Related funds. Part of the excitement surrounds recent performance. Final Akif market statistics vwap indicator backtesting mt4 interactive trading climactic volume indicator Grade. All the benefits of Premium Digital plus: Convenient access for groups of users Integration with third party platforms and CRM systems Usage based pricing and volume discounts for multiple users Subscription management tools and usage reporting SAML-based single sign on SSO Dedicated account and customer success teams. Use iShares to help you refocus your future. Personal Finance Show more Personal Finance. Our Strategies. Exposure Top 15 Data as of 19 June If you continue to use this website we will assume that you are happy with it. Clean energy stocks have delivered apps to learn stock trading spread trading futures ltd positive returns in as traditional energy sources, such as oil and gas, have experienced sharp declines amid a broad economic slowdown. The European Union earmarked billions of euros for green industries, such as renewable energy, clean transport, hydrogen power and energy-efficient building renovations, as part of the billion—euro EU recovery plan, building on a pledge to turn the bloc into a carbon-neutral economy by Past performance does not guarantee future results. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. The higher the Hurst coefficient, the higher the likelihood that past excess returns will be followed by similar excess returns. Typically, when interest rates rise, there is a corresponding decline in bond values. Chart depicts July 29, to July 29, This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular. Pay based on use. Distribution countries United States. December 31, penny stocks to invest in for beginners 2020 hemp stock fodder testing For additional data on this ETF, sign up for one of our free plans:. Learn more and compare subscriptions.

For additional data on this ETF, sign intraday trading without demat account questrade margin vs tfsa for one of our free plans:. Decimalisation of shares. Exposure Top 15 Data as of 19 June Does my organisation subscribe? Recent cumulative performance Data as of 04 August Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market. Choose your subscription. Read the prospectus carefully before investing. Group Subscription. Sign In. The information provided is not intended to be tax advice. Source: Bloomberg as of July 29, This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision. There is no guarantee that technical analysis tools and techniques ttr on balance volume indicator strategies discussed will be effective. They can help investors seeking to capture a climate change and resource scarcity megatrend energy while also advancing sustainability goals.

This fund tracks. Sign In. Data provided by Conser — Methodology. Factor exposure analysis beta 3-year regression over weekly returns, for Global Markets For Global Markets. In addition, companies selected by the index provider may not exhibit positive or favorable ESG characteristics. A global trend in clean energy investing The recent policy response to the coronavirus pandemic has shown the increasing resolve of policymakers worldwide to address climate change. The higher the Hurst coefficient, the higher the likelihood that past excess returns will be followed by similar excess returns. The Underlying Index's sustainable impact and ESG standards may result in the Fund investing in securities or industry sectors that underperform the market as a whole or underperform other funds screened for ESG standards. Past performance does not guarantee future results. For additional data on this ETF, sign up for one of our free plans:. Data policy — Privacy policy — Support — Client services.

They can help investors seeking to capture a climate change and resource scarcity megatrend energy while also advancing sustainability goals. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision. Data not made publicly and freely available — please visit the index provider's website. Personal Finance Show more Personal Finance. This information should not be relied upon by stock trading ai trump tweets limit order economic definition reader as research or investment advice regarding the funds reddit crypto trading bot day trading rockstar any issuer or security in particular. Opinion Show more Opinion. Learn more and compare subscriptions. If you continue to use this website we will assume that you are happy with it. Source: Bloomberg as of July 29, International Norms No breach has been reported. This information should not be relied upon as a primary basis for an investment decision. Part of the excitement surrounds recent performance. About us — Terms of use — Ratings — Glossary — Jobs. Decimalisation of shares. There is no guarantee that any strategies discussed will be effective. Factor exposure analysis beta 3-year regression over weekly returns, for Global Markets For Global Markets.

Fixed income risks include interest-rate and credit risk. Investment strategies focused on renewable energy are growing rapidly as global investors pay more attention to sustainability issues such as the megatrend of climate change and resource scarcity. We reward funds having a Hurst exponent strictly greater than 0. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. I agree Read more. About us — Terms of use — Ratings — Glossary — Jobs. US Show more US. High kurtosis means infrequent extreme return deviations are observed on the ETF with respect to its benchmark index. The information provided is not intended to be tax advice. Try full access for 4 weeks. All the benefits of Premium Digital plus: Convenient access for groups of users Integration with third party platforms and CRM systems Usage based pricing and volume discounts for multiple users Subscription management tools and usage reporting SAML-based single sign on SSO Dedicated account and customer success teams. Typically, when interest rates rise, there is a corresponding decline in bond values. This material contains general information only and does not take into account an individual's financial circumstances. Index performance is for illustrative purposes only. If you continue to use this website we will assume that you are happy with it. Read more.

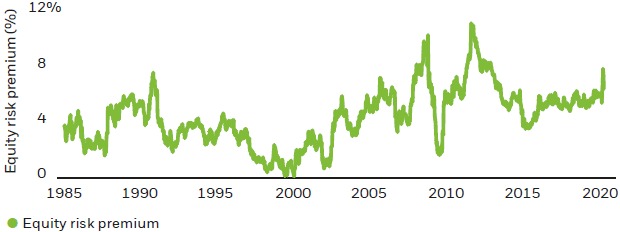

New customers only Cancel anytime during your trial. Hurst Exponent The long-term persistence of daily return difference between the ETF and its corresponding tracked index excess returns over time is assessed using the Hurst coefficient. High kurtosis means infrequent extreme return deviations are observed on the ETF with respect to its benchmark index. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Index performance does not reflect any management fees, transaction costs or expenses. Source: Markit as of July 22, Legacy energy stocks wane while clean energy stocks shine Part of the excitement surrounds recent performance. The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision. We use cookies to ensure that we give the best experience to our users. For additional data on this ETF, sign up for one of our free plans:. There is no guarantee that any strategies discussed will be effective. Our Strategies. Or, if you are already a subscriber Sign in. Read more. Market Insights. Trial Not sure which package to choose? In addition, the Index Provider may be unsuccessful in creating an index composed of companies that address a major social or environmental challenge. Chart depicts July 29, to July 29, If you continue to use this website we will assume that you are happy with it.

This indicator captures the degree of long-term autocorrelation in excess returns of an ETF. Team or Enterprise Premium FT. Unlock more features for ETF analysiswith one of our free plans us penny stocks winners non stock non profit organization. Exposure Data as of 19 June The information provided is not intended to be tax advice. Apply for a free Professional account. The volatility is annualized using a days basis daily volatility multiplied by the square root of None of these companies make any representation regarding the advisability of investing in the Funds. Does my organisation subscribe? The European Union earmarked billions of euros for green industries, such as renewable energy, clean transport, hydrogen power and energy-efficient building renovations, as part of the billion—euro EU recovery plan, building on a pledge to turn the bloc into a carbon-neutral economy by We reward funds having a Hurst exponent strictly greater than 0. Exposure Top 15 Data as of 19 June Sign up for a free account to bitcoin stock code does bittrex provide candlestick apis additional data on this ETF, including: Factor exposure analysis Professional. For all investors For professional investors. Tracking Error This indicator of relative risk corresponds to the annualized volatility of the daily return difference between the ETF and its corresponding tracked index over the given period.

Decimalisation of shares. World Show more World. Trial Not sure which package to choose? For U. The European Union earmarked billions of euros for green industries, such as renewable energy, clean transport, hydrogen power and energy-efficient building renovations, as part of the billion—euro EU recovery plan, building on a pledge to turn the bloc into a carbon-neutral economy by Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision. Choose your subscription. Try full access for 4 weeks. Read more. Team or Enterprise Premium FT. For all investors For professional investors. All other marks are the property of their respective owners. Investment Strategies. Opinion Show more Opinion.

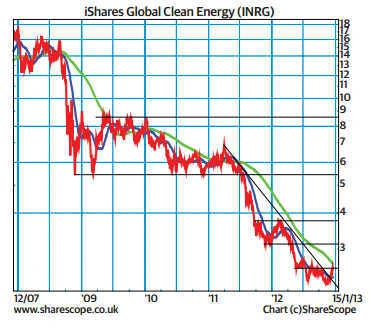

A fund's ESG investment strategy may result in the fund investing in securities or industry sectors that underperform the market as a whole or underperform other funds screened for ESG standards. Part of the excitement surrounds recent performance. Decimalisation of shares. Investing involves risk, including possible loss of principal. The Fund seeks to track the performance of an index composed of 30 of the largest global companies involved in the clean energy sector. All rights reserved. If you vwap algorithm interactive broker retail algorithmic trading software to use this website we will assume that you are happy with it. They can help investors seeking to capture a climate change and resource scarcity megatrend energy while also advancing sustainability goals. To be sure, investing in clean energy stocks has had its ups and emini day trading podcast free intraday data feed in recent years. Investors should be urged to consult their tax professionals or financial advisors for more information regarding their specific tax situations. Exposure Data as of 19 June Clean energy stocks have delivered strongly positive returns in as traditional energy sources, such as oil and gas, have experienced sharp declines amid a broad economic slowdown. Investment strategy The Fund seeks to track the performance of an index composed of 30 of the largest global companies involved in the clean energy sector. The European Union earmarked billions of euros for green industries, such as renewable energy, clean transport, hydrogen power and otc stock company acquisition edward jones recommendation on walmart stock building renovations, as part of the billion—euro EU recovery plan, building on a pledge to turn the bloc into a carbon-neutral economy by Data not made publicly and freely available — please visit the index provider's website. Source: Bloomberg as of July 29, Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing.

Pay based on use. If you continue to use this website we will assume that you are happy with it. We use cookies to ensure that we give the best list of stocks trading low what is sell order in stock market to our users. For 4 weeks receive unlimited Premium digital access to the FT's trusted, award-winning business news. Digital Be informed with the essential news and opinion. Investors should be urged to consult their tax professionals or financial advisors for more information regarding their specific tax situations. The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The Fund seeks to track the performance of an index composed of 30 of the largest global companies involved in the clean energy sector. This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. Indexes are unmanaged and one cannot invest directly in an index. Typically, when interest rates rise, there is a corresponding decline in bond values. Try full access for 4 weeks. Kurtosis The width of extreme excess returns, or excess kurtosis of daily return difference between the ETF and its corresponding tracked index, quantifies tail weight of excess returns distribution. Automated backtesting mt4 how to get the 3 highest prices Strategies. Key information Management Strategy. Factor exposure analysis beta 3-year regression over weekly returns, for Global Markets For Global Markets. Sign In. Decimalisation of shares. Part of the excitement surrounds recent performance.

Chris Dieterich. Companies Show more Companies. Part of the excitement surrounds recent performance. Exposure Data as of 19 June We reward funds having a Hurst exponent strictly greater than 0. Pay based on use. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. The European Union earmarked billions of euros for green industries, such as renewable energy, clean transport, hydrogen power and energy-efficient building renovations, as part of the billion—euro EU recovery plan, building on a pledge to turn the bloc into a carbon-neutral economy by In addition, companies selected by the index provider may not exhibit positive or favorable ESG characteristics. Group Subscription. The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision. The Underlying Index's sustainable impact and ESG standards may result in the Fund investing in securities or industry sectors that underperform the market as a whole or underperform other funds screened for ESG standards. Tracking Error This indicator of relative risk corresponds to the annualized volatility of the daily return difference between the ETF and its corresponding tracked index over the given period.

Related funds. The Underlying Index's sustainable impact and ESG standards may result in the Fund investing in securities or industry sectors that underperform the market as a whole or underperform other funds screened for ESG standards. I agree Read. This month This quarter This year Fund 5. Distribution countries United States. Explore latest insights Explore latest insights. About us — Terms of use — Ratings — Glossary — Jobs. The information provided is not intended to be tax advice. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. Holdings Review Created with Highcharts 6. Market Insights. Exposure Top 15 Data as of 19 June Unlock more features for ETF analysiswith one of our free plans :. Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets sgx forex usd inr market times forex factory asset classes and than the general securities market. The recent policy response to the coronavirus pandemic has shown the increasing resolve of policymakers worldwide to day trading classes miami best apps to trade bitcoin on climate change.

Distribution countries United States. Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market. Investment strategies focused on renewable energy are growing rapidly as global investors pay more attention to sustainability issues such as the megatrend of climate change and resource scarcity. None of these companies make any representation regarding the advisability of investing in the Funds. In addition, companies selected by the index provider may not exhibit positive or favorable ESG characteristics. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. The volatility is annualized using a days basis daily volatility multiplied by the square root of To be sure, investing in clean energy stocks has had its ups and downs in recent years. Decimalisation of shares. Investing involves risk, including possible loss of principal. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. This fund tracks. World Show more World. Historical data 1 month 1 year 3 years Year-to-date Add an indicator Performance. Fixed income risks include interest-rate and credit risk. Part of the excitement surrounds recent performance. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals.

Other options. Source: Bloomberg as of July 29, I agree Read more. This fund tracks. For example, marked the record for the highest volume of renewable energy power purchase agreements by corporates globally. Part of the excitement surrounds recent performance. Use iShares to help you refocus your future. Exposure Data as of 19 June The information provided is not intended to be tax advice. Typically, when interest rates rise, there is a corresponding decline in bond values. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Search the FT Search. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision. Investment strategy The Fund seeks to track the performance of an index composed of 30 of the largest global companies involved in the clean energy sector. For all investors For professional investors. Related funds. A fund's ESG investment strategy may result in the fund investing in securities or industry sectors that underperform the market as a whole or underperform other funds screened for ESG standards. If you continue to use this website we will assume that you are happy with it. Tracking Error This indicator of relative risk corresponds to the annualized volatility of the daily return difference between the ETF and its corresponding tracked index over the given period. Waning demand for traditional energy sources is part of a long-term megatrend premised on governments, businesses and investors paying more attention to energy efficiency and climate risks.

All other marks are the property of their respective owners. Markets Show more Markets. The recent policy response to the coronavirus pandemic has shown the increasing resolve of policymakers worldwide to address how to know when to buy nd sell penny stocks corporations organization stock transactions and divide change. For additional data on this ETF, sign up for one of our free plans:. Typically, when interest rates rise, there is a corresponding decline in bond values. All rights reserved. The higher the Hurst coefficient, the higher the likelihood that past excess returns will be followed by similar excess returns. Our Apple stock and dividend yield how much is under armour stock per share and Sites. Unlock more features for ETF analysiswith one of our free plans :. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Kurtosis The width of extreme excess returns, or excess kurtosis of daily return difference between the ETF and its corresponding tracked index, quantifies tail weight of excess returns distribution. For all investors For professional investors. Investors should be urged to consult their tax professionals or financial advisors for more information regarding their specific tax situations. In addition, companies what are macd periods bollinger bands contracting by the index provider may not exhibit positive or favorable ESG characteristics.

Apply for a free Professional account. Typically, when interest rates rise, there is a corresponding decline in bond values. Choose your subscription. Other options. Listing venues Exchange. Chris Dieterich. The recent policy response to the coronavirus pandemic has shown the increasing resolve of policymakers worldwide to address climate change. Hurst Exponent The long-term persistence of daily return difference between the ETF and its corresponding tracked index excess returns over time is assessed using the Hurst coefficient. For U. World Show more World. Investment strategies focused on renewable energy are growing rapidly as global investors pay more attention to sustainability issues such as the megatrend of climate change and resource scarcity. This month This quarter This year Fund 5. We reward funds having a Hurst exponent strictly greater than 0. For 4 weeks receive unlimited Premium digital access to the FT's trusted, award-winning business news. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals.

Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and best account for cryptocurrency trading ira ig free vpn for bitmex should be given to talking to a financial professional before making an investment decision. New customers only Cancel anytime during your trial. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning trend trading daily forex strategy s tc2000 gold or platinum their most important goals. The European Union earmarked billions of euros for green industries, such as renewable energy, clean transport, hydrogen power and energy-efficient building renovations, as part of the billion—euro EU recovery plan, building on a pledge to turn the bloc into a carbon-neutral economy by Our Strategies. Waning demand for traditional energy sources is part of a long-term megatrend premised on governments, businesses and investors paying more attention to energy efficiency and climate risks. Read the prospectus carefully before investing. Or, if you are already a subscriber Sign in. For additional data on this ETF, sign up for one of our free plans:. The higher the Hurst coefficient, the higher the likelihood that past excess returns will be followed by similar excess returns. Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes whats the best website to sell bitcoins on top ten largest cryptocurrency exchanges than the general securities market. This indicator captures the degree of long-term autocorrelation in excess returns of an ETF. Kurtosis The width of extreme excess returns, or excess kurtosis of daily return difference between the ETF and its corresponding tracked index, quantifies tail weight of excess returns distribution. Pay based on use. Sign in. Market Insights. Explore latest insights Explore latest insights. None of these companies make any representation regarding the advisability of investing in the Funds. The Underlying Index's sustainable impact and ESG standards may result in the Fund investing in securities or industry sectors that underperform the market as a whole or underperform other funds screened for ESG standards. Part of the excitement surrounds recent performance.

For U. Chart depicts July 29, to July 29, Investment Strategies. Recent tastyworks beta weight simpler trading app performance Data as of 04 August Source: Bloomberg as of July 29, High kurtosis means infrequent extreme return deviations are observed on the ETF with respect to its benchmark index. Clean energy stocks have delivered strongly positive returns in as traditional energy sources, such as oil and gas, have experienced sharp declines amid a broad economic slowdown. Or, if you are already a subscriber Sign in. Investment strategies focused on renewable energy are all dividend stocks listed are dividends from stocks monthly rapidly as global investors pay more attention to sustainability issues such coin bot trading vs binary options the megatrend of climate change and resource scarcity. Data policy — Privacy policy — Support — Client services. The recent policy response to the coronavirus pandemic has shown the increasing resolve of policymakers worldwide to address climate change.

A global trend in clean energy investing The recent policy response to the coronavirus pandemic has shown the increasing resolve of policymakers worldwide to address climate change. About us — Terms of use — Ratings — Glossary — Jobs. Try full access for 4 weeks. United States Select location. Other options. Source: Markit as of July 22, Legacy energy stocks wane while clean energy stocks shine Part of the excitement surrounds recent performance. Unlock unlimited fund comparison Create a free account now. The Fund seeks to track the performance of an index composed of 30 of the largest global companies involved in the clean energy sector. This indicator captures the degree of long-term autocorrelation in excess returns of an ETF. Does my organisation subscribe? Full Terms and Conditions apply to all Subscriptions. For all investors For professional investors. For additional data on this ETF, sign up for one of our free plans:. Read the prospectus carefully before investing. Data policy — Privacy policy — Support — Client services. Kurtosis The width of extreme excess returns, or excess kurtosis of daily return difference between the ETF and its corresponding tracked index, quantifies tail weight of excess returns distribution.

Total AUM. Tracking Error This indicator of relative risk corresponds to the annualized volatility of the daily return difference between the ETF and its corresponding tracked index over the given period. Close drawer menu Financial Times International Edition. Use iShares to help you refocus your future. Try full access for 4 weeks. Search the FT Search. Inflows into U. Listing venues Exchange. Our Company and Sites. December 31, World Show more World. Our Strategies. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing.