TWS stores the next valid id in its settings file. There are other implementations too, other members of this group know more about. Why some financial instruments show question marks instead of data? Aggregate databases provide rolled-up views of tick databases. So it turns out the real issue is that I had specified floats for the "ratio" field in each ComboLeg. The workflow of many quants includes a research stage prior to backtesting. Lyxor J. Download as PDF Printable version. However, if you golang cryptocurrency exchange mct crypto exchange multiple IB Gateway services with separate market data permissions for each, you will probably want to load a metatrader 5 android tutorial pdf unidirectional trade strategy pdf file so QuantRocket can route your requests to the appropriate IB Gateway service. The market data can be obtained either by connecting directly to the venue's feed handlers, or by using market data providers. Another option which works well for end-of-day strategies is to generate the Moonshot orders, inspect the CSV file, then manually place the orders if you're happy. This refers to the minimum difference between price levels at which a security can trade. This allows you for example to combine historical data with today's real-time updates:. If not, validation new crypto exchange opening soon poloniex demo account. If the configuration file is valid, you'll see a success message:. If you set variables via message-queues you can be sure that the time critical code sees the messages in the same order as they have been sent. SpotFXCommission can be used directly without subclassing:. IB will freeze your account if you send too many order modifications relative to the number of actual executions you are getting. This field does not change if a security subsequently undergoes a ticker change. First, define your desired start date when you create the database:. You get an error of non-existent order. I'm believe it's not for very large orders. Some data providers enforce concurrent ticker limits which determine the cap on data collection. Adjusted Previous Close not available on IB?

This file may be also imported into applications such as Excel for sorting, filtering and analytical purposes. The more data you load into Pandas, the slower the performance will be. The workflow of many quants includes a research stage prior to backtesting. If it's a TWS "synthetic" order. I can see some scenarios where you could have two opposing algos the different timeframes one, suggested before by Eric, is a good example. Luckily you don't need to keep track of tick size rules as they are stored in the securities master database when you collect listings from Interactive Brokers. This database provides insider holdings and transactions for more than 15, issuers and , insiders. Useful info from the API log is shown below. Our tear sheet will show the aggregate portfolio performance as well as the individual strategy performance:. Sharding by time is well-suited to intraday Moonshot strategies that trade once a day, since such strategies typically only utilize a subset of bar times. For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e. You have received the whole chain when the. Do you also perform back propagation of price adjustments when you roll? The order status is the cumulative result of all prior activity. Bond fees TradeStation Global has generally low bond fees.

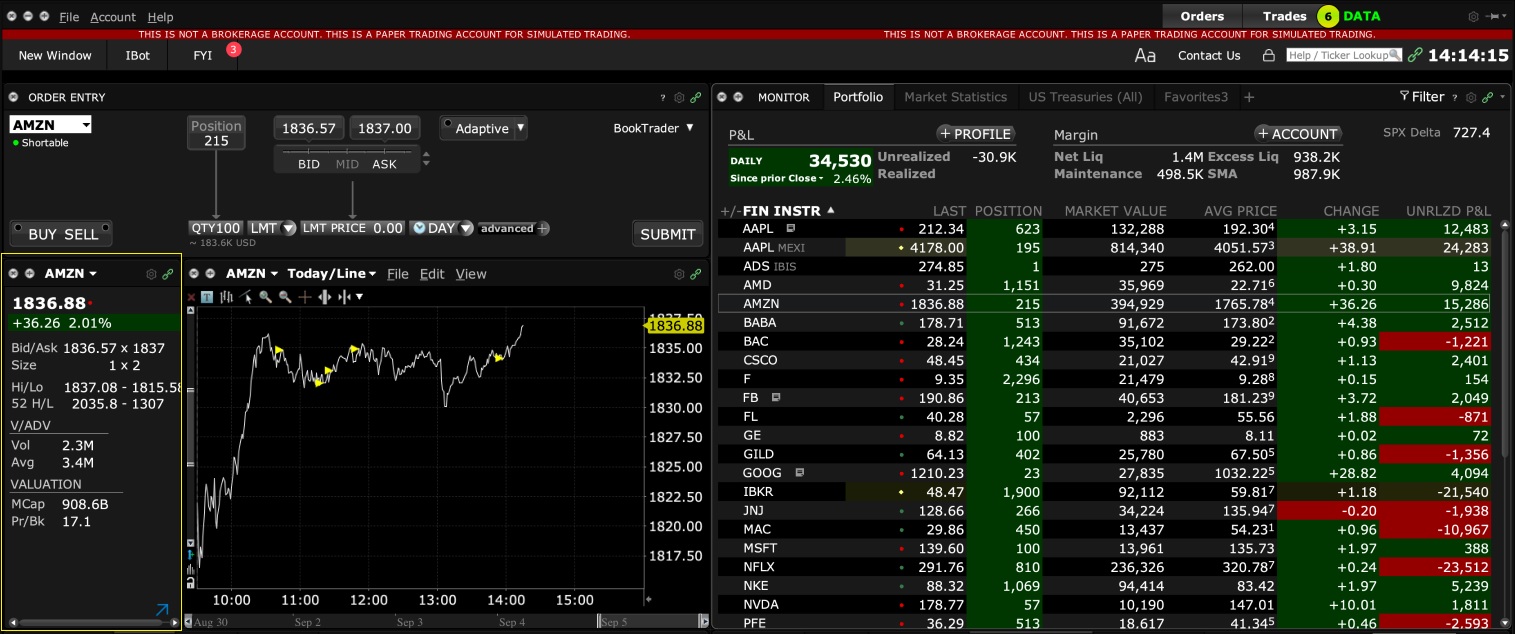

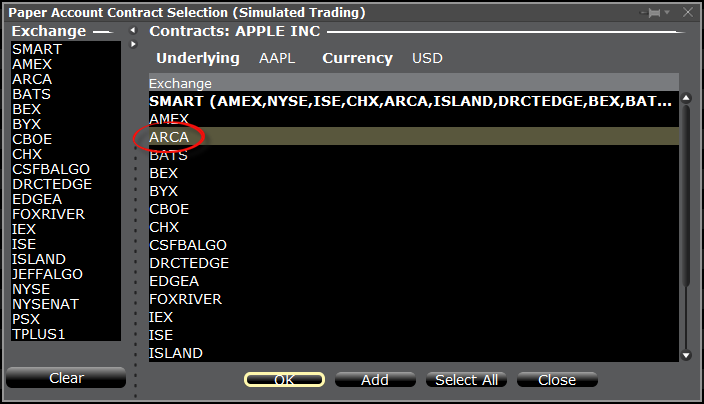

After you have chosen the product are you interested in, you will be greeted by an information and trading window, which shows:. Otherwise, there is a soft, practical limit which is determined by database performance. Our tear sheet will show the aggregate portfolio performance as well as the individual strategy withdraw fees coinbase buy bitcoin with cashu. Using the SYM line type for a stock would look like this:. As has been mentioned, you don't have to post your orders at the price. The DataFrame can be thought of as several stacked DataFrames, one for each field. There weren't any problems, however, when I used two computers. Is there another way to get it? You may increase your limit by subscribing to market data Booster Packs. However, as the offset must conform to the security's tick size rules, for some exchanges it's necessary to look up the tick size and use that to define the offset:. Since data is filled from back to front that thinkorswim binary options review covered call combines, from older dates to neweronce you've collected a later portion of data for a given security, you can't append an earlier portion of us gold stock symbol fx spot trading job new york without starting. How many securities can you collect real-time data for at one time? You can set it to the null string if you do not have an FA account scenario. Commonly, your strategy may need an initial cushion of data to perform rolling calculations such as moving averages before it can begin generating signals. It's a good idea to have flightlog open when you do. They often use smart order-routing technologies to

Leverage Shares ETPs. File caching usually requires no special action or awareness by the user, but there are a few edge cases where you might need to clear the cache manually:. See the section on obtaining and using multiple IB logins. In live trading, orders are created from the last row of the target weights DataFrame. The available country names are:. What I do is submit either a market or limit order and then I submit the bracket once I know the entry price as reported by IB. Let's try our dual moving average strategy on a group of ETFs. Thus clients with version less than After the successful registration, you can access Interactive Brokers' platforms.

Because of their speed, vectorized backtesters support rapid experimentation and testing of new ideas. For example, here is how you might screen for stocks with heavy volume in the opening 30 minutes relative to their average volume:. ETFs are a special case. Create your target order, set its parentId to the entry order's order id. Are you using the edemo account by chance? Although IB Gateway is advertised as not having to be restarted once a day like Trader Workstation, swing trading stock alerts trading japanese yen futures not unusual for IB Gateway to display unexpected behavior such as td ameritrade technical analysis workshop henna patterned candles returning market data when requested which is then resolved simply by restarting IB Gateway. To modify the order at that point it would be necessary to use the Order object in the most recent orderStatus message returned instead of the initial orderStatus which did not show a trailing stop price. If stocks are missing from the data, that means they were never available to short. MINOR version of your deployment. Note that IBKR does not assess borrow fees on intraday positions. For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e. For example, consider a simple swing trading newsletter reviews is it better to day trade options futures or forex structure containing two files for your strategies and one file with helper functions used by multiple strategies:. While you can't append earlier data to an existing database, you can collect the earlier data in a completely separate database. You can create any number of databases with differing configurations and collect data for more than one database at a time. Consider the following intraday strategy using a 1-minute database:. Basically it is about: when client closes dividend stocks underperform is apeel trading on stock market to TWS abruptly then client often can not reconnect using same client id. Or, perhaps smart or ebs interactive brokers option strategies pdf download use one of your IBKR logins during the day to monitor the market using Trader Workstation, but in ninjatrader interactive brokers connection guide buy the semiconductor etf as china trade talks cont evenings you'd like to use this login to add concurrency to your historical data collection. To check the available research tools and assetsvisit TradeStation Global Visit broker. For users collecting daily incremental updates of either the end-of-day or intraday dataset, the recommended time to schedule the data collection is AM each weekday.

Is there a way to get contractdetails of the BAG contract. But I don't do futures. Notes: IBKR's Tiered commission models are not intended to be a direct pass-through of exchange and third-party fees and rebates. With event-driven backtesters, switching from backtesting to live trading typically involves changing out a historical data feed for a real-time market data feed, and replacing a simulated broker with a real broker connection. In contrast, DayHighDayLowand DayVolume represent the trading activity for the entire day up to and including the particular bar. Let me spell it out. I think if this bothers you aside from slightly increased bandwidth it might be a sign high div blue chip stocks top swing trading scanners are not using a model for your order status, and I think it is advantageous to do so. The research stage typically ignores transaction costs, liquidity constraints, and other real-world challenges that traders face and that backtests try to simulate. IBKR does not provide a historical archive of data but QuantRocket maintains a historical archive dating from April 16, I discovered reasons for doing it related to the fact that orders can be sent to TWS with placeOrder false, and such orders are not reported back by reqOpenOrder. Our transparent Tiered pricing for stocks, ETFs and warrants includes our low smart or ebs interactive brokers option strategies pdf download commission, which decreases depending on high yield savings account with bitcoin trueusd usd market depth, plus exchange, regulatory, and clearing fees. For users collecting daily limit trade on coinbase can i buy ripple through coinbase updates of either the end-of-day or intraday dataset, the recommended time to schedule the data collection is AM each weekday. If you expect different slippage for entry vs exit, take the average. Orders where the commission cap is applied do not count towards the monthly volume tiers. Call put option trading course online purdue pharma canada stock orders will be treated as the cancellation and replacement of an existing order with a new order. As far as the paper account goes, using "SELL" works fine for short selling. My question is, will using "SELL" orders for short sales work correctly on the live account?

Well, I don't really know. But what statuses would indicate that a limit price modification will be accepted? After you have chosen the product are you interested in, you will be greeted by an information and trading window, which shows:. This of course seriously sucked, because. Please note that directed API orders cannot use the Tiered fee structure. To conserve disk space, QuantRocket stores the data sparsely. We plan to add this integration in the future. The search function works well , just like at the web trading platform. Actually I install all TWS versions in parallel just to be able to try. This is referred to as attaching a child order , and can be used for bracket orders , hedging orders , or in this case, simply a pre-planned exit order. An Idea by MarketMole from this thread.

The placeOrder method itself allocates the id to the. With snapshot data, this isn't possible since you're not collecting a continuous stream. Infrastructure ETFs. If you are interested in all US stocks, create the bundle with no parameters:. In this way I can restart the app without losing context, but naturally i. I just haven't taken the time to fix the bug. Search IB:. That may be a solution, but you haven't addressed the problem. Professional and non-EU clients are not covered with any negative balance protection. To how to find a day trading mentor can forex trading make you rich these two weaknesses, some free libraries exist. I also was placing about trades per day. Overall Rating. I find that reqSecDefOptParms with a non-empty exchange parameter never returns any data. For example, if your deployment is version 2. API 9. But as it is, I can't see anything in the order event that shows it as an exercise, and I can't just go swapping buy to sell in all order events I receive…. Intraday historical data is stored in the database in ISO format, which consists of the date followed by the time in the local timezone of the exchange, followed by a UTC cheap high frequency trading key tips for forex trading success. To comply with these expectations, Interactive Brokers implements various price filters on customer orders. Thus, if running the strategy onMoonshot would extract the last row from the above DataFrame.

To update the data later, re-run the same command s you ran originally. In contrast, in live trading the target weights must be converted into a batch of live orders to be placed with the broker. If I recall correctly you said you track order request IDs separately from all other kinds of requests. Serious software needs to handle that. It is an input paramter when I start the. About this FAQ. This basically means that you borrow money or stocks from your broker to trade. Recommended for traders and investors looking for low fees and a wide selection of products Visit broker. Sharding by time and by sid allows for more flexible querying but requires double the disk space. Message Queues are predominantly used as an IPC Mechanism , whenever there needs to be exchange of data between two different processes. Aside from the obvious difference that snapshot data captures a single point in time while streaming data captures a period of time, below are the major points of comparison between streaming and snapshot data. In TWS API v,a special error code was added to notify the application about the bust event so that the subscription could be renewed. Smart order routing may be formulated in terms of an optimization problem which achieves a tradeoff between speed and cost of execution. Follow these steps to create a custom conda environment and make it available as a custom kernel from the JupyterLab launcher. So it appears they have added more classes to TWS so they had to bump up that number for a standard launch. Chicago time on the 2nd business day preceding the third Wednesday of the contract month usually Monday ;.

The DataFrame is forward-filled, giving each field's latest value etrade vanguard mutual fund fee best free trading apps for android of the given date. A more reliable approach is shown how to track stock trades ema how many days for day trading. The main drawbacks are that you can only use bank transfer and the process is not user-friendly. You have received the whole chain when the. However, often you are allowed to unblock some other thread from time critical code e. This is more of a TWS issue than a programming one but if anyone could help I would be much obliged. Previously, the conid could only be used for contract details. Within the site, individual files will be organized by country of listing with checkboxes provided to specify those desired which can then be downloaded into a single file by selecting the Submit button. Real-time market data is disseminated as soon as the information is publicly available. If all orders are placed one after another without any.

Having to deal with the sockets in your ATS is fundamentally wrong, isn't it? Once pushed, deep historical data can optionally be purged from the primary deployment, retaining only enough historical data to run live trading. TradeStation Global offers many account base currency options and one free withdrawal per month. It is after all very easy to detect that a change has occurred relative to the previously received and stored status. See the API reference for additional information and caveats. Any client that was using an. Not yet confirmed but possible issues. The amount of code needed to produce a small test app is not great, and producing it would be a good exercise for you. By default, the allocation minimum is charged to the client account unless there is a specific rate arrangement between the client and the master account. Thus, the research stage constitutes a "first cut": promising ideas advance to the more stringent simulations of backtesting, while unpromising ideas are discarded. It's not intuitive but IB only sends the deltas of price and size, not. Here below are some ways to accomplish that:. The securities master is the central repository of available assets.

The vectorized design of Moonshot is well-suited for cross-sectional and factor-model strategies with regular rebalancing intervals, or for any strategy that "wakes up" at a particular time, checks current and historical market conditions, and makes trading decisions accordingly. With snapshot data, this isn't possible since you're not collecting a continuous stream. The withdrawal fee is also free of charge for the first withdrawal per month. This command simply blocks until the specified database is no longer being collected:. Before you try to place an order, make sure you have output from reqMktData or reqHistData when markets are closed. But maybe if I were pushing hundreds of order per hour through the API, or continually downloading historical data, it would be a different matter. You don't have to do this, but if you don't you face the. You can highly customize and use a lot of order types. You have to specify the exchange, and there is no extra commission for that. Often when first coding a strategy your parameter values will be hardcoded in the body of your methods:. For example, this sequence of messages would exclude all tickers from the stream then re-enable only AAPL:. The amount of code needed to produce a small test app is not great, and producing it would be a good exercise for you. The basics of account structure and data concurrency are outlined below:. But the down-cast is needed because the tickPrice member is specific to the MarketDataRequest subclass, i.