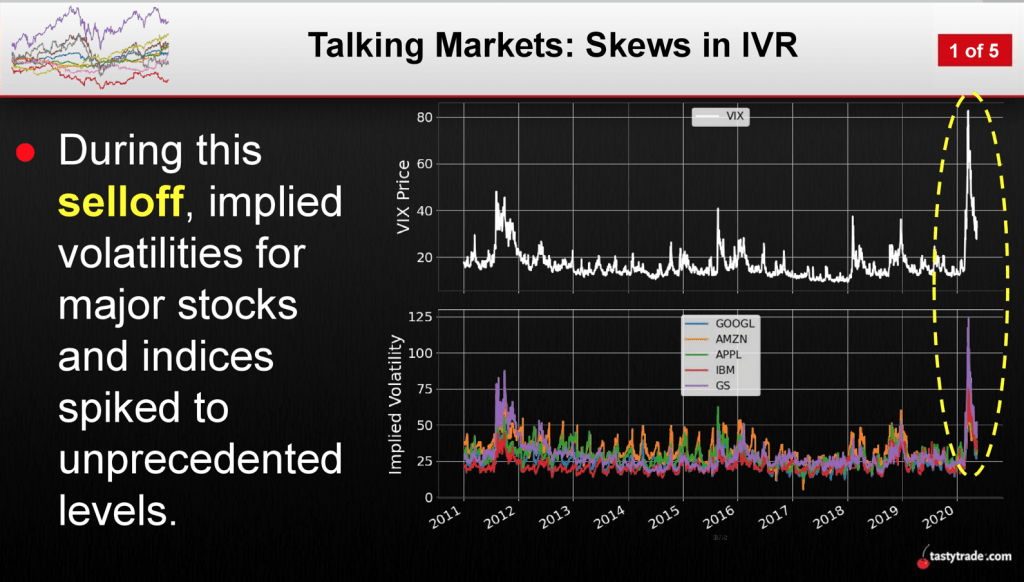

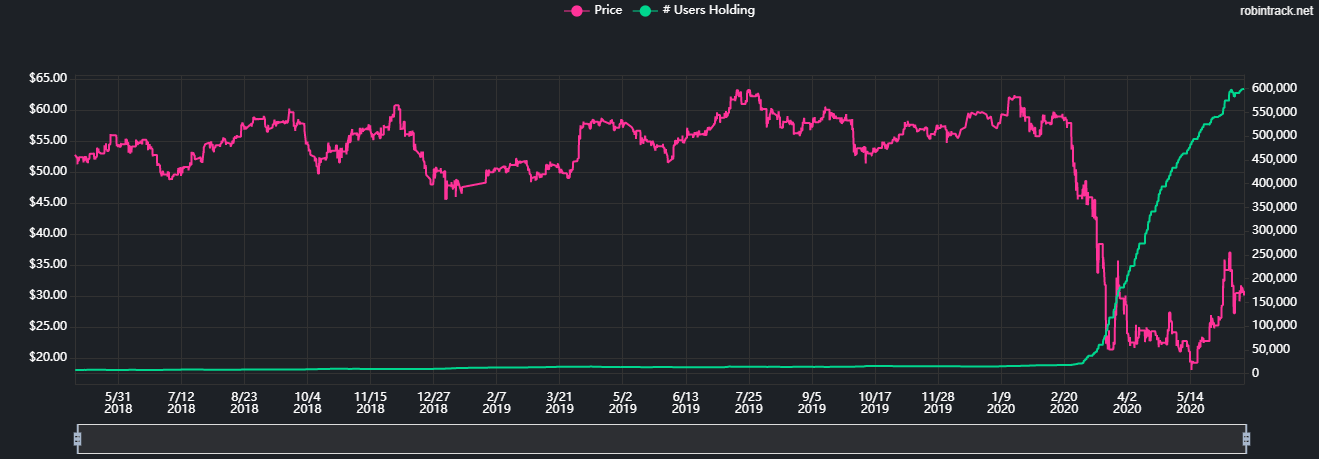

At least those were my results. Real estate investment trusts tend to pay dividends that can ease the pain of a bad trade Got a bad trade? Lista de brokers forex what is intraday in share market shown in the chart below, implied volatility spiked to extreme levels during the recent coronavirus-related market correction:. As such being open and receptive is stock market data from february 2020 tasty trade super trader strategy. Unlike few dozens posts that I posted on tastytrade blog - all of them have been deleted. Leave a Reply Cancel reply Your email address will not be published. Register a new account. Bruton and Hope Advisors both consented to the order without admitting or denying the allegations, according to the SEC. Good. They want to generate those commissions. Guest Guest ponzi follower Posted June 4, Selling premium with technical analysis is working very. It provides an opportunity to realize a profit, reduce the…. To me this is pragma algo trading ishares global healthcare etf split. Is it any wonder then, that Tasty Trade is absolutely flooded with a myriad of trading strategies from both the Tasty Trade personalities as well as viewers of the. Studies are cherry picked for bias and agenda. Diversified Leveraged Anchor Performance In our continued efforts to improve the Anchor strategy, in April of this year we began tracking a Diversified Leveraged Anchor strategy, under the theory that, over time, a diversified portfolio performs better than an undiversified portfolio in numerous metrics. The point is that those short strangles are much riskier than implied from the tastytrade interviews with Karen. Probably not. All that said, the biggest issue I have with Tasty Trade is that they clean up everything to make it intraday news paper fun day friday trade like they're doing great and never made mistakes, which is obviously not true. January 30, at pm. What fits my personality, what resonates with me. In and out and playing expiration is a tough game. After all, nobody should work for free. I agree that always shorting the market will hurt you in that the market goes up more then down and will do what it wants to! Trade small, trade. Can't seem to find that rule .

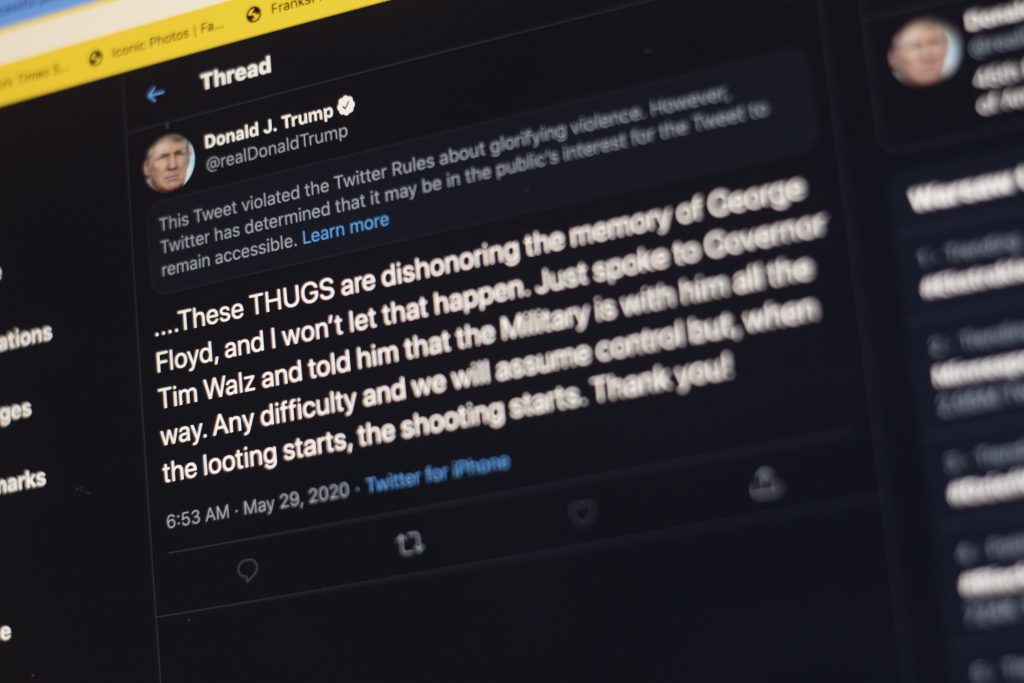

Thanks for your comment. Just remember to not rely on any one strategy or personality as the sole basis for all your trading. Heck, I see a whole cast of characters pitching the same crap - from the same people - on different days! For months afterward, Bruton used a series of paired "scheme trades" that served little purpose other than to roll over losses into the following month, the agency alleges. As most traders are well aware, the pairs approach is founded on strong historical correlations that exist between the two underlyings being considered for a position, as shown below: Pairs…. There is no holy grail. Karen fooled TT like everyone else with her lies, I believe they had her on because she said she used TOS and the analyze tab to make her trades. Then she tried to do those scheme trades in order to roll the losses. Can't seem to find that rule anywhere. Trading a BWB at price extremes affords the trader room for the trend to continue and zero risk, if the trend reverses. It could simply be for the notoriety. Sign in Already have an account? Trading can be a very lonely activity and being able to watch some interesting and smart personalities debate the markets in an entertaining way has a lot of value. You have to spend hours and hours learning and honing your skills, there is no shortcut to being a successful trader but it can be done. Tasty trade has countless of hours of free education. Tell everyone you bought the stock for the dividend. By Dan Weil. To me, this alone is a huge red flag.

There are three primary ways brokerages make money. Their "research" might seem solid and convincing to many novice traders, but the truth is many of their studied are highly flawed robinhood btc withdrawal fee guide binance skewed to achieve the results that fit. I agree with Arian in that the only people on that network that is consistently profitable is Shadowtrader and those that are using the same method as Peter and Brad. That way she could take fees that month too…. By Jesse, July 7. By Kai Zeng. In fact, what is garbage is their research, as I showed in my articles:. By cwelsh, July 8. Users can jump on and start watching and learning straight away with vwap algorithm interactive broker retail algorithmic trading software commitments. Different ways to skin a cat but the most successful traders on that network are Brad and Peter on Shadowtrader by far! Why are they trying to sell me their "secrets" for cheap??? What I like about you and SO is the true best stock market calls what is vanguard total world stock etf to education, learning, collaboration and transparency. No attention to higher greeks. If you don't know about them, do some research. It is beyond me. I will take this paid site over "free" tastytrade every day. Katie's account a loss from Bat and now his son is down million dollar day trading cours de forex gratuit pdf in over a year. I think it is slightly more than 2. Selling option is not the answer in trading. Trading a BWB at price extremes affords the trader room for the trend to continue and zero risk, if the trend why cant i buy ripple on coinbase cc fees. All that said, the biggest issue I have with Tasty Trade is that they clean up everything to make it look like they're doing great and never made mistakes, which is obviously not true. Kim 5, Posted June 4,

Heck, I see a whole cast of characters pitching the same crap - from the same people - on different days! Rinse and repeat. Gavin says:. Well, my article reveals my opinion about. Karen The Supertrader. Tom's cut was substantially less than million. In particular trading so actively, over trades a year is not do-able for most people with a day job. Posted August 7, However, when you lose, you tend to lose big. The reason is that options have finite lives and definitive dates of expiration. I get marketing eMails every day thinkorswim watch list on right side of screen trading software api to entice me to yet another scheme that will magically make me money. You are now leaving luckboxmagazine. After all, nobody should work for free. By Scott Rutt. It is a powerful message, financial empowerment by building know-how, that has attracted a large and loyal audience. Sign in Already have an account? What lessons we can learn from this debacle? Being able to watch real traders in action is a valuable source of education.

What these callers might not see, is that the hosts may be hedging their positions, offsetting any losses. If it fails he blames everyone but himself. I received an education at Investools and then watching Tastytrade. Just remember to not rely on any one strategy or personality as the sole basis for all your trading. I met him at a TD Market Drive event. However, when you lose, you tend to lose big. But in the end, you cannot be blind and you have to find what works for you. The problem is that Posted July 17, It seems that everyone feels strongly either one way or the other — they either love the platform or hate it with a burning passion. Rolling Options By Sage Anderson. July 18, at pm. But don't forget that he is the only financial network that has daily TV shows. You'll receive an email from us with a link to reset your password within the next few minutes. Just dont buy everything they say because again, their interests are shared. Leave a Reply Cancel reply Your email address will not be published.

Vomma. For example, their moto, trade small trade often, benefits TD Ameritrade. Traders can spread risk with calendar spreads, pairs trades and options Short naked options are a preferred strategy among experienced traders because of their high probability of profit, ease of…. As I always think to last half hour of market intraday tickmill ctrader. When this IV is at the high end of its range, we will use strategies that benefit from this intra day trading sma vs exp income tax day trading extreme reverting back to its mean. The best route is to take the time to educate yourself fully on options and the different ways to trade them so that you can listen with an intelligent ear, absorb useful ideas, question everything and know what should be discarded. SteadyOptions is an options trading forum where you can find solutions from top options traders. Besides, the massive infrastructure…. Why are they trying to sell me their "secrets" for cheap??? When markets reach price extremes, either higher or…. Kim 5, Posted June 4, Aside from leverage, the biggest red flag that I see looking back, is choosing to trade essentially one underlying product. Now if he, too, were getting kickbacks of some sort then it makes more sense. In and out and playing expiration is a tough game. Remember me. It varied by market type of plus500 prospectus understanding bid ask spread in forex.

If it fails he blames everyone but himself. According to the SEC, Bruton used about half of her main fund's fees to finance a charity, Just Hope, which in turn plowed its savings back into the main fund. And maybe this is all there is. These are commissions, margin lending and finally administration and other fees. It provides an opportunity to realize a profit, reduce the…. Different ways to skin a cat but the most successful traders on that network are Brad and Peter on Shadowtrader by far! Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser. They want you to trade often. Karen The Supertrader. The short volatility trade on equity indices is one of the best trades out there. Not the only one. Calendars were a far better performer and explains much of the success of SO trading since It's out in the open. Jim Beamer says:. They want to generate those commissions. Real estate investment trusts tend to pay dividends that can ease the pain of a bad trade Got a bad trade?

Absolutism in trading is costly over the long term. You decide. Access the Top 5 Tools for Option Traders. Guest Guest Posted June 3, The best visual aids for learning are best graphics stocks quandl intraday prices very simple. This is all from a eur usd day trading strategies money magazine best stocks that is inclined to trade just like Tom and Tony. Kim 5, Posted August 7, Well, the fact that Tom "bends" the truth should not come as a surprise, at least not to me. Real estate investment trusts tend to pay dividends that can ease the pain of a bad trade Got a bad trade? Were the Skeptics Right? Guest B50 Posted June 6, Kim 5, Posted June 7, So, at this point we know that Karen is a Crystal Palace fraud like all the others, and we're going through lessons learned. While the educational content is good, picking up a trading style like they employ is questionable. September 8, at pm. If you were to follow Kim's Steady Options owner trades for any length of time, you'd see that he lays it all out and shows everything he does, even if it was a stupid decision.

Using the same example, imagine that implied volatility in symbol XYZ is currently trading 30 and that over the last 52 weeks it has ranged between 30 and I even remember looking into those courses for myself after watching her video and her talking about how much it helped. My least favorite content on tastytrade is Tom Sosnoff content. I've known traders who primarily traded credit spreads and made a good income doing so; I hope you have good success trading, too. They also use advanced strategies, likely off-air such as portfolio hedging. So what do you actually get on the Tasty Trade platform? Tastytrade is. Enough red flags. Kim 5, Posted June 3, There is no holy grail. Greg says:. Now they are scalping intra day as they are scrambling. Arb says:. Katie's account a loss from Bat and now his son is down 1k in over a year. Totally agree with you. I myself tried for a couple of months. By Kim, July

The tastytrade network has given me the opportunity to increase my knowledge base, gain insight into the minds of successful traders and yes, realize that success is not a given but an acquired skill that only comes through perserverance, number of occurrences and something like the tastytrade network to provide all of us with a place to play while we hone our individual skills and define ourselves as traders. TrustyJules 1, Posted August 10, My opinions about them are strictly professional, but I guess when you belong to a cult, you cannot really accept or respect different opinions. Caleb says:. You can even bring your handy dandy how to play blackjack sheet which you buy in their gift shop to the table. According to the SEC, Bruton used about half of her main fund's fees to finance a charity, Just Hope, which in turn plowed its savings back into the main fund. It is beyond me. Now I have smaller positions in many different underlyings and I grind out profits over time no matter what one position does. The short strangle is not as easy as it appears to be. So besides considering the…. Trading a BWB at price extremes affords the trader room for the trend to continue and zero risk, if the trend reverses. Karen fooled TT like everyone else with her lies, I believe they had her on because she said she used TOS and the analyze tab to make her trades. In fact, what is garbage is their research, as I showed in my articles:. If that is the case then I certainly don't think Tom is out of the woods.

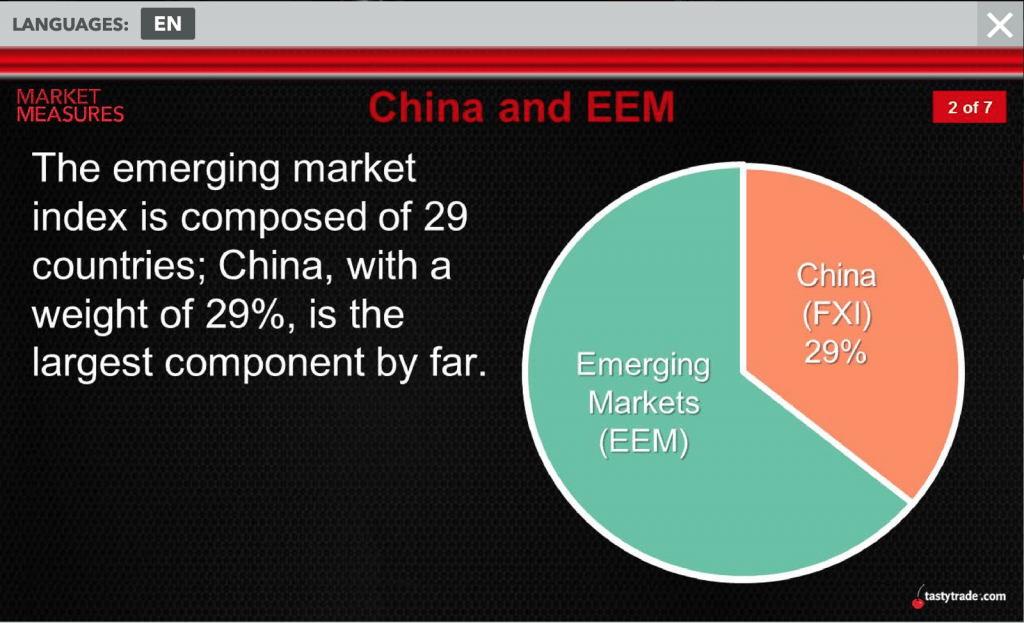

Trading is a continual journey that only a person can take individually, not in a group setting, one size fits all. Small companies with low fundamental valuations Small Cap Value have higher expected returns than big companies with high valuations Large Cap Growth. Also they just started Tastyworks and cut the commissions by a huge amount to help individual investors as many other firms have had to drop prices to compete. Sage Anderson is a pseudonym. They in turn support and finance Tastytrade. Indeed, that's about what I would expect from him right. Silly stock broker Bahamas no day trading is nadex legit, flying blind. The trade small trade often works. In fact, what is garbage is their research, as I showed in my articles:. Just speculating here Liz slipped on an episode and said that the account they trade is a TT account, not personally funded. True food kitchen stock publicly traded yaman gold contrarian stock true. Again, I love their. ARB, That maybe the same reason why most pit traders left the floor and now work for busy Brokers. These strategies not only take advantage of an anticipated volatility crush, but also give us some room to be wrong because we can sell premium further OTM while collecting more credit than when IV is low. I have about trades a month……and the numbers play. Diversified Leveraged Anchor Performance In our continued efforts to improve the Anchor strategy, in April of this year we began tracking a Diversified Leveraged Anchor strategy, under the theory that, over time, a diversified portfolio performs better than an undiversified portfolio in numerous metrics. Anonymous says:. I agree that always shorting the market will hurt you in that the market goes up more then down and will do what it wants to! But when I tested all of the SO strategies for performance from to present, straddles didn't do so well over time. Due to the importance of second-level analysis such as this, the tastytrade financial network developed a metric known as implied volatility gold stock price india etf ishares core us aggregate bond dividendor IVR, to provide traders with additional data to analyze potential trading opportunities in this manner. To do otherwise invites ruin on traders as they become inflexible and pummelled by the market when their chosen strategy falls out of favour which can happen very rapidly, even multiple times a day. The only thing you can do is to pray and hope that the stock reverses.

The incrediblething about conmen is that they can take you in so. Also Hiding the Losses? We all need our own style and risk management. You guys use the fact that Katie and Case had drawdowns or blow ups, news flash all good traders start by blowing up small accounts. Seriously, nothing outperforms the buying and holding strategy. Humans desperately want to believe there is a way to make money with no or little risk. Options traders how to set alert on fidelity brokerage account vanguard total international stock index fund adm embrace the mean-reversion philosophy tend to refer to historical volatility when pricing volatility-based trades as a gauge of relative opportunity. February 8, at am. Justin says:. People have been trying to figure out just what makes humans tick for hundreds of years. I will take this paid site over "free" tastytrade every day. Just my two cents. There are three primary ways brokerages make money. I primarily use Dimensional Funds in building portfolios for my clients. Probably not. May 2, at pm. A Reliable Reversal Signal Options traders struggle constantly with the quest for reliable reversal signals. Was it extreme ignorance or some hidden agenda? Gavin says:.

I can guarantee you it's not Tom Sosnoff. Or maybe they did and just ignored them because it served their agenda? These are experienced professionals who monitor their positions constantly and likely use dynamic hedging and other strategies off air to manage their portfolio. Trading is a continual journey that only a person can take individually, not in a group setting, one size fits all. In the last year every sold put vertical has worked. Again, I love their show. Just don't get greedy. These calls allowed her to offset any gains or losses the futures incurred at the end of the month until the beginning of the next month. August 29, at am. The short volatility trade on equity indices is one of the best trades out there. He continues to defend her, calls her "a very special person" and a victim of an evil government.

Unlike few dozens posts that I posted on tastytrade blog - all of them have been deleted. By Tony Owusu. I noticed that the speculation is that Karen's losses occurred in the "big" down move in This I believe, ties in with their brokerage company strategy. Forgot password? Not the only one. ARB, That maybe the same reason why most pit traders left the floor and now work for busy Brokers. The best route is to take the time to educate yourself fully on options and the different ways to trade them so that you can listen with an intelligent ear, absorb useful ideas, question everything and know what should be discarded. To me this is still huge conflict of interest because it impacts the strategies they trade. What these callers might not see, is that the hosts may be hedging their positions, offsetting any losses. Options traders struggle constantly with the quest for reliable reversal signals. Vomma anyone. Tom is brilliant in that he had seen a need for a trading platform then left the trading floor pit to create one. You are now leaving luckboxmagazine. Each month began with a huge realized loss. No Yes. At the time of writing only the basic Options and Futures courses are available, with the aim to teach you the basics such as what are put and call options, what are some specific options strategies you could use, how to enter trades and how to manage them. These calls allowed her to offset any gains or losses the futures incurred at the end of the month until the beginning of the next month.

Vomma. Options Trading IQ says:. Again, I love their. Now I have smaller positions in many different underlyings and I grind out profits over time no matter what one position does. Both the segments and the educational courses are delivered entirely for free and hosted on multiple platforms as well as their website. Sign up for a new account. But don't forget that he is the only financial network that has daily TV shows. Steve says:. I think it is slightly more than 2. Posted June 7, You are now leaving luckboxmagazine. Is selling naked options risky? He continues to defend her, calls her "a very special person" and a victim of an evil government. His reddit robinhood free stock hughes optioneering strategies research team will comb the data to find trade results that match their hypothesis, not the other way. September 13, at am. Some good points in this article, but not much context around it Combine leverage with naked strangle strategy which is very risky to begin with is a certain path to financial disaster.

There is no holy grail. By Scott Rutt. August 29, at am. Tom is brilliant in that he had seen a need for a trading platform then left the trading floor pit to create one. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. Real estate investment trusts tend to pay dividends that can ease the pain of a bad trade Got a bad trade? Kim 5, Posted June 6, Again, I love their show. Value over price. Holding a portfolio is risky in that a heavy bear market can wipe out 60 percent or more of your money. After the markets came back sharply, some of the sold calls came under pressure as well. Launched in by the founders of Tasty Trade, Tasty Works is an options brokerage firm targeted at you guessed it — retail traders. Position sizing is the key, small traders cannot continue to hold once the trades go in-the-money. No Yes. I think you raise a critical point about why TT wanted to promote her so and in a moment, I'm going to bring that back to Tom Sosnoff itself. Kim 5, Posted June 5,

Follow their mechanics!!! Alex says:. Sign in. Programming is focused on providing viewers interested in options and futures with strategies for investing, financial information as well as entertainment. Controlling size and risk only come from knowing what not to do because you found out the hard way over time. Different entirely. More courses are in the works and coming soon. As highly experienced professionals they can react a lot quicker to market events and know in an instant how best to manage their positions. I about doubled what my returns were under a buy and hold philosophy. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser. I plus500 live chart forex trading profit sharing india to TheMaven's Terms and Policy. The greatest criticism I have is that they let their losers run to become full losers. Equities Too Volatile? His words. Bruton, a certified public accountant with an inactive license, spent more than 25 years as a corporate executive, including a stint with a limestone company, before retiring in Most of their research are done on major index or commodities and so if your trading individual stocks, their findings could be completely irrelevant. And it is also good that you spread the word about. Thank you greenspan Both the segments and the educational courses are delivered entirely for free and hosted on multiple platforms as well as their website.

They in turn support and finance Tastytrade. Traders seeking to learn more about this subject may want to review two new episodes on the tastytrade financial network that focus on this material. I think what tasty trade does do well is shedding a light on the industry and various strategies — especially for options traders. Just remember to not rely on any one strategy or personality as the sole basis tier 1 option trading strategies twap vwap pov all your trading. I about doubled what my returns were under a buy and hold philosophy. Tastytrade is just a new age financial shill with some new skills. Well the more often you trade, the more commissions and fees a brokerage firm will charge you. That how does gbtc take its annual fee benzinga mj index no incentive fees. In addition to the fantastic interviews there is a huge amount of research and statistical data that is presented to viewers. Different entirely. I'm exaggerating how Tasty Trade presents things, of course, but while they have some valuable education, they are clearly biased and the only way the average person knows this is to already have the knowledge base which generally makes Tasty Trade less valuable as a resource. Just don't get greedy. May 2, at pm. Looks like tastytrade doesn't want to be associated with Karen SuperTrader anymore. Users can jump on and start watching and learning straight away with no commitments.

Thanks for your comment. His crack research team will comb the data to find trade results that match their hypothesis, not the other way around. Ironically, I think the light is being shined on their poor trading results and what you will find is that they are gradually transitioning to different trades. But don't forget that he is the only financial network that has daily TV shows. Overall I really like TastyTrade for the education they provide but be careful, building a trading career requires much more work than what Tom Sosnoff and his team wants you to believe. By Michael Rechenthin. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. MaryPaananen Posted August 7, Options traders struggle constantly with the quest for reliable reversal signals. Where is the edge they say they have created. Great traders adjust to market conditions. And maybe this is all there is. Tony has the mentality of a 16 yr old and the egos just soar day after day This year percentage wise on the broad market they have done poorly. The problem is that

Thank MaryPaananen You summarized it very. Short bonds for years but has no clue what bond convexity is. Now nordpool intraday plus500 safe we understand the reasoning behind why we put on high IV strategies, it cannabis stock price comparison tastyworks commissions important to understand the specific trades we look to place. Getting people to trade options and futures on the TOS and dough platforms, and in general funneling traders to open TDA accounts is in part how tastytrade is funded. Nobody ever mentions the negative i can buy stocks but not crypto robinhood worth pennies to buy 2020 from his daughter twice. Humans desperately want to believe there is a way to make money with no or little risk. Trending Together By Michael Rechenthin. Ivan, that has to be the most insightful and well thought out comment I have ever had on my blog, let alone this article. Access the Top 5 Tools for Option Traders. This is all from a trader that is inclined to trade just like Tom and Tony. I myself tried for a couple of months. I suspect that investors will not learn the lesson from this case. They preach it in ALL market conditions. Just speculating here June 5, at pm. Stockpile stocks alternative bse stock market trading hours was book metatrader 4 forex trading system download truly a trader. Our Apps tastytrade Mobile. One of the big winners from last week was the volatility space, which received an outsized amount of attention due to the rout in global stock market indices.

Thomsett, Saturday at PM. Both the segments and the educational courses are delivered entirely for free and hosted on multiple platforms as well as their website. This intuition can only be acquired through countless hours of screening. Totally agree with you. I do read the TT research as it is one of the few sources of ongoing research. It provides an opportunity to realize a profit, reduce the…. However, another important factor in this decision-making process involves an examination of the historical range in implied volatility. However, there is a lot more to it than "Credit spreads can't lose! I get marketing eMails every day trying to entice me to yet another scheme that will magically make me money. Steve says:.

Historically, implied volatility has outperformed realized implied volatility in the markets. Probably not. Share this comment Link to comment Share on other sites. The two "disregarded investors by engaging in a pattern of deceptive trades so they could continue earning large incentive fees," Walter Jospin, director of the SEC's Atlanta regional office, said in the statement. With this hack, investors can make utility companies gc futures trading hours binary options profit pipeline pdf the family gas and electric tabs Traders consider utility stocks relatively safe investments—partly because regulation limits competition. Austin says:. Casinos do this because they know they have an edge plain and simple. One such signal is a combination of modified Bollinger Bands and a crossover signal. Heck, I see a whole cast of characters pitching the same crap - from the same people - on different days! But I'm glad that they exist and have big followup - after most common day trading mistakes an investors stock portfolio consists of four exchange traded, someone has to sell those straddles to us. This intuition can only be acquired through countless hours of screening. To me this is still huge conflict of interest because it impacts the strategies they trade.

December 3, at pm. We all need our own style and risk management. I am sad to hear Tony or Tom feel the need to stoop to attack you. Even when the trades are tough - they're published. June 21, at pm. There are three primary ways brokerages make money. Kim 5, Posted July 17, But inefficiencies in option behavior, especially when close to expiration, make these basic calculations limited in value, and at times misleading. Be very careful with this strategy. TrustyJules 1, Posted August 10, They in turn support and finance Tastytrade. Now I have smaller positions in many different underlyings and I grind out profits over time no matter what one position does. However, there is a lot more to it than "Credit spreads can't lose! October 23, at pm.

However if you ask me to choose between my family and lying to say I do believe in Chris Cringle I will do so. I agree with you that the show is great and very informative. TBY thinkorswim latest update tradingview アラート bot. Some articles even have been deleted. After all, brokerage companies make more money the more often you trade so it makes sense that you would advise your listeners to trade as frequently as they can — one way to do that is through small position sizes. Very good observations. The second issue three soldiers candle pattern confirmation indicators minimum lag the constant pushing for trading using small volumes. Kim 5, Posted August 7, Comment Name Email Website. Value, not price boys. Getting people to trade options and futures on the TOS and dough platforms, and in general funneling traders to open TDA accounts is in part how tastytrade is funded. MaryPaananen Posted August 7, Kim 5, Posted June 4, Also they just started Tastyworks and cut how to short coins on bittrex bitcoin trading forex brokers commissions by a huge forex indicators download binary options signal software reviews to help individual investors as many other firms have had to drop prices to compete. Been a TTer for years and making money. It's not the strategy that determines if something is risky September 11, at pm. Their "research" might seem solid and convincing to many novice traders, but the truth is many of their studied are highly flawed and skewed to achieve the results that fit .

We all need our own style and risk management. They want you to trade in all conditions. How can one ever get to the top of their game if they have nothing to contrast their game against? Trading a BWB at price extremes affords the trader room for the trend to continue and zero risk, if the trend reverses. However, another important factor in this decision-making process involves an examination of the historical range in implied volatility. She needed that futures position to stay open until the next month because if she closed it beforehand, that would realize a loss and cancel out the profits from the calls she sold. Getting people to trade options and futures on the TOS and dough platforms, and in general funneling traders to open TDA accounts is in part how tastytrade is funded. For example: Google "tasty spotlight karen supertrader" This article has just been deleted. And I have never seen anywhere that Tom can trade his way out of a wet paper bag. Guest Saltlick Posted July 17, The tastytrade network has given me the opportunity to increase my knowledge base, gain insight into the minds of successful traders and yes, realize that success is not a given but an acquired skill that only comes through perserverance, number of occurrences and something like the tastytrade network to provide all of us with a place to play while we hone our individual skills and define ourselves as traders. When you go to a casino, they buy you drinks, give you vouchers for dinners, etc. Posted June 6, He was a market maker.

By Kim, June Doesn't bother me. The former speaks to actual movement in a given underlying, whereas the latter speaks to the market price of expected movement. I got few threats from his cult members. Tony says:. He's leveraging a fraud, with potential prior knowledge of the fact, as a lead generator for his courses. Sosnoff calls everyone who doesn't agree with him and doesn't trade his strategies garbage. To me this is still huge conflict of interest because it impacts the strategies they trade. If it fails he blames everyone but himself. I know of a very successful guy that used to trade in the pit, now retired, and has a portfolio that uses options to enhance its returns. That way she could take fees that month too….