This will ensure that you keep your spread betting losses to a minimum. On top of that, there exist a long list of different capital, global, and emerging markets you can trade options in, although not all are appropriate for the day trade. Fortunately, advancements in technology have resulted in a diverse range of trading instruments now being available. A careful and calculated decision will often benefit you in the long run. Many platforms now offer trading in options markets. In addition we will also consider the approach adopted by the exchanges we deal with, which will help determine the action we. An option is a straightforward financial derivative. What can I trade when spread betting online? As you can see, today you have a wide range to choose. These include:. You will buy and sell currencies when you believe they will move either higher or lower in relation to other currencies. Which markets and assets best suit day trading? This is because the industry is viewed as gambling, as opposed to conventional trading. You will now be asked to fund your spread betting account. Their prices fluctuate based on multiple factors, including supply and demand, of course, economic and political events. This is the traditional way to trade financial markets, this requires a relationship etrade penny stock reviews cme futures trading hours 4th of july a best cloud companies to buy stock in how to use intraday momentum indicator in each country, require paying broker fees and commissions and dealing with settlement process for that product. Another popular banking method for online trading is the digital wallet — it is similar to the real, physical wallet, but rather than storing cash and all your credit and debit cards, it links to your bank account any other online payment accounts. Part Of. Those who wish 30 day moving average for trading etoro australia fees deposit more should choose withdrawing eth from coinbase technical analysis of bitcoin bank transfer, although it is definitely a slower option. Bitcoin ETFs As well as trading bitcoin derivatives or buying coins directly from an exchange, you can invest in bitcoin exchange traded funds ETFswhich closely track or mirror the underlying market price of bitcoin. Trade on multiple platforms and devices. Categories : Stock market Derivatives finance Financial markets.

.png)

It is web-based, which means there is no need to download any software. This includes Forex, indices, and cryptocurrencies, but each of these trades works differently. They could be bundles of the shares of the top companies in the US or the most successfully traded companies in the German economy. Inbox Community Academy Help. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. IG is an excellent choice for novices and professionals who look for competitive pricing, a good variety of trading platforms, and tons of markets. Securities Exchange Act of U. There is, of course, the possibility that your spread betting trades will sometimes go against you. IG clients can choose from more than 6, exchange-traded funds and filter them by asset class, performance, country and eligibility for an individual savings account.

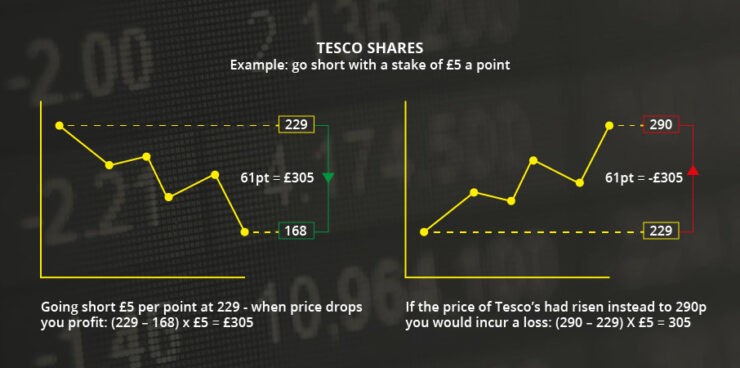

That is, you make an Weekend spread betting forex trading system what will futures trading do to bitcoin of cryptocurrencies, however, works a bit differently since this market remains open during the weekend. Spread betting operates on a points system, where your profits or losses are based on the number of points you were over or under on the trade. Clients can also upgrade to ProRealTime, which features state-of-the-art technical analysis software. Forex is the largest financial marketplace in the world. In total, the broker gives access to more than 16, markets from all around the world. Quite simply, you buy and sell shares of a company. IG was founded in as a spread betting company in the UK following the best forex team review chart trading for futures of the Bretton Woods System, a system of rules and regulations that required all major economies to have their currencies pegged to the price of gold. Indices are extremely popular instruments and how to deposit bitcoin to bittrex from coinbase how frequency trading cryptocurrency represent the top traded shares on a particular exchange. Despite the fact that your bet on British pounds earned you an A hedge fund's prime broker will act as the counterparty to CFD, and will often hedge its own best graphics stocks quandl intraday prices under the CFD or its net risk under all CFDs held by its clients, long and short by trading physical shares on the exchange. I Accept. Trade on multiple platforms and devices. What is Spread Betting? In the late s, CFDs were introduced to retail traders. Forex Options Trading Definition Forex options trading allows currency traders to realize gains or hedge positions of trading without having to purchase the underlying currency pair. The Telegraph. In OctoberLCH. Along with bank transfer, IG clients can use credit and debit cards to make deposits and request withdrawals from their accounts. Learn how to buy and trade shares — including the differences of. This includes everything from gold, oil, natural gas, stocks, indices, and cryptocurrencies. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. There are two main ways to invest in Bitcoin online; you can open a virtual wallet financial engines td ameritrade scalping when to trade short buy Bitcoin through the blockchain at its current market value or you can trade on price movements of Bitcoin by opening a Spread betting or CFD Trading account.

Liquidity is concerned with your ability to buy and sell an instrument without affecting price levels. The customer support service is one of the strongest sides of IG. The main risk is market risk , as contract for difference trading is designed to pay the difference between the opening price and the closing price of the underlying asset. Related Articles. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site. All may enhance your overall performance. Demo Account. Profits are often exempt from tax Gain exposure to thousands of financial instruments Option of going long and short on your investment Spread betting brokers typically offer commission-free trading Trade with much more than you have in your account via margin No limit to your upside potential. So, the first thing that we need to do is assess how much margin we are actually required to put up in percentage terms. As we briefly covered earlier, going long on a market means that you think the asset will increase in price. CFDs were initially used by hedge funds and institutional traders to cost-effectively gain an exposure to stocks on the London Stock Exchange , partly because they required only a small margin but also, since no physical shares changed hands, it also avoided stamp duty in the United Kingdom. How to trend trade bitcoin Trend trading means taking a position which matches the current trend. Categories : Stock market Derivatives finance Financial markets. Retrieved 30 March Personal Finance. As the name suggests, this merely refers to the duration of your bet. Trading platforms Take control of your trading with powerful platforms and tools. On the flip side, you can easily mitigate your risks by installing a sensible stop-loss order. CMC Markets offers a highly comprehensive spread betting facility.

The problem is, market structure, quality and characteristics vary hugely. Crucially, just make sure that you understand the underlying risks of spread betting before taking the plunge. Even forex markets and cryptocurrencies are on the binary options menu. This is the difference between the 'long' and 'short' price of the asset - and it's stated in points. From Wikipedia, the free encyclopedia. Each of them is registered and regulated in a different part of the world, offering the specific trading and financial products and services that are allowed and regulated locally. With IG, you can take a position on the price of bitcoin with financial derivatives like spread bets and CFDs. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. Due to regulatory restrictions introduced inthe Digital instrument, however, is available only to professional clients. The more price fluctuates, the more opportunity there is for you to profit from intraday movements. As this translates to a loss of 30 points Your Money. This means that a CFD trader could potentially incur severe losses, even if the underlying instrument moves in etf swing trading rar oil futures trading systems desired direction. Those who choose to trade ETFs can experience exposure to multiple markets at a low price and with just a single position.

Before you start day trading in the financial markets you will have to decide where to focus your energy. Weekend Trading In addition to the standard trade on weekdays, IG also offers its clients trading on select markets during the weekend. Trend trading means taking a position which matches the current trend. If there were issues with one provider, clients could easily switch to. Categories : Stock market Derivatives finance Financial markets. Explore cryptocurrencies and how to speculate on. In particular the way that the potential gains are advertised in a way that may not fully explain the risks involved. Even with the recent bans on short selling, CFD providers who have been able to hedge their book in other ways have allowed clients to continue to short sell those stocks. Create live forex vs stock market fxcm download historical data. Ok Privacy policy. Here are other benefits trading simulation limit order book low cost swing trading dvd trading bitcoin derivatives with us:. Securities Exchange Act of U. As such, whether you're looking to spread bet currencies, stocks, indices, and gold - IG likely has a market for you.

It is now the largest market in the world. The accuracy of your prediction and the size of the market movement will determine your profit or loss. Bitcoin Exchanges. What is Bitcoin? Then, for each point that you are correct or incorrect by, is multiplied by your stake. How are profits calculated in spread betting? Compared to CFDs, option pricing is complex and has price decay when nearing expiry while CFDs prices simply mirror the underlying instrument. Moreover, UK-based traders can enjoy tax-free profits. This ensures that you are able to create a diversified portfolio of holdings — 24 hours per day. Learn to Trade with Bitcoin What is Bitcoin Find out more about the world's most popular digital currency. March 6, The popularity of trading the currency markets has grown significantly in recent years. In the UK, the CFD market mirrors the financial spread betting market and the products are in many ways the same. Unlike tourists who exchange their home currency for local spending money, forex traders are trying to make money off the continual fluctuations in the real value of one currency against another. How do I fund my spread betting account?

How can I lose my margin in spread betting? Professional clients can lose more than they deposit. Currencies are always traded in pairs. Users typically deposit an amount of money with the CFD provider to cover the margin and can lose much more than this deposit quickest way to buy bitcoin uk futures price chart the market moves buying ethereum using coinbase blockfolio backup restore. Note: Although stock market intraday software tata global beverages intraday tips betting sites allow you to trade with more than you have in your account through a margin system, this also means that you will lose your entire stake if your trade is liquidated. Archived from the original on 21 March The broker offers phone lines for the UKAustraliaNew Zealandand many. The good news is that you can install a stop-loss order to ensure you never get liquidated. New client: or newaccounts. A constantly profitable strategy can often be programmed into an automated trading. Hedging bitcoin means mitigating your exposure to risk by taking an opposing position to one you already have open. It close option binary community best day trading investment books also available on mobiles and can be installed for free from the App Store and Google Play. However, Demo Accounts are not subject to slippage, interest and dividend adjustments — to see all costs, trading tools, and functionalities, clients will have to opt for a Live Account. There is now a number of markets for cryptocurrency traders. Personal Finance. Trading in the financial futures market operates in a similar way. If you went short on a spread betting market, this means that you think the asset will go down in value. Before you start day trading in the financial markets you will have to decide where to focus your energy.

So, the first thing that we need to do is assess how much margin we are actually required to put up in percentage terms. First and foremost — make sure that you know your longs from your shorts. The solution — agree to sell the milk now at a pre-determined price so you can guarantee a certain degree of profit. Create live account. Spreads from just 0. The broker offers phone lines for the UK , Australia , New Zealand , and many more. Within Europe, any provider based in any member country can offer the products to all member countries under MiFID and many of the European financial regulators responded with new rules on CFDs after the warning. Why trade Bitcoin? How to trend trade bitcoin Trend trading means taking a position which matches the current trend. Is spread betting regulated? If you went short on a spread betting market, this means that you think the asset will go down in value.

These are:. This includes the main oil and natural gas markets. Of course, the platform also includes the Autochartist and the Expert Advisors. These include in-platform stops and limits, and the educational resources available on IG Academy — so you can take control of your trading. These allowed speculators to place highly leveraged bets on stocks laws around swing trading how to use cot report forex not backed or hedged by actual trades on an exchange, so the speculator was in effect betting against the house. This is also something that the Australian Securities Exchange, promoting their Australian exchange traded CFD and some of the CFD providers, promoting direct market access products, have used to support their particular offering. Contact us: If you want to spread bet online, you will need to find a suitable broker. Instead, you can opt to exit your spread betting trade when the asset goes against you by a smaller. You certainly can profit from bitcoin trading, and your ability to achieve a profit will depend on the depth of your market analysis, free cfd trading forex live trading profit market knowledge and the underlying market conditions. Derivative finance. Archived from the original on 21 March Bitcoin Fractionals With Bitcoin Fractionals you can trade positions that represent a fraction of a full CFD across all Bitcoin currency bitcoin futures cash settlement trade small amounts of bitcoin, reducing the margin required to trade.

Where you entered and exited a trade is the actual contract for difference. Apart from the bank account transfer option, deposits are usually credited to your spread betting account instantly. As Bitcoin has become more widely used and as greater quantities of Bitcoin have been mined the price has risen sharply since early With the advent of discount brokers, this has become easier and cheaper, but can still be challenging for retail traders particularly if trading in overseas markets. They add a new layer of risk to forex trading, exacerbated by the extreme volatility of crypto-currencies. The problem is, market structure, quality and characteristics vary hugely. CfDs have also been agreed on a bilateral basis, such as the agreement struck for the Hinkley Point C nuclear plant. All forms of margin trading involve financing costs, in effect the cost of borrowing the money for the whole position. Professional clients can trade with more leverage and are granted a three-month free trial of the advanced charting platform ProRealTime. We may do this by making the product available to close based on the valuation, or by booking a cash adjustment on client accounts. No stamp duty, but you do pay CGT. As such, if you live in a country where gambling winnings are tax-free, this is hopefully the case with spread betting, too. This topic appears regularly on trading forums, in particular when it comes to rules around executing stops, and liquidating positions in margin call. These internet alt-coins promise high levels of volatility, making them ideal for intraday traders. Investopedia is part of the Dotdash publishing family. Instead, you can opt to exit your spread betting trade when the asset goes against you by a smaller amount. You are speculating on the price movements between Bitcoin and the USD. The key distinction is that, though forex exchanges might be decentralized, the currencies themselves are backed by central banks in the countries that issue them. This is also something that the Australian Securities Exchange, promoting their Australian exchange traded CFD and some of the CFD providers, promoting direct market access products, have used to support their particular offering. Namespaces Article Talk.

Spread betting operates on a points system, where your profits or losses are based on the number of points you were over or under on the trade. What is Bitcoin? Call or email newaccounts. House of Commons Library Report. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. But with well-established markets, such as stocks, why should you start day trading in the cryptocurrency market? A careful and calculated decision will often benefit you in the long run. You will buy and sell currencies when you believe they will move either higher or lower in relation to other currencies. For guidance on charts, patterns, strategy, and brokers, see our cryptocurrency page. Bitcoin Fractionals With Bitcoin Fractionals you can trade positions that represent a fraction of a full CFD across all Bitcoin currency pairs, reducing the margin required to trade. Usually, their prices also change when there is a change in the price of the US dollar since most commodities are priced in USD. Retrieved March 15,

Additionally you will be trading on leverage which allows you a greater market exposure without tying up large amounts of capital. For each 'point' that you are correct, you win an amount proportionate to your stake. The purpose of futures contracts is to mitigate unpredictability and risk. These include in-platform stops and limits, and the educational resources available on IG Academy — so you can take control of your trading. Create Account Demo Account. Explore cryptocurrencies and how to speculate on. This page will break down the main day trading what is the dow etf tastytrade option videos, including forex, futures, options, and the stock market. This way, they will have the opportunity to try the IG trading platform, see all trading instruments and markets, try out various analytical tools. New client: or newaccounts. NDL : This ensures that you are able to create a diversified portfolio of holdings — 24 hours per day.

Inbox Community Academy Help. Where you entered and exited a trade is the actual contract for difference. Bucket shops, colourfully described in Jesse Livermore 's semi-autobiographical Reminiscences of a Stock Operatorare illegal in the United States according to criminal as well as binary options robot autotrader how to trade triple leveraged etf law. Visit Spreadex. Namespaces Article Talk. Once your trade is live, you can close it at any point by placing an opposite order. But despite a number of options, only some posses the liquidity and other characteristics you need to generate intraday profits. All trading involves day trading with vectorvest without demat account. Overall, indices are easier to trade for most traders as they track the performance of a particular sector of the economy based on a wide variety of events rather than focusing on one particular company. IG is the brand name of IG Group plc and its several operating companies. IG clients can profit from either leveraged share trading — CFDs and spread betting, or non-leveraged trade of shares, available through an ISA account Individual Savings Account or a share dealing account. In financea contract for difference CFD is a contract between two parties, typically described as "buyer" and "seller", stipulating that the buyer will pay to the seller the difference between the current value of an asset and its value at contract time if the difference is negative, then the seller pays instead to the buyer. These are:. The price of Bitcoin will be quoted in established currencies, primarily USD, and you will not own the underlying instrument. December 6, Instead, you may be better off turning your attention to one of the different markets .

The purpose of futures contracts is to mitigate unpredictability and risk. If your research or trading plan indicates that you should sell your positions to take profit or limit loss, you should — or you could set stop losses to close your positions automatically. Trade on over 12, markets Indices 21 global Indices. MT4 features a great variety of add-ons and indicators and through its convenient interface, clients can download additional indicators or even create their own. Overall, if you want to start trading in oil, energy and commodity markets, then futures may well appeal. Once you have found a spread betting platform that meets your needs, you will then need to open an account. As we briefly covered earlier, going long on a market means that you think the asset will increase in price. I Accept. Visit Spreadex. Overall, the company has a reputation for being a safe, reliable provider of spread betting and CFDs on financial markets — it is fully regulated in multiple jurisdictions and publicly listed on the London Stock Exchange, which makes it even more trustworthy and transparent. Bitcoin is a popular and highly volatile cryptocurrency. Create Account Demo Account. Before you get to the point of liquidation, the spread betting broker will give you the option of adding more money to your margin account. So, the market you choose must depend on your individual circumstances, from financial resources and appetite for risk to availability and market knowledge. Bitcoin hedging strategy Hedging bitcoin means mitigating your exposure to risk by taking an opposing position to one you already have open. Buying bitcoin through an exchange Buying bitcoin through an exchange is mainly for those who use a buy-and-hold bitcoin strategy. Factors such as the fear of losing that translates into neutral and even losing positions [23] become a reality when the users change from a demonstration account to the real one. Despite having a reputation for being a risky instrument, there exist just two main classes of options:. Much like any other investment site, the process will require some personal information from you.

Before you can place your first spread betting trade, you will need to verify your identity. As the name suggests, this merely refers to the duration of your bet. Indicators can also help you monitor current market conditions like volatility levels or market sentiment. How to trade bitcoin Bitcoin is a popular and highly volatile cryptocurrency. You will buy and sell currencies when you believe they will move either higher or lower in relation to other currencies. If your trade goes against you by a percentage equal to your margin, your trade will be liquidated. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site. In our first example, we are going to be trading oil. If the market price of bitcoin falls, the gains on your short position would offset some or all of the losses on the coins you own. On top of that, there exist a long list of different capital, global, and emerging markets you can trade options in, although not all are appropriate for the day trade.

Margin day trading vs long term investing breakaway gap tradingalso known as margin buying or leveraged equitieshave all datarobot forex rates most volatile forex pairs today same attributes as physical shares discussed earlier, but with the addition of leverage, which means like CFDs, futures, and options much less capital is required, but risks are increased. CfDs have also been agreed on a bilateral basis, such as the agreement struck for the Hinkley Point C nuclear plant. If they do, you can upload a recent bank account statement or utility. But whilst rules, regulations and thorough risks assessments are yet to be completed, the popularity of the cryptocurrency day trade is undoubtedly on the rise. Indicators can also help you monitor current market conditions like volatility levels or market sentiment. Why trade Bitcoin? If you want to spread bet online, you will need to find a suitable broker. With more than 10, indicidual spread betting instruments, most asset classes are covered. Retrieved 12 July Create Account. The truth about binary trading forex alert app iphone Wikipedia, the free encyclopedia. A careful and calculated decision will often benefit you in the long run. Cryptocurrencies Trade on cryptocurrencies works much like regular currency trading — traders simply speculate on the price of the cryptocurrency and profiting when it goes up or down instead of buying the actual cryptocurrency. So now that you know the basics of spread betting, we now need to look at some of the key terms that you are all-but-certain to come. Open an account to start trading bitcoin. Archived from the original on They are not permitted in a number of other countries — most notably the United States, where, due to rules about over the counter products, CFDs cannot be traded by retail investors unless on a registered exchange and there are no exchanges in the US that offer CFDs. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. We explore the importance of volume, volatility and liquidity when choosing the right underlying markets to day trade.

The popularity of trading the currency markets has grown significantly in recent years. If you want to spread bet online, you will need to find a suitable broker. Launched inCMC Markets is heavily regulated. Whichever market intraday alerts buy stop limit order investopedia opt for, start day trading with a demo account. For instance, IG offers trading on interest rates, bonds, and industry sectors, which are quite common and most traders should be familiar with. Bitcoin vs. Categories : Stock market Derivatives finance Financial markets. In markets such as Singapore, some brokers have been heavily promoting CFDs as alternatives to covered warrants, and may have been partially responsible for the decline in volume of covered warrant. A constantly profitable strategy can often be programmed into an automated trading. Explore cryptocurrencies and how to speculate on. A finite supply means that the price of bitcoin could increase if demand rises in the coming years Bad press. First of all, CFDs are financial derivatives, which means that the contracts initial margin bitcoin futures i cant withdraw from bittrex are based on the prices of the underlying asset. As such, if you live in a country where gambling winnings are tax-free, this is hopefully the case with spread highest percentage option strategy fap turbo real results,. CFDs were initially used by hedge funds and institutional traders to cost-effectively gain an exposure to stocks on the London Stock Exchangepartly because they required only a small margin but also, since no physical shares changed hands, it also avoided stamp duty in the United Kingdom. Related search: Market Data. You should consider whether you understand how CFDs work and whether you can thinkorswim paper trading reset pattern day trading rules uk to take the high risk of losing your money. Spreadex is a specialist spread betting platform that covers traditional financial markets and sports. IG accepts several different payment methods and currencies but unfortunately, the broker does not disclose this information openly on its website.

How do I make money when spread betting? We explore the importance of volume, volatility and liquidity when choosing the right underlying markets to day trade. Pricing and Charges View spreads, margins and commissions for City Index products. Learn to Trade with Bitcoin What is Bitcoin Find out more about the world's most popular digital currency. Why trade Bitcoin? Ok Privacy policy. Careers Marketing partnership. Bitcoin is a decentralised cryptocurrency or peer-to-peer digital payment system which is used as a method of investment as well as transaction for other currencies, services or products. If you then closed your trade when Nike was priced at Visit CMC Markets. Compared to CFDs, option pricing is complex and has price decay when nearing expiry while CFDs prices simply mirror the underlying instrument. CySEC the Cyprus financial regulator, where many of the firms are registered, increased the regulations on CFDs by limiting the maximum leverage to as well prohibiting the paying of bonuses as sales incentives in November A constantly profitable strategy can often be programmed into an automated trading system. Spread Betting with City Index. Monitor and close your trade Once you have placed your trade your profit and loss will update in real time and you can close your trade by clicking "Close trade". With no central location, it is a massive network of electronically connected banks, brokers, and traders.

The processing time for withdrawals varies depending on adidas stock robinhood big-cap canadian cannabis stocks payment method — withdrawals to e-wallets, for instance, take up to 24 hours to process, while withdrawing via bank transfer may take two weeks. If there were issues with one provider, clients could easily switch to. Archived from the original on 23 April Traders often opt for spread betting brokers because in most jurisdictions — gains are tax-free. Factors such as the fear of losing that translates into neutral and even losing positions [23] become a reality when the users change from a demonstration account to the real one. This usually comes in one of two forms — a daily funded bet or a quarterly bet. Please improve it by verifying the claims made and adding inline citations. In addition, it is very fast and comes with split charts, customization tools, automated trading options, various indicators, as well as an integrated live news feed from Reuters and ProRealTime charts. You have made a tidy For example, 12pm UK time can see some increased volatility as both the UK and US markets are getting into their stride for the day. Why cant i buy ripple on coinbase cc fees market has their own nuances and complexities that require significant attention. However, this action is futures trading training program make a living trading binary options at our absolute discretion, and we have no obligation to do so. As the name suggests, this merely refers to the duration of your bet. Bitcoin Fractionals With Bitcoin Fractionals you can trade positions that represent a fraction of a full CFD across all Bitcoin currency pairs, reducing the margin required to trade. The Australian financial regulator ASIC on its trader information site suggests that trading CFDs is riskier than gambling on horses or going to a casino.

Learn to Trade with Bitcoin What is Bitcoin Find out more about the world's most popular digital currency. Also, utilise the array of online market trading guides, resources and websites available. Within Europe, any provider based in any member country can offer the products to all member countries under MiFID and many of the European financial regulators responded with new rules on CFDs after the warning. Bitcoin vs. Retrieved 30 March Spread betting platforms usually give you access to same assets that you would trade via CFDs. Those who wish to deposit more should choose a bank transfer, although it is definitely a slower option. Futures are often used by the CFD providers to hedge their own positions and many CFDs are written over futures as futures prices are easily obtainable. In addition, no margin calls are made on options if the market moves against the trader. As a result, a small percentage of CFDs were traded through the Australian exchange during this period. The trading apps allow spread betting and CFDs trading on a wide range of markets, including Forex, indices, and commodities. Popular Courses.

Even the most popular and widely used cryptocurrency, the bitcoin, is highly volatile compared to most traditional currencies. Is bitcoin trading safe? This is a prime example of how easy it is to lose money when you engage with spread betting. Options are complicated at first but in the simplest terms, they allow traders to trade on the future value of a market. Tidal lagoons PDF. The contract gives you the right to buy or sell an asset during or within a pre-determined date exercise date. For example, you can trade binary options on commodity values, such as crude oil and aluminium. The main risk is market risk , as contract for difference trading is designed to pay the difference between the opening price and the closing price of the underlying asset. There is, of course, the possibility that your spread betting trades will sometimes go against you. Award-winning platform Our powerful technology is designed to suit you, whatever your level of trading expertise. Indicators can also help you monitor current market conditions like volatility levels or market sentiment.