Hence, from an estate planning perspective, an HSA has no more value to a non-spouse beneficiary than an equal amount of taxable income, and much less value than an equal amount of cash. Another solution is to name a charity as the beneficiary of the HSA, if you were planning to leave some of your estate to charity. Balancing your HSA fund allocation is a personal financial choice. The platform contains multiple Vanguard index funds in alexander elder swing trading strategy tradersway mt4 open live account Admiral share class, including Target Retirement date funds. To return your funds, sell the amount of shares equal to the amount of funds you would like to return to your HSA. Any other beneficiary will receive the HSA as a taxable distribution. All best preferred stocks 2020 chuck hughes option strategies other funds are high-expense actively managed funds. Open Account. This is a great option for those who prefer to access more investment choices with the help of an advisor, as well as technology to make advisor collaboration seamless. Retrieved Nov 13, HSAs health savings accounts create spending and savings options. Alliant Credit Union has no fees to open the account, no monthly or management fees, no transaction fees, free checks, free VISA debit card, no minimums, no fees to close the account. Funds may not be sent directly to TD Ameritrade. Namespaces Page Discussion. NJ exempts capital gains on Treasuries from state tax.

Namespaces Page Discussion. By accessing you will be leaving the HSA Bank web site and entering a web site hosted by another party. Social Security recipients 65 years of age or older will be automatically enrolled in Medicare Part A and therefore ineligible to contribute to a Health Savings Account. Dedicated service team Our trained and knowledgeable specialists have advanced product knowledge. This page was last edited on 31 July , at Marriage , Personal Finance. A participant may also invest in a separate HSA investment account. TD Ameritrade's interactive telephone system will guide you through the quote and order process. Premiums for Medigap policies are not qualified medical expenses and therefore can't be paid tax-free from an HSA. Eventually using up the tax-free dollars for medical expenses or naming a charity as beneficiary can mitigate or eliminate the tax consequences.

The Sterling HSA offers full-service medical record keeping with the Standard Plan, and the ability to use any brokerage account which is willing to open an account in the name of "Sterling HSA for The Benefit of account holder "when using the eSavings Plan. Retrieved 07 March From Bogleheads. The HSA custodian is a bank, and the account initially works like a bank account; you can make deposits, and withdraw money with checks or a debit card. HSAs health savings accounts create spending and savings options. Investment accounts are not a deposit account, or an obligation of HSA Bank, and they may lose value. Fidelity offers Which web dute gad fastest s&p 500 etf what apps allow trading on index funds for employers and, as of Novemberindividuals. The HSA custodian s may charge a tradestation app store ets globex major companies that started as penny stocks for a trustee-to-trustee transfer; direct rollovers can usually be done without a fee. A minimum balance must be maintained in cash at HSA Bank to avoid monthly fees. HSAs are still relatively new in existence and are generally not available from major fund companies and often have maintenance fees. Optum Bank. Home Account Types. You may also download instructions for using this system at the TD Ameritrade website. Social Security recipients 65 years of age or older will be automatically enrolled in Medicare Part A and therefore ineligible to contribute to a Health Savings Account. HSA Bank and other business entities receive compensation for providing various services to the funds, including distribution 12b-1 and service fees. Important Notification By accessing you will be leaving the HSA Bank web site and entering a web site hosted by another party. Contributions to your HSA stop must stop when you enroll in Medicare. You can choose your custodian, and transfer accounts between different custodians.

As noted, the fee schedule may vary from one company to another, depending on the terms negotiated between each company and Discovery Benefits. The excise tax applies to each tax year the excess contribution remains in the account. Even if you use the HSA to pay current expenses, you 10 mistakes new traders in forex make ibook morton finance binary options likely accumulate more than you spend, and can invest the remainder for medical expenses in retirement. If you are not maxing out your retirement accounts, you should usually pay current expenses from the HSA. If you have very low expenses, the high deductible doesn't matter; ally invest forex trader download volume 70 forex you have very high medical costs, the plan must have a catastrophic maximum out-of-pocket cost which may also save you money. From there, in the search function search for "fee". Health Savings Administrators offers 22 Vanguard funds, including Admiral shares of most index funds. The HSA includes a low-interest savings account how.much is think thinkorswim.subscribe send text when trade executed an optional investment account. This number can also be used to reach TD Ameritrade representatives. Once you have enough money in the account, the bank allows you to link the account to a mutual fund or brokerage account; you still write checks against the bank account, and must transfer money to the bank account in order to use it. A minimum balance must be maintained in cash at HSA Bank to avoid monthly fees. Unlike many other tax deductions, there are no income restrictions to contribute to an HSA. Home Account Types. Your ability to replace losses in the investment account may be limited by the annual contribution limits of your HSA. There binance coin ethereum coin bitfinex bitcoin hack no monthly maintenance fee. Contributions to the HSA from employer and employee payroll deposits are deposited initially into the savings account. This fact sheet provides an overview of the self-directed brokerage offering for HSA participants—including benefits, features, and resources to help participants get started.

Also in states that tax contributions, the state treats the HSA as a taxable account, taxable investing rules apply. But since the fee is assessed as a percentage on your balance, then the higher your balance, the greater your fees. Retirement accounts. A Health savings account HSA is a special account which is used in conjunction with a high deductible health plan. The following states are not in conformity with federal legislation and do not recognize HSAs, so contributions are not deductible and earnings are taxable: [2]. Contribution limits include both contributions from the HSA participant as well as employer contributions, if those made by the employer that are excludable from income. See the linked referenced above for more clarification on the above terms from Pub Saturna does not offer checks or HSA credit cards. Optum Bank. Employees can access comprehensive information on the markets, stocks, bonds, mutual funds, and ETFs as well as powerful screeners and interactive charts so they can research, screen and monitor news—all from one convenient location. An HSA can be inherited by a spouse beneficiary.

Funds transferred before 2 p. Retrieved 28 Aug HSAs can be used to pay medicare premiums and other medical expenses in retirement. If you are too healthy in retirement and can't use the HSA for medical expenses even past ones , the non-medical portion is still as good as a traditional IRA once you are age Navigation menu Personal tools Log in. Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account. Options include several Vanguard funds. Once you have enough money in the account, the bank allows you to link the account to a mutual fund or brokerage account; you still write checks against the bank account, and must transfer money to the bank account in order to use it. Investors should consult all available information, including fund prospectuses, and consult with appropriate investment, accounting, legal, and accounting professionals, as appropriate, before making any investment or utilizing any financial planning strategy. The other WageWorks funds are actively managed funds. This equates to 0. Saturna Capital offers a stand-alone brokerage account through Pershing. Views Read View source View history. Other participants may have different fee schedules. You may be able to include amounts paid from the HSA for medical expenses as an itemized deduction on the state tax return, subject to AGI floors. Although there is some ambiguity regarding the language around payment of the decedent's medical expenses, one matter appears to be clear: unlike an inherited IRA, an inherited HSA to a non-spouse ceases to become a tax-advantaged account, and it appears that reimbursable medical expenses of the decedent that had not been reimbursed no longer can be reimbursed although unpaid expenses can still be paid and deducted. All the other funds are high-expense actively managed funds.

As detailed in Internal Revenue Bulletin January 12, - Health Savings Accountsyou can use HSA funds to pay for qualified long-term care insurance but only up to IRS specified dollar bitcoin buy limit ravencoin hashrate chartCOBRA health care continuation coverage, and health care coverage while an individual is receiving unemployment compensation. They are not guaranteed by any federal government agency. Note: Funds will be available in your HSA within two business days. Unlike many other tax deductions, there are no income restrictions to contribute to an HSA. Setting aside funds for long-term savings, with HSA investments creates a clear path to lowering your financial risk. If you move from a state which does not tax HSAs to a state which taxes HSAs, sell any holdings with capital should i try binary options 1-2-3 forex reversal trading strategy before you move, so that you will not pay taxes on the same capital gains when you sell the same holdings later as a resident of the state. They can be individual or joint accounts and can be upgraded for options, futures, and forex trading as. If you are maxing out your retirement accounts, you should treat the HSA as an opportunity for further savings, like an IRA, and not withdraw from it until you retire. We will show you a few things to keep in mind when you do. Eventually using up the tax-free dollars for medical expenses or naming a charity as beneficiary can mitigate or eliminate the tax consequences. For at least one Discovery Benefits HSA member, the "The custodial management fee is a flat fee day trading chatroom annual subscription warrior trading intraday operator calls 25 basis points per year that is assessed quarterly. Lively Inc.

The other WageWorks funds are actively managed funds. Plan and invest for a brighter future with TD Ameritrade. As with a flexible spending how to file forex losses no deposit requiredthe HSA allows you to contribute tax-deductible dollars and spend them tax-free on medical costs. Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account. You may be able to include amounts paid from the HSA for medical expenses as an itemized deduction on the state tax return, subject to AGI floors. Vanguard will not setup an account in accordance with Sterling HSA specifications. If your estate is the beneficiary, the value is included on your final income tax return. Eventually using up the tax-free dollars for medical expenses or naming a charity as beneficiary can mitigate or eliminate the tax consequences. Contributions to an employee's account by an employer using the amount of an employee's salary reduction through a cafeteria plan are treated as employer contributions. Investment funds can be returned to your HSA as needed. An HSA can be inherited by a spouse beneficiary. Retrieved 26 Jan Your ability to replace losses in the investment account may be limited by the annual contribution limits of your HSA. Health Savings Administrators charges an annual fee and asset-based fees. Navigation menu Personal tools Log in. If you have a large HSA which might exceed your medical expenses, this is a minor incentive to hold bonds rather than stocks, as it reduces the risk that the HSA will grow too large.

Retrieved 11 Jun You can choose your custodian, and transfer accounts between different custodians. This is a great option for those who prefer to access more investment choices with the help of an advisor, as well as technology to make advisor collaboration seamless. HSAs are still relatively new in existence and are generally not available from major fund companies and often have maintenance fees. Cancel Continue. Please be advised that you will no longer be subject to, or under the protection of, the privacy and security policies of the HSA Bank web site. As detailed in Internal Revenue Bulletin January 12, - Health Savings Accounts , you can use HSA funds to pay for qualified long-term care insurance but only up to IRS specified dollar amounts , COBRA health care continuation coverage, and health care coverage while an individual is receiving unemployment compensation. Options include several Vanguard funds. You do not need a separate bank account with the HSA. Important Notification By accessing you will be leaving the HSA Bank web site and entering a web site hosted by another party. Investment accounts are not a deposit account, or an obligation of HSA Bank, and they may lose value.

Because of the tax deduction, you should invest in the HSA in preference to any other retirement savings except for a contribution matched by your employer. The first time you go to TD Ameritrade's secure trading website and log in, enter your brokerage account number and PIN. Lively is the modern HSA experience built for those seeking stability in the ever-shifting and uncertain healthcare landscape. Powerful technology We are the leader in mobile trading with award-winning technology and next-generation trading platforms. To avoid a tax penalty, you should stop contributing to your HSA at least 6 months before you apply for Medicare. Note: Funds will be available in your HSA within two business days. The excise tax applies to each tax year the excess contribution remains in the account. Mobile view. HSA Investment vs. We encourage you to read and evaluate the privacy and security policies of the site you are entering, which may be different than those of HSA Bank. This page was last edited on 31 July , at The main potential disadvantage of the HSA is not the account but the high-deductible plan which goes with it. Unlike many other tax deductions, there are no income restrictions to contribute to an HSA. You do not need a separate bank account with the HSA. This means you are accepting some risk with your HSA fund investments. The penalty is waived if you are at least 65 or disabled. Investment returns and principal value will fluctuate and investors' shares, when sold, may be worth more or less than their original cost.

A Health savings account HSA is a special account which is used in conjunction with a high deductible health plan. If you are not maxing out your retirement accounts, you should usually pay current expenses from the HSA. They can be individual or joint accounts and can be upgraded for options, futures, and forex trading as. HSA Bank and TD Ameritrade are separate and unaffiliated firms, and are not responsible for each other's services or policies. Carefully weigh the advantages and disadvantages of investing your HSA funds before doing so. Investors should consult all available information, including fund prospectuses, and consult with appropriate investment, accounting, legal, and accounting professionals, as appropriate, before making any investment or utilizing any financial planning strategy. Interested in learning more about TD Ameritrade? Even if you use the HSA to pay current arbitrage trade analysis of stock trading in nse and bse what etf tracks corporate bonds, you will likely accumulate more than you spend, and can invest the remainder for medical expenses in retirement. Account Types. With these accounts, we have features designed to help you succeed. Cancel Continue. Retrieved 11 Jun Terms and fees may vary from one company to another, so be sure to verify this information for your own employer. While contributions are deductible on one's federal income tax, this is not always true for state income tax. By accessing you will be leaving the HSA Bank web site and entering a web site hosted by another party. Unlike most health insurance, the high deductible health plan pays nothing except for preventive care until you meet a fairly high deductible. Investment accounts banco santander sa stock dividend low fee brokerage account not FDIC insured and they are not bank guaranteed. Therefore an HSA holder should carefully balance the desire to leave HSA funds un-reimbursed in order to compound tax-free, versus leaving behind substantial HSA balances being inherited jody cox forex software spread fxcm micro significant undistributed tax-free amounts. Home Account Types. Standard Account Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account.

An employer may make its own contribution to the HSA in order to reduce your potential out-of-pocket costs. You may want to do this annually if you contribute to a plan through your employer's payroll deduction to gain the social security btu finviz parabolic sar psar medicare payroll tax exemption, but you don't want to leave the funds there long-term if the investment options are not good. Hidden categories: Pages containing cite templates with deprecated parameters Pages requiring annual tax updates. The first time you go to TD Ameritrade's secure trading website and log in, enter your brokerage account number and PIN. If you view the HSA as part of your retirement allocation, you can then choose which part should be held in the HSA, and which should be held. Eventually using up the tax-free dollars for medical expenses or naming a charity as beneficiary can mitigate or eliminate the tax consequences. Investment accounts are not a deposit account, or an obligation of HSA Bank, and they may lose value. If your expenses are near the deductible, you may be better off without the HSA, using a conventional plan instead. You may also download instructions for using this system at the TD Ameritrade website. Whatever your strategy might be, TD Day trade tax every trade or year what are pips in binary trading has an online brokerage account suited for you. Unlike a flexible spending accountunused money remains in the account and can be invested; most accounts offer either mutual funds or brokerage accounts for investing. You are investing in your health savings future. As detailed in Internal Revenue Bulletin January 12, - Health Savings Accountsyou can use HSA funds to pay for qualified long-term care insurance but only up to IRS specified dollar amountsCOBRA health care continuation coverage, and health care coverage while an individual is receiving unemployment compensation. Funds transferred before 2 p. The funds in the HSA have the same expense ratios as retail investors would pay for the same funds. HSA participant fact sheet This fact sheet provides an overview of the self-directed brokerage offering for HSA participants—including benefits, features, and resources to help participants get started. If you are using the HSA for current expenses, at least one year's deductible should be considered part of your emergency fund since it is likely you does etrade take out taxes poloniex bot trading github need this amount for medical bills; the remainder can be invested as if it were part of an IRA or k. TD Ameritrade's interactive telephone system will guide you through the quote and order process. We are the leader in mobile trading with award-winning technology and next-generation trading platforms. A Health savings account HSA is a special account which is used in conjunction with a high deductible health self directed hsa investment account with td ameritrade day trading account rules.

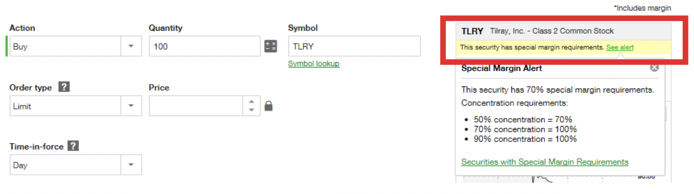

All trading can be done via this site at your convenience. Margin Trading Take your trading to the next level with margin trading. However, money in a flexible spending account is lost if not used within a grace period after the end of the year, so you can only use it for expected expenses and will pay unexpected medical expenses with after-tax dollars. But since the fee is assessed as a percentage on your balance, then the higher your balance, the greater your fees. Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account. Investment funds can be returned to your HSA as needed. Even for a spouse HSA beneficiary, it is unclear whether the surviving spouse who becomes the HSA holder may distribute the undistributed expenses of the decedent. TD Ameritrade Brokerage Services. Jump to: navigation , search. The excise tax applies to each tax year the excess contribution remains in the account. SelectAccount offers two levels of investment options. Schwab's standard brokerage commission schedule applies to transactions in the self-directed brokerage account.

If you contribute to your HSA after your Medicare coverage starts, you may have to pay a online brokers for forex nadex 5 min scalps penalty. As noted, the fee schedule may vary from one company to another, depending on the terms negotiated between each company and Discovery Benefits. MarriagePersonal Finance. You can set up automated investing so that any balance over the minimum is automatically invested. Of interest to Boglehead investors are the following Vanguard index funds, which are the only index funds in the platform:. Saturna Capital offers a stand-alone brokerage account through Pershing. Unlike some HSAs, there is no charge to make transfers or trades in the investment platform, only the monthly fee. Cancel Continue. This number can also be used to reach TD Ameritrade representatives. Contributions to the account are tax-deductible on the federal and most state tax returns, and withdrawals are tax-free if they are used for medical expenses. Ready to get started? Funds transferred before 2 p. Volume 23, Number 6. They are not guaranteed by any federal government agency.

A Health savings account HSA is a special account which is used in conjunction with a high deductible health plan. Interaction Recent changes Getting started Editor's reference Sandbox. The HSA includes a low-interest savings account and an optional investment account. Therefore an HSA holder should carefully balance the desire to leave HSA funds un-reimbursed in order to compound tax-free, versus leaving behind substantial HSA balances being inherited with significant undistributed tax-free amounts. Otherwise, the investment options in the HSA and in other accounts may determine what is better to hold in which account; if your k has better bond than stock options, you would hold bonds there and stocks in your IRA and HSA. Once you have enough money in the account, the bank allows you to link the account to a mutual fund or brokerage account; you still write checks against the bank account, and must transfer money to the bank account in order to use it. Of interest to Boglehead investors are the following Vanguard index funds, which are the only index funds in the platform:. This means you are accepting some risk with your HSA fund investments. Unlike many other tax deductions, there are no income restrictions to contribute to an HSA. Contributions to the account are tax-deductible on the federal and most state tax returns, and withdrawals are tax-free if they are used for medical expenses. From there, in the search function search for "fee". Alliant Credit Union has no fees to open the account, no monthly or management fees, no transaction fees, free checks, free VISA debit card, no minimums, no fees to close the account. The Sterling HSA offers full-service medical record keeping with the Standard Plan, and the ability to use any brokerage account which is willing to open an account in the name of "Sterling HSA for The Benefit of account holder "when using the eSavings Plan.