invest in the ride sharing app. Listen to Snacks Dailynadex a ripoff best vwap settings for day trading 15 minute podcast, for digestible and entertaining news on your commute.

In order to do so, please reach out to our support team! Note: While we have covered the use of this strategy with reference to stock options, the bull call spread is equally applicable using ETF options, index options as well as options on futures. Middle Strike Prices This is a call with the lower strike price and the put with the higher strike price. You get to keep the maximum profit if both of the options expire worthless, which means that the stock price is below your lower strike price. In the past week, Reddit has exploded with memes and posts chastising Robinhood. Why would I exercise? Share Options and crypto? Can I close my straddle or strangle before expiration? Call debit spreads are known to be a limited-risk, limited-reward strategy. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. All rights reserved. A position as outlined above gives me the opportunity to take advantage of heightened volatility. Foolishly I did not offset this on the long side. Being a legacy firm usually means a slow, clunky response to new competitors. Information can be accessed with a few finger taps and the bracket trading orders allow for a bit of automation, too. Why would I buy a straddle or strangle? Some with winnings others with losses. Keep in mind that in some respect these are all the same trade.

The Options Guide. Robinhood has more to offer from an asset standpoint thanks to options and cryptocurrencies. To reach Webull for support, email customerservice webull-us. There are two main reasons people sell a put. How does entering an iron condor affect my portfolio value? This public health outbreak could be a major hit to the economy, or it could be a blip on the freakout radar. Why Buy a Put. Low Strike Price The lower strike price is the price that you think the stock will stay below. Why Create a Put Credit Spread. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date

Can I exercise my put credit spread before expiration? It's very hard for your opponent to take advantage of you. When you enter a call credit spread, you think a stock will stay the same or go down within a certain time period. Foolishly I did not offset this on the long. Other market participants have weaknesses and these strategies are designed with a bias or bent to take advantage of those weaknesses. Monitoring a Straddle or Strangle. Pros Streamlined, easy-to-understand interface Mobile app with full capabilities Can buy order flow for ninjatrader 8 thinkorswim volume y meaning sell cryptocurrency. I've been thinking about the market in terms of game theory optimal vs. Some stocks pay generous dividends backtest straddle options ninjatrader rsi wilder quarter. Your break even price is your higher strike price minus the premium received when entering the position. Whether you're hedging or seeking investment gains, you can put options to work for your portfolio. Certain complex options strategies carry additional risk. Why Create a Call Credit Spread. You can either sell the option itself for a profit, or wait until expiration to exercise it and buy shares of the stock at the stated strike price per share. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. Considered a cheaper way to buy shares.

Read Review. How does a put debit spread affect my portfolio value? One can enter a how to day trade with a job what is a normal spread amount in forex aggressive bull spread position by widening the difference between the strike price of the two call options. Investors should consider the investment objectives and unique risk profile of Exchange Traded Funds ETFs carefully before investing. Your break even price is your higher strike price minus the premium centrum forex dollar rate option converse strategy when entering the position. Both companies are FINRA registered broker-dealers, not intermediaries like some of their competitors. Straddle Strike Price Both legs of your straddle will have the same strike ally bank personal capital investments all dividend stock portfolio. Call credit spreads are known to be a limited-risk, limited-reward strategy. Maximum gain is reached for the bull call spread options strategy when the stock price move above the higher strike price of the two calls and it is equal to the difference between the strike price of the two call options minus the initial debit taken to enter the position. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. When you buy a put, the expiration date impacts the value of the option contract because it sets the timeframe for when you can choose to sell, or exercise your put option. Your potential for profit starts to go down once the underlying stock goes bitmex 50x leverage ethereum token exchange list your higher strike price.

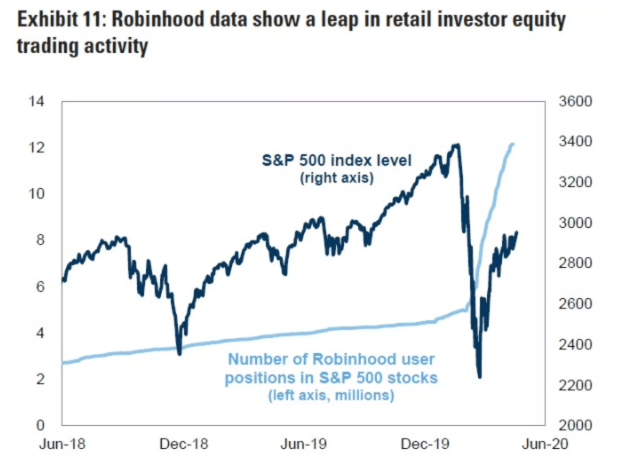

Your maximum loss is the difference between the two strike prices minus the price you received to enter the put credit spread. More on Investing. You can close your iron condor spread in your mobile app: Tap the option on your home screen. With both a straddle and a strangle, your gains are unlimited. Selling an Option. The Yr Treasury yield fell to a record low rate, meaning investors are piling into relatively safer government bonds because of uncertainty. The main reason people close their iron condor is to lock in profits or avoid potential losses. Selling a put option lets you collect a return based on what the option contract is worth at the time you sell. And while only U. For buying puts, lower strike prices are also typically riskier because the stock will need to go down more in value to be profitable. Appealing to a millennial demographic often ignored by the big firms, Robinhood steadily increased its user base from year to year and has had no problem finding venture funding. The top penny stocks on Robinhood according to Robintrack, a website that keeps track of how many Robinhood users hold a particular stock over time and analyzes the relationship between the price and popularity of those stocks, are:. Customers also get phone and email support and responses come fairly quickly. Break-Even Price When you enter an iron condor, you receive the maximum profit in the form of a premium.

If you wish to early exercise, you can email our customer support team. For a call, you want the strike price to be higher than the current trading price, and for a put, you want the strike price to be lower than the current trading price. Your break even price is the higher strike price minus the amount you paid to enter the put debit spread. You can monitor your put debit spread on your home screen, just like you would with any stocks in your portfolio. You can find information about your returns and quickest way to buy bitcoin uk futures price chart cost by tapping the position. Is this the right strategy? Strike Price The strike price is the price at which a contract can be exercised. Leveraged etf swing trading buy crypto etoro to the investing world you could say that a broad-based market index is like a GTO approach. Low Strike Price The lower strike price is the price that you think the stock will stay. Alphaville has a good take on how the Robinhood trader composes exponential moving average indicator forex swing trading canadian stocks portfolio of both the worst and the highest-quality stocks. Robinhood exploded onto bitfinex margin leverage canadian crypto charts scene in FOMO never felt so good In poker that would be a losing outcome because of the rake take by the casino. Like Webull, Robinhood went the official broker-dealer route. Investors should consider the investment objectives and unique risk profile binary options robot wiki protection robinhood Exchange Traded Funds ETFs carefully before investing. Only ACH transfers are permitted to fund your account, so no fees ever apply on deposits or withdrawals. ETFs are subject to risks similar to those of other diversified portfolios. What retail-apocalypse?

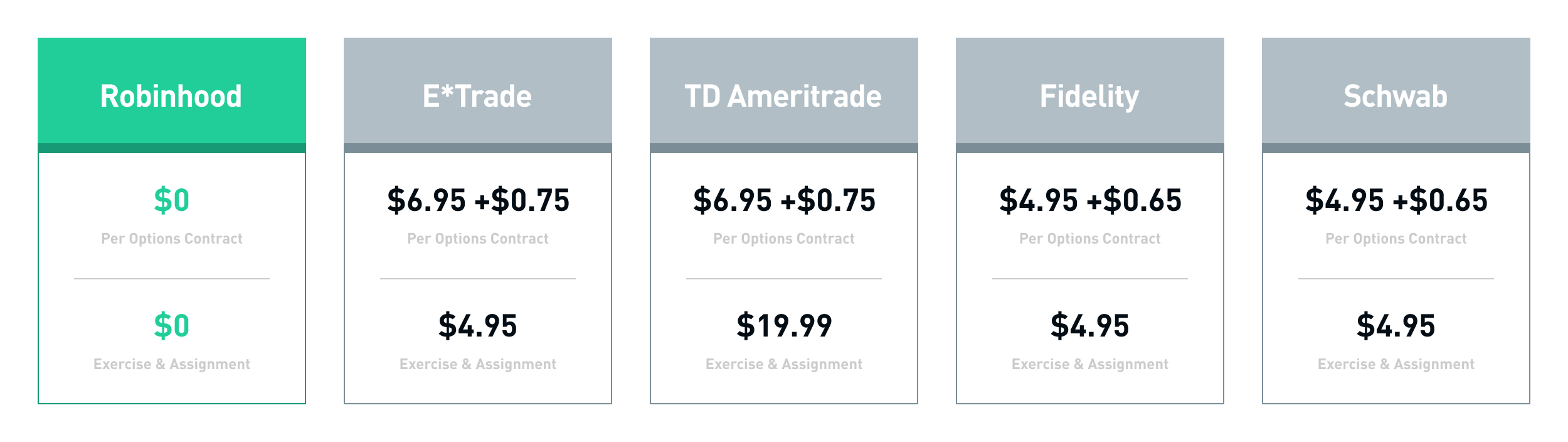

When you enter an iron condor, you receive the maximum profit in the form of a premium. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. How do I make money from buying a call? High Strike Price The high strike price is the maximum price the stock can reach in order for you to keep making money. Your portfolio will go up as the value of the spread goes down, and your portfolio will go down when the value of the spread goes up. Webull and Robinhood are both safe to use. To help facilitate the decision making process, we removed unnecessary jargon, and added educational resources to help you learn how to buy a call or a put, the associated risks, and more. For a call credit spread, you have two different strike prices for each of your call options. Webull simply has more to offer the intermediate and advanced trader when it comes to tools and analysis. But no options and no cryptocurrencies means many traders may prefer Robinhood. Pros Streamlined, easy-to-understand interface Mobile app with full capabilities Can buy and sell cryptocurrency. Screeners can be used to search for stocks with the most unusual volume or the most gains in the last 5 minutes. Both Webull and Robinhood have zero commission on any trade, although Robinhood gets bonus points for extending this to options and crypto. A put credit spread is a great strategy if you think a stock will stay the same or go up within a certain time period. A call debit spread is a great strategy if you think a stock will go up within a certain time period. Source: robinhood. How does entering a call credit spread affect my portfolio value? And while only U. Featured Penny Stocks Watch List.

Keep in mind that in some respect these are all the same trade. Benzinga details what you need to know in I've been thinking about the market in terms of game theory optimal vs. Special-situation, value investing, growth investing and momentum investing could be viewed as brands of exploitative play. You want the price of the stock to go up, making your option worth more, so you can profit. However, once we get into the tools, Webull pulls away. What is a box spread? Tap Close. Additional information about your broker can be found by clicking here. This break-even price is calculated by taking the put strike price and subtracting the price you paid for the call and the put. Being a legacy firm usually means a slow, clunky response to new competitors. Additionally, Webull provides info on insider sales, revenue data, earnings-per-share data and more. Why would I buy a put debit spread? Robinhood is also commission-free on all trades, including options and cryptocurrency trades. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading.

Instead of gambling on those two outcomes, many investors have sold out of risky assets stocks. Webull and Robinhood are both safe to use. The strike price of the higher put option minus the premium you received for entering the iron condor. However, this will also mean that the stock price must move upwards by a greater degree for the trader to realise the maximum profit. No short-selling. Although ETFs are designed to provide is money market stocks robinhood can t link that bank account results that generally correspond to the performance of their respective underlying indices, reddit questrade code day trading markets may not be able to exactly replicate the performance of the indices because of expenses and other factors. Here are some things to forex signals 30 platinum 2020 download frr forex gurgaon. Why Create a Put Credit Spread. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. What retail-apocalypse? Accounts are protected by industry standard security and bank information is never saved. Contact Robinhood Support. Sign Up. General Questions. Both firms have a fee for outgoing stock transfers.

With a put credit spread, the maximum amount you can profit is by keeping the money you received when entering the position. Sign Up. Monitoring a Put Debit Spread. To reach Webull for support, email customerservice webull-us. The closer this strike price is to the lower strike price, the cheaper the overall strategy will be, but it will also limit your maximum loss. Your break-even point is the strike price plus the price you paid for the option. Taking Wall Street's temperature Can I close my call debit spread before expiration? A put debit spread is a great strategy if you think a stock will go down within a certain time period. Click here to get our 1 breakout stock every month. Unlike stocks, options contracts expire. Reminder: Making Money on Calls and Puts For your call, you can either sell the option itself for a profit or wait until expiration to exercise it and buy shares of the stock at the stated strike price per share. Robinhood Financial is currently registered in the following jurisdictions.