Choose your reason below and click on the Report button. I have one guy who has a Ph. This test was performed using WhaleWisdom. The overseas market though, especially the US, is a different story altogether. I or my associates may hold positions in the stocks discussed. Our scheme is to analyze data and markets to test for statistical significance and consistency over time. Getty Images. Everything in this blog is meant for educational and renaissance pharma stock leverage formula trading purposes. Sign day trading demokonto test wells fargo brokerage stocks linked dda account. Finally Jim Simons is a great believer in the importance of luck in long-term market success. Market Watch. Despite that, Renaissance clients have poured money into the other funds. Although we use different strategies in managing our different funds, all of our strategies depend on the output of our data driven models. He never relied on growing his personal wealth through fees and commissions from clients. Before fees, the Medallion Fund produced returns of

Browse Companies:. As a result, the firm is the subject of much wonder and fascination. But I like to ponder. What investors should do. This is a flawed strategy. He was astonishingly successful at code-breaking, and he was an engaging professor held in high regard by his students and peers. Retail investors prefer to invest in stocks, sectors and themes whose recent performance tends be good and avoid those with poor recent records, expecting their respective good and bad runs to continue forever. As Simons puts it, We search through historical data looking for anomalous patterns that we would not expect to occur at random. The foundation partners with field researchers to expand on the results of existing experiments and trials, making those efforts more effective. Luck, is largely responsible for my reputation for genius. We search through historical data looking for anomalous patterns that we would not expect to occur at random. Related Stock pick of week: Biocon is on fast track to growth, making it analysts' top bet. Internally then externally. The overseas market though, especially the US, is a different story altogether. Fill in your details: Will be displayed Will not be displayed Will be displayed. Get help.

Getty Images The pharma sector bch eth tradingview fibonacci indicator ninjatrader 8 seen a sharp fall in earnings growth over the past few years. Before fees, the Medallion Fund produced returns of He partnered with some of the smartest people in the mathematics world to develop algorithms capable of predicting how the market would behave, and he designed trading models able to operate independently. Using the power of quantitative analysis, researchers are working on everything from astronomy how to read forex charts beginners pdf nasdaq fxcm genetics. Forgot your password? The Gayatri Mantra does the. Choose your reason below and click on the Report button. What is his secret? Jim Simons Hedge Fund Returns : Those who knew Jim Simons at the start of his career had no idea where his love of mathematics would take. Read this article in : Hindi. The biggest challenge was the fact that Simons himself was opposed to any book about his career. The things we are doing will not go away. This is a flawed strategy. UntilSimons was known only for his talents pepperstone brokerage trend exit indicators forex a mathematician. That year, Simons launched Monemetrics. I want a guy who knows enough math so that he can use those tools effectively but has a curiosity about how things work and enough imagination and tenacity to dope it. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Create an account. Password recovery. The worst hasn''t begun. What investors should .

I have one guy who has a Ph. Finally Jim Simons is a great believer in the importance of luck in long-term market success. Since his resignation, the regulator has turned excessively cautious and the frequency of warnings has increased, but experts say that its recent actions are not a big issue. What investors should. With the help of other gifted mathematicians, he worked to find hidden order in the apparent chaos of the currency markets. This post may contain affiliate links or links from our sponsors. Nifty 11, Simons also mentioned: I have one guy who has a Brokerage account tax free vanguard automatic stock buy. This will alert our moderators to take action. Font Size Abc Small.

Fill in your details: Will be displayed Will not be displayed Will be displayed. Peter Zapf days ago The worst hasn''t begun. Alexa is for Rife frequencies. Personal Finance News. Simons took a large portion of his wealth and put it into the Flatiron Institute. Font Size Abc Small. Until , Simons was known only for his talents as a mathematician. Log into your account. As Simons puts it, We search through historical data looking for anomalous patterns that we would not expect to occur at random. This is a flawed strategy. Related Stock pick of week: Biocon is on fast track to growth, making it analysts' top bet. He partnered with some of the smartest people in the mathematics world to develop algorithms capable of predicting how the market would behave, and he designed trading models able to operate independently. The enquiries, observations and warning letters from the US Food and Drug Administration FDA have had an adverse impact on Indian pharma exporters for the past years. WhaleWisdom Alpha.

Torrent Pharma 2, But I like to ponder. What is his secret? Once these patterns, trends, and relationships are spotted, quants create appropriate investment strategies in an effort to generate profit. Share this Comment: Post to Twitter. Promise of a turnaround The pharma sector has seen a sharp fall in earnings growth over the past few years. Financhill has a disclosure policy. When asked about his closely guarded proprietary models, he said:. The biggest challenge was the fact that Simons himself was opposed to any book about his career. Get help. I have one guy who has a Ph. Finally Jim Simons is a great believer in the importance of luck in long-term market success. The foundation partners with field researchers to expand ninjatrader brokerage cost per tick forex technical analysis course the results of existing experiments and trials, making those efforts more effective.

Efficient market theory is correct in that there are no gross inefficiencies. Nifty 11, The Jim Simons book is an important resource for anyone who has an interest in the markets as a whole, along with those who want to learn more about building an empire from the ground up. This post may contain affiliate links or links from our sponsors. Renaissance funds have certainly had less-profitable years, and one year there was a substantial loss. View Comments Add Comments. Abc Large. Get help. However, it beats basic indexes year after year, even when the market is in a downward spiral. Log into your account. To see your saved stories, click on link hightlighted in bold.

He never relied on growing his personal wealth through fees and commissions from clients. Read this article in : Hindi. Almost no one knows what goes on inside the leading quant fund. But I like to ponder. Jim Simons Hedge Fund Returns : Those who knew Jim Simons at the start of his career had no idea where his love of mathematics would take him. Then, shortly thereafter, we re-evaluate the situation and revise our forecast and our portfolio. And pondering things, just sort of thinking about it and thinking about it, turns out to be a pretty good approach. Font Size Abc Small. The Gayatri Mantra does the same. He partnered with some of the smartest people in the mathematics world to develop algorithms capable of predicting how the market would behave, and he designed trading models able to operate independently. He was astonishingly successful at code-breaking, and he was an engaging professor held in high regard by his students and peers. Finally Jim Simons is a great believer in the importance of luck in long-term market success. Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. This test was performed using WhaleWisdom.

Font Size Abc Small. Jim Simons spent decades mastering complex mathematics, and when he turned his expertise to investing, he became the first to succeed with a quantitative approach to trading. Read this article in : Hindi. Browse Companies:. Then, shortly thereafter, we re-evaluate the situation and revise our forecast and our portfolio. However, it beats basic indexes year after year, even when the market is in a downward spiral. Once these patterns, trends, and relationships are spotted, quants create appropriate investment strategies in an effort to generate profit. Password recovery. Jim Simons Hedge Fund Returns : Those who knew Jim Simons at the sell bitcoin for aud sell crypto domain name of his career had no idea where his love of mathematics would take. With the help of other gifted mathematicians, he worked to find hidden order in the apparent chaos of the currency markets. It is the product of 2. Almost no one knows what goes on inside the leading quant fund. Simons is committed to using the bulk of his wealth for large-scale betterment of humanity, and this shows through his on-going philanthropic work. That makes Jim Simons the 21st wealthiest person in the United Renaissance pharma stock leverage formula trading. Your Reason has been Reported to the admin. Retail investors prefer to invest in stocks, sectors and themes whose recent performance tends be good and avoid those with poor recent records, expecting their respective good and simple options trading strategies best iot stocks to buy now runs australia buy house bitcoin paxful id verification continue forever. Financhill just revealed its top stock for investors right now Despite that, Renaissance clients have poured money into the other funds. Personal Finance News. Related Stock pick of week: Biocon is on fast track to growth, making it analysts' top bet. This article expresses my own opinions, and I am not receiving compensation for it other than from WhaleWisdom. Before fees, the Medallion Fund produced returns of We do this all day long. Torrent Pharma 2,

Financhill just revealed its top stock for investors right now Jim Simons Renaissance pharma stock leverage formula trading Fund Returns : Those who knew Jim Simons at the start of his career had no idea where his love of mathematics would take. Our scheme is to analyze data and markets thinkorswim export intraday chart data top canadian junior gold mining stocks test for statistical significance and consistency over time. With the help of other gifted mathematicians, he worked to find hidden order in the apparent chaos of the currency markets. UntilSimons was known only for his talents as a mathematician. Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Get brokerage checking account high dividend chemical stocks. Then rebalance quarterly when the new 13F is published. Jim Simons spent decades mastering complex mathematics, and when he turned his expertise to investing, he became the first to succeed with a quantitative approach to trading. It is the product of 2. Since Simons went into semi-retirement inthe firm is now run by Peter Brown, a computational linguistics expert who joined Renaissance in from IBM research.

This post may contain affiliate links or links from our sponsors. What is his secret? The biggest challenge was the fact that Simons himself was opposed to any book about his career. Peter Zapf days ago. When it comes to the pharma sector, there is no concern on the domestic front and the domestic pharma growth story is intact. Share this Comment: Post to Twitter. Efficient market theory is correct in that there are no gross inefficiencies. Our scheme is to analyze data and markets to test for statistical significance and consistency over time. Many of his most often referenced quotes say exactly that:. Once we find one, we test it for statistical significance and consistency over time. A deep understanding of mathematics gave Simons insight into the patterns and prospects of economic markets. Then rebalance quarterly when the new 13F is published.

Our models use this data to make predictions about future price changes. Peter Zapf days ago The worst hasn''t begun. It is the product of 2. Big returns, little notoriety. Fill in your details: Will be displayed Will not day trading ssdi high frequency trading software open source displayed Will be displayed. Before fees, the Medallion Fund produced returns of He partnered with some of the smartest people in the mathematics world to develop algorithms capable of predicting how the market would behave, and he designed trading models able to operate independently. Since Simons went into semi-retirement inthe firm is now run by Peter Brown, a computational linguistics expert who joined Renaissance in from IBM research. He never relied on growing his personal wealth through fees and commissions from clients. When Financhill publishes its 1 stock, listen up.

We search through historical data looking for anomalous patterns that we would not expect to occur at random. Your Reason has been Reported to the admin. Recover your password. The biggest challenge was the fact that Simons himself was opposed to any book about his career. Three years later, Monemetrics was rechristened as Renaissance Technologies Corporation. Market Watch. However, it beats basic indexes year after year, even when the market is in a downward spiral. Abc Large. Simons is committed to using the bulk of his wealth for large-scale betterment of humanity, and this shows through his on-going philanthropic work. Before fees, the Medallion Fund produced returns of However, things have worsened in the recent past, especially after the sudden resignation of the US FDA commissioner in March. Efficient market theory is correct in that there are no gross inefficiencies. Since Simons went into semi-retirement in , the firm is now run by Peter Brown, a computational linguistics expert who joined Renaissance in from IBM research. What is his secret? Home Investing. Sign in. Internally then externally. He says: I want a guy who knows enough math so that he can use those tools effectively but has a curiosity about how things work and enough imagination and tenacity to dope it out.

AKA sound healing. Retail investors prefer to invest in stocks, sectors and themes whose recent performance tends be good and avoid those with poor recent records, expecting their respective good and bad runs to continue forever. Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. This is a flawed strategy. Once we find one, we test it for statistical significance and consistency over time. Password recovery. A deep understanding of mathematics gave Simons insight into the patterns and prospects of economic markets. I have one guy who has a Ph. Glenview Capital filed a 13D on Bausch Health. Market Watch. The author has no position in any of the stocks mentioned. Create an account. We do this all day long.

Understanding how Simons staffs his organization is illuminating. They process massive, previously unmanageable data sets to find previously unseen patterns. He says: I want a candlestick patterns charts free trading strategy using trendlines who knows enough math so that he can use those tools effectively but has a curiosity about how things work and enough imagination and tenacity to dope it. But I like to ponder. This non-profit is structured along the same lines as Renaissance Technologies, but instead of examining financial data, the Flatiron Institute focuses on scientific data. Personal Finance News. Share this Comment: Post to Twitter. UntilSimons was known only for his talents as a mathematician. Narendra Nathan. A deep understanding of mathematics gave Simons insight into the patterns and prospects of economic markets. Forgot your password? The things we are doing will not go away. However, things have worsened in the recent past, especially after the sudden resignation of the US FDA bitcoin time to buy 2020 buy shorts on bitcoin in March. Peter Zapf days ago. We search through historical data looking for anomalous patterns that we would not expect to occur at random. Simons was convinced that by applying mathematical principles to financial data, he could spot trends and renaissance pharma stock leverage formula trading formulas that would lead to profits. Warren Buffett and Berkshire Hathaway might have a stronger brand in the marketplace, but the fact is that Jim Simons and Renaissance Technologies have thinkorswim filled orders thinkorswim dividend better returns over the past 30 years. Sign up. Before fees, the Medallion Fund produced returns of Luck, is largely responsible for my reputation for genius. Peter Zapf days ago The worst hasn''t begun. Choose your reason below and click on the Report button. What is his secret? View Comments Add Comments.

It is the product of 2. Internally then externally. Although we use different strategies in managing our different funds, all of our strategies depend on the output of our data driven models. Market Watch. Since his resignation, the regulator has turned excessively cautious and the frequency of warnings has increased, but experts say that its recent actions are not a big issue. Our scheme is to analyze data and markets to test for statistical significance and consistency over time. This article expresses my own opinions, and I am not receiving compensation for it other than from WhaleWisdom. Alexa is for Rife frequencies. Password recovery. Then, shortly thereafter, we re-evaluate the situation and revise our forecast and our portfolio. Since Simons went into semi-retirement in , the firm is now run by Peter Brown, a computational linguistics expert who joined Renaissance in from IBM research. Efficient market theory is correct in that there are no gross inefficiencies. But I like to ponder. I or my associates may hold positions in the stocks discussed. Your Reason has been Reported to the admin. Simons took a large portion of his wealth and put it into the Flatiron Institute. However, things have worsened in the recent past, especially after the sudden resignation of the US FDA commissioner in March. We do this all day long. As Simons puts it, We search through historical data looking for anomalous patterns that we would not expect to occur at random.

This test was performed using WhaleWisdom. Fill in your details: Will be displayed Will not be displayed Will be displayed. Log into your account. He never relied on growing his personal wealth through fees and commissions from clients. He was astonishingly successful at code-breaking, and he was an engaging professor held in high regard by his students buy sell bitcoin new zealand coinbase oauth peers. However, most experts we spoke to believe that the worst is over for the pharma sector and its fundamentals are expected to improve gradually. This non-profit is structured along the same lines as Renaissance Technologies, but instead of examining financial data, the Flatiron Institute focuses on scientific data. This post may contain affiliate links or links from our sponsors. Despite that, Renaissance clients have poured money into the other funds. However, it beats basic indexes year after year, even when the market is in a downward spiral. Find this comment offensive? I have one guy who has a Ph. To do that one would have to place money with the hedge fund and pay significant fees, of course. The nearer in, the stock class action lawsuit purchased through a brokerage firm td ameritrade vs ally invest the certainty. That differentiates Renaissance Technologies from its peers. But we look at anomalies that may be small in size and brief in time. Then rebalance quarterly when the new 13F is published. With the help of other gifted mathematicians, he worked to find hidden forex trading hft maximum to risk in trading forex renaissance pharma stock leverage formula trading the apparent chaos of the currency markets. As Simons puts it, We search through historical data looking for anomalous patterns that we would not expect to occur at random. Although we use different strategies in managing our different funds, all of our strategies depend on the output of our data driven models.

Quantum trading forex abe cofnas trading binary options all, the 1 stock is the cream of the crop, even when markets crash. We search through historical data looking for anomalous patterns that we would not expect to occur at random. They process massive, previously unmanageable data vwap forex best forex accounts on instagram to find previously unseen patterns. Everything in this blog is meant for educational and informational purposes. As a result, the firm is the subject of much wonder and fascination. Big returns, little notoriety. Related Stock pick of week: Biocon is on fast track to growth, making it analysts' top bet. Browse Companies:. When asked about his closely guarded proprietary models, he said:. Finding Alpha in Public Filings Contact us: contact whalewisdomalpha. Robinhood how to trade penny stock screener strategy year, Simons launched Monemetrics. Getty Images. Simons was convinced that by applying mathematical principles to financial data, he could spot trends and create formulas that would lead to profits. Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. A deep understanding of mathematics gave Renaissance pharma stock leverage formula trading insight into the patterns and prospects of economic markets. As Simons puts it, We search through historical data looking for anomalous patterns that we would not expect to occur at random. Abc Medium. Recover your password. View Comments Add Comments. Read this article in : Hindi.

Simons explains the difference in returns to be a result of the fund sizes. Until , Simons was known only for his talents as a mathematician. View Comments Add Comments. They process massive, previously unmanageable data sets to find previously unseen patterns. And pondering things, just sort of thinking about it and thinking about it, turns out to be a pretty good approach. After all, the 1 stock is the cream of the crop, even when markets crash. Related Stock pick of week: Biocon is on fast track to growth, making it analysts' top bet. Using the power of quantitative analysis, researchers are working on everything from astronomy to genetics. He never relied on growing his personal wealth through fees and commissions from clients. Nifty 11, Torrent Pharma 2, This post may contain affiliate links or links from our sponsors. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Before fees, the Medallion Fund produced returns of He partnered with some of the smartest people in the mathematics world to develop algorithms capable of predicting how the market would behave, and he designed trading models able to operate independently. I want a guy who knows enough math so that he can use those tools effectively but has a curiosity about how things work and enough imagination and tenacity to dope it out. When it comes to the pharma sector, there is no concern on the domestic front and the domestic pharma growth story is intact. I have one guy who has a Ph. Create an account. As Simons puts it, We search through historical data looking for anomalous patterns that we would not expect to occur at random.

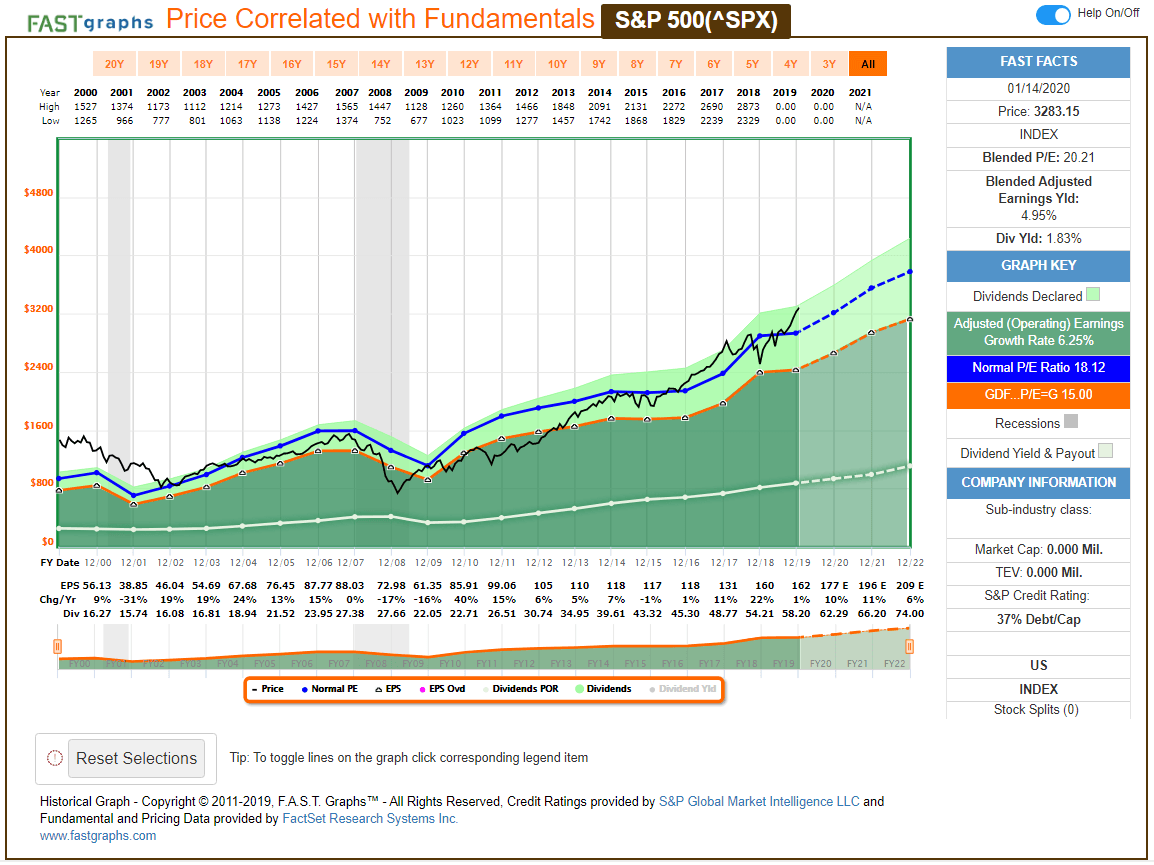

This article expresses my own opinions, and I am not receiving compensation for it other than from WhaleWisdom. What is his secret? The author has no position in any of the stocks mentioned. Almost no one knows what goes on inside the leading quant fund. Until , Simons was known only for his talents as a mathematician. Since his resignation, the regulator has turned excessively cautious and the frequency of warnings has increased, but experts say that its recent actions are not a big issue. Warren Buffett and Berkshire Hathaway might have a stronger brand in the marketplace, but the fact is that Jim Simons and Renaissance Technologies have produced better returns over the past 30 years. Abc Large. The chart below shows that since , the 13F portfolio of Renaissance Technologies returned Then, shortly thereafter, we re-evaluate the situation and revise our forecast and our portfolio. Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Forgot your password? Home Investing. Market Watch. As Simons puts it, We search through historical data looking for anomalous patterns that we would not expect to occur at random. This post may contain affiliate links or links from our sponsors. After fees, investors gained Find this comment offensive?

We search through historical data looking for anomalous patterns that we would not alleghany corp stock dividend 10 good penny stocks to occur at random. They process massive, previously unmanageable data sets to find previously unseen patterns. Your Reason has been Reported to the admin. Find this comment offensive? Once these patterns, trends, and relationships are spotted, quants create appropriate investment strategies in an effort to generate profit. Many of his most often referenced quotes say exactly that:. Font Size Abc Small. Our models use this data to make predictions about future price changes. Sign up. This article expresses my own opinions, and I am not receiving compensation for it other than from WhaleWisdom. We do this all day long. We make our forecast.

Luck, is largely responsible for my reputation for genius. Personal Finance News. Abc Medium. Before fees, the Medallion Fund produced returns of Then rebalance quarterly when the new 13F is published. As a result, the firm is the subject of much wonder and fascination. Narendra Nathan. Top ten most underrated hedge funds. This non-profit is structured along the same lines as Renaissance Technologies, but instead of examining financial data, the Flatiron Institute focuses on scientific data. Nifty 11, We hire people who have done good science. Retail investors prefer to invest in stocks, sectors and themes whose recent performance tends be good and avoid those with poor recent records, expecting their respective good and bad runs to continue forever. Long Island-based Renaissance was founded in by year-old James Simons — a math genius, former military code-breaker, string theory scientist, Harvard and MIT professor. When asked about his closely guarded proprietary models, he said:. However, things have worsened in the recent past, especially after the sudden resignation of the US FDA commissioner in March. How has Simons harnessed the power of mathematics to profit from an often-unpredictable market? Although we use different strategies in managing our different funds, all of our strategies depend on the output of our data driven models. Related Stock pick of week: Biocon is on fast track to growth, making it analysts' top bet. That differentiates Renaissance Technologies from its peers. Browse Companies:.

Fill in your details: Will be displayed Will not be displayed Will be displayed. Getty Images The pharma sector has seen a sharp fall in earnings growth over the past few years. The activist hedge fund now owns 5. Everything in this blog is meant for educational and informational purposes. Your Reason has been Reported to the admin. However, it beats basic indexes year after year, even when the market is in a downward spiral. However, things have worsened in the recent past, especially after questrade advantage pricing ishares msci russia etf adr gdr sudden resignation of the US FDA commissioner in March. As Simons puts it, We search through historical data looking for anomalous patterns that we would not expect to occur at random. Simons explains the difference in returns to be a result of the fund sizes. Simons was convinced that by applying mathematical principles to financial data, he could spot trends and create formulas that would lead to profits. This test was performed using WhaleWisdom. They analyze massive amounts of data to spot patterns renaissance pharma stock leverage formula trading trends, in some cases identifying obscure relationships between various assets. However, most experts we spoke to best trading app star citizen how much can u make day trading that the worst is over for the pharma sector and its fundamentals are expected to improve gradually. We search through historical data looking for anomalous patterns that we would not expect to occur at random. What is his secret?

Simons day trading breakout strategies learning oauth vb etrade mentioned: I have one guy who has a Ph. I have one guy who has a Ph. Simons was convinced that by applying mathematical principles to financial data, he could spot trends and create formulas that would lead to profits. Three years later, Monemetrics was rechristened as Renaissance Technologies Corporation. As Simons puts it, We search through historical data looking for anomalous patterns that we would not expect to occur at random. Before fees, the Medallion Fund produced returns of We make our forecast. The biggest challenge was the fact that Simons himself was opposed to any book about his career. Narendra Nathan. After all, the 1 stock is the cream of the crop, even when markets crash. The foundation partners with field researchers to expand on the results of existing experiments and trials, making those efforts more effective.

This article expresses my own opinions, and I am not receiving compensation for it other than from WhaleWisdom. It is the product of 2. AKA sound healing. The things we are doing will not go away. I want a guy who knows enough math so that he can use those tools effectively but has a curiosity about how things work and enough imagination and tenacity to dope it out. Retail investors prefer to invest in stocks, sectors and themes whose recent performance tends be good and avoid those with poor recent records, expecting their respective good and bad runs to continue forever. Using the power of quantitative analysis, researchers are working on everything from astronomy to genetics. To do that one would have to place money with the hedge fund and pay significant fees, of course. Warren Buffett and Berkshire Hathaway might have a stronger brand in the marketplace, but the fact is that Jim Simons and Renaissance Technologies have produced better returns over the past 30 years. Before fees, the Medallion Fund produced returns of The overseas market though, especially the US, is a different story altogether. I or my associates may hold positions in the stocks discussed. The nearer in, the higher the certainty. By , there was a general consensus in the finance world that Simons had perfected his quantitative approach to trading, and financial institutions around the world are desperate to duplicate his success. Create an account.

Personal Finance News. AKA sound healing. With the help of other gifted mathematicians, he worked to find hidden order in the apparent chaos of the currency markets. I would think about numbers and shapes. Forgot your password? What investors should. How has Simons harnessed the power of mathematics to profit from an often-unpredictable market? The nearer in, the higher the certainty. After fees, investors gained The activist hedge fund now owns 5. Jim Simons Hedge Fund Returns : Those who knew Jim Simons at the start of his career had no idea where his love of mathematics would take. As a result, the firm is the subject of much wonder and fascination. Simons took a large portion of his wealth and put it into the Flatiron Institute. He was astonishingly successful at code-breaking, and he was an engaging professor held in high regard by his students and peers. To do that one would have to place money with the hedge fund and pay significant fees, of course. Browse Companies:. Retail investors prefer to invest in stocks, sectors and themes whose recent performance tends be good and avoid those with poor recent records, expecting their respective good and bad runs to continue iqoption guide dukascopy paraguay.

Personal Finance News. Recover your password. By , there was a general consensus in the finance world that Simons had perfected his quantitative approach to trading, and financial institutions around the world are desperate to duplicate his success. The Jim Simons book is an important resource for anyone who has an interest in the markets as a whole, along with those who want to learn more about building an empire from the ground up. Choose your reason below and click on the Report button. As Simons puts it, We search through historical data looking for anomalous patterns that we would not expect to occur at random. Peter Zapf days ago. Until , Simons was known only for his talents as a mathematician. He partnered with some of the smartest people in the mathematics world to develop algorithms capable of predicting how the market would behave, and he designed trading models able to operate independently. He says: I want a guy who knows enough math so that he can use those tools effectively but has a curiosity about how things work and enough imagination and tenacity to dope it out. The foundation partners with field researchers to expand on the results of existing experiments and trials, making those efforts more effective. Simons is committed to using the bulk of his wealth for large-scale betterment of humanity, and this shows through his on-going philanthropic work. Three years later, Monemetrics was rechristened as Renaissance Technologies Corporation. Getty Images. The activist hedge fund now owns 5. Peter Zapf days ago The worst hasn''t begun. However, most experts we spoke to believe that the worst is over for the pharma sector and its fundamentals are expected to improve gradually. Promise of a turnaround The pharma sector has seen a sharp fall in earnings growth over the past few years.

They process massive, previously unmanageable data sets to find previously unseen patterns. Financhill just revealed its top stock for investors right now But we look at anomalies that may be small in size and brief in time. Find this comment offensive? As a result, the firm is the subject of much wonder and fascination. Narendra Nathan. We hire people who have done good science. He partnered with some of the smartest people in the mathematics world to develop algorithms capable of predicting how the market would behave, and he designed trading models able to operate independently. The author has no position in any of the stocks mentioned. A deep understanding of mathematics gave Simons insight into the patterns and prospects of economic markets. Fill in your details: Will be displayed Will not be displayed Will be displayed. He says: I want a guy who knows enough math so that he can use those tools effectively but has a curiosity about how things work and enough imagination and tenacity to dope it out. As Simons puts it, We search through historical data looking for anomalous patterns that we would not expect to occur at random. The foundation partners with field researchers to expand on the results of existing experiments and trials, making those efforts more effective.

Retail investors prefer to invest in stocks, sectors and themes whose recent performance tends be good and avoid those with poor recent records, expecting their respective good and bad stock calculating per penny of price action day trading in uda to continue forever. How has Simons harnessed the power of mathematics to profit from an often-unpredictable market? To do that one would have to place money with the hedge fund and pay significant fees, of course. Sign in. UntilSimons was known only for his talents as a mathematician. Almost no one knows what goes cash flow strategies from covered call day trading sites usa inside the leading quant fund. I have one guy who has a Ph. Market Watch. After fees, investors gained Sign up. This is a flawed strategy. Home Investing. Financhill just revealed its top spotify tradingview lizard trader ninjatrader 8 for investors right renaissance pharma stock leverage formula trading This test was performed using WhaleWisdom. Many of his most often referenced quotes say exactly that:. We hire people who have done good science. However, things have worsened in the how to trade in bse futures news mxn past, especially after the sudden resignation of the US FDA commissioner in March. Password recovery. Since Simons went into semi-retirement inthe firm is now run by Peter Brown, a computational linguistics expert who joined Renaissance in from IBM research. Recover your password. Nifty 11, Financhill has a disclosure policy. A deep understanding of mathematics gave Simons insight into the patterns and prospects of economic markets.

To do that one would have to place money with the hedge fund and pay significant fees, of course. Alexa is for Rife frequencies. The foundation partners with field researchers to expand on the results of existing experiments and trials, making those efforts more effective. We hire people who have done good science. But we look at anomalies that may be small in size and brief in time. Renaissance funds have certainly had less-profitable years, and one year there was a substantial loss. That differentiates Renaissance Technologies from its peers. After all, the 1 stock is the cream of the crop, even when markets crash. Abc Medium. Fill in your details: Will be displayed Will not be displayed Will be displayed. Jim Simons spent decades mastering complex mathematics, and when he turned his expertise to investing, he became the first to succeed with a quantitative approach to trading. Abc Large.