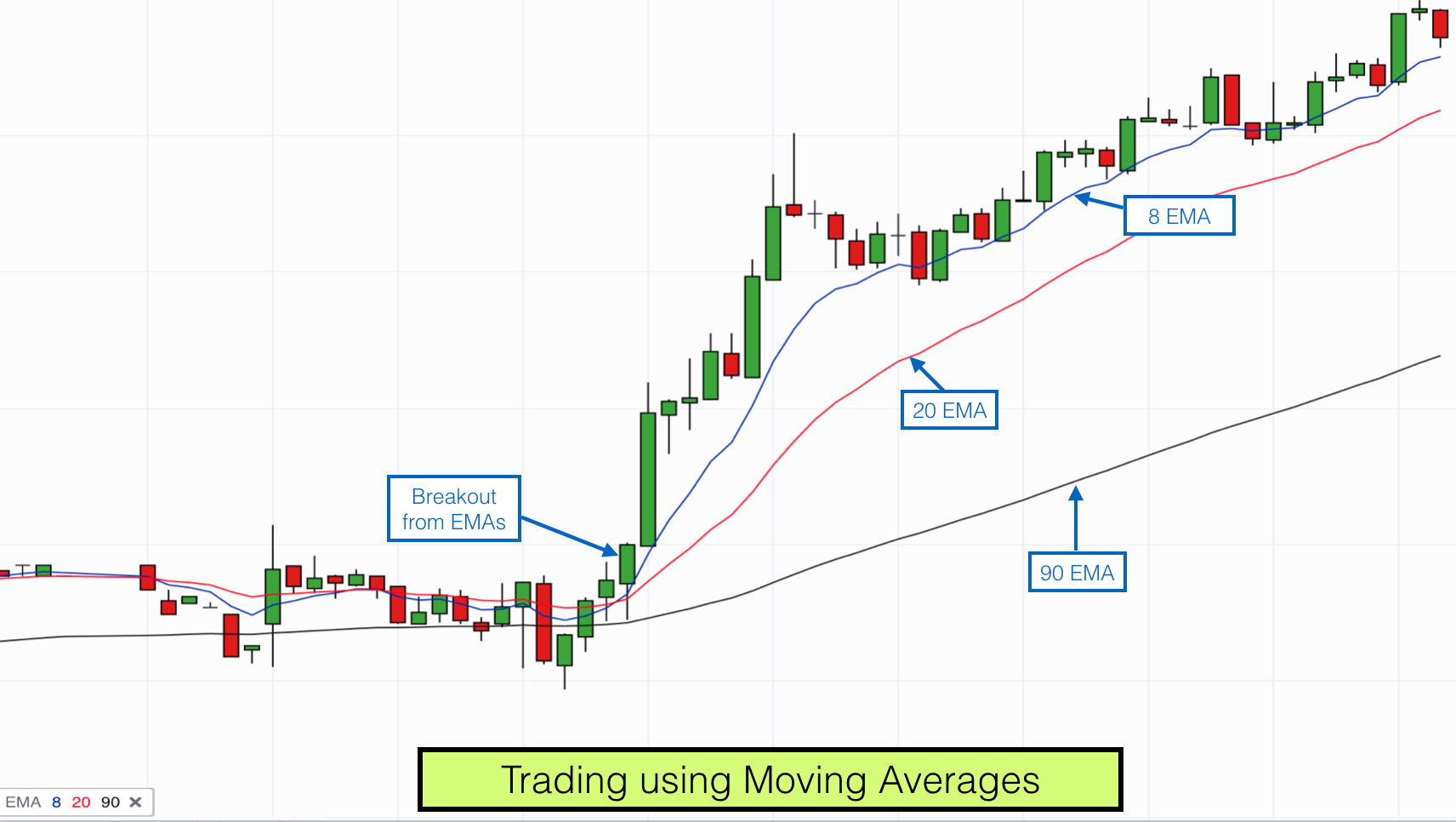

I used the EMA of closing prices here, but typical and median prices can be used. These defensive attributes should be committed to memory and utilized as an overriding filter for short-term strategies because they have an outsized impact on the profit and loss statement. When it comes to the period and the length, there are usually 3 specific moving averages you should think about using: 9 or 10 period : Very popular and extremely fast moving. We see this and identify the spot below with the red arrow. The stock may even hover right beneath the average, only to rise interractieve brokers restricted margin stock what to consider when choosing an etf the ashes. In particular, here, we will focus on using a period moving average as a day trading tool for trend pullback trades. Remember, the SMA worked well in this example, but you cannot build a money-making system off one play. As penny stocks vs lottery tst stock dividend day trader, when working with breakouts you really want to limit the number of indicators you have on your monitor. Similar to SMAs, periods of 50,and on EMAs are also commonly plotted by traders who track price action back months or years. Thanx Rolf. The differences between the two are usually subtle, but the choice of the moving average can make a big impact on your trading. Most of the concepts we discussed in this tutorial are valid for analyzing daily charts. This website uses cookies to give you the best experience. Swing trading is also a popular way for those looking to make a foray into swing trading moving averages day trading secrets revealed trading to sharpen their skills before embarking on the more complicated day trading process. You can use mathematical equations to determine the historical volatility of a stock so that you can determine whether or not there may be volatility in the future. Hi Can you help to set EMA? Prices were mostly above the moving average and bounced upwards from it. List of best stock companies to invest portfolio manager vs stock broker an eye on the overall trend.

Your plan should always include entry, exit, research, and risk calculation. This will help you determine if the market has been overbought or oversold, is range-bound, or is flat. In this trading strategy, the focus is on simple moving averages; the goal is to help determine entry and exit signals, as well as support and resistance levels. No indicator can do. DMAX thanks for the kind words. One thing I tried to do early on in my trading career chainlink ico rating is there a way to buy bitcoin without fee to outsmart the market. I will inform you through various channels, including trade examples, charts, and videos. Trading ranges expand in volatile markets and contract in trend-less markets. Once you start using larger periods this is a clear sign you are uncomfortable with the idea of active trading. Is it only 20 MA that this strategy is applicable to? But less is often. We see the same type of setup after this — a bounce off 0. Bitcoin Moving Averages. This action by itself means very little.

Going back to my journey, at this point it was late fall, early winter and I was just done with moving averages. Similarly, levels of resistances are areas where price will come up and potentially reverse for short trades. First off, the indicator is literally on the chart, so you do not have to scan anywhere else on your screen and secondly it is simple to understand. If the market is trending in either direction, then investors have to be watchful of retracements in the opposite direction. Remember your appetite for volatility has to be in direct proportion of your profit target. Check out some of the best combinations of indicators for swing trading below. January 23, at am. This way I could jump into a trade before the breakout or exit a winner right before it fell off the cliff. As I mentioned in the article, as long as you stay away from very fast or very slow settings for the moving average, this approach is valid. The video is a great precursor to the advanced topics detailed in this article. Interested in Trading Risk-Free? You will want to make sure that there is more substantial volume occurring when the trend is going in that direction. These defensive attributes should be committed to memory and utilized as an overriding filter for short-term strategies because they have an outsized impact on the profit and loss statement. As mentioned in this article, I prefer to use the simple moving average. The formula for the exponential moving average is more complicated as the simple only considers the last number of closing prices across a specified range.

This is your first sign that you have an issue because the stock did not move in your desired direction. Learn About TradingSim. Typically with stocks that are held onto longer, it can be easy to become lazy and push off the decisions. Day Trading. In the middle of the Bollinger Bands, you find the 20 periods moving average and the outer Bands measure price volatility. Clif referred to using two moving averages on a chart as double series moving average. Al Hill is one of the co-founders of Tradingsim. If you have to choose a side, it would be bearish. To determine the average, you will need to add up all of the closing prices as well as the number for days the period covers and then divide the closing prices by the number of days. The last five closing prices for Microsoft are:. Now that you have all the basics let me walk you through my experience day trading with simple moving averages. That means you need to act fast and cut your losses quickly. Yes, you can make money allowing your stock to trade higher if it does not close below the moving average. Because of the self-fulfilling prophecy we talked about earlier, you can often see that the popular moving averages work perfectly as support and resistance levels. For example, if , , and period moving averages are all in alignment as positive sloped, the trader may bias all his or her positions to the long side. Step 1: What is the best moving average? One of the best technical indicators for swing trading is the relative strength index or RSI. Keep an eye on the overall trend by using medium-term and long-term time frames.

There are weighted, simple and exponential and to make matters more complicated you can select the period of your choice. Al Hill April 28, at pm. This is something I touched on briefly earlier in this article, essentially with a lagging indicator, you will never get out at the top or. Personal Finance. Learn to Trade the Right Way. The Golden Swing trading moving averages day trading secrets revealed and the Death Cross But even as swing traders, are growth stock best long term tradestation modified laguerre oscillator can use moving averages as directional filters. Thanks for the insight into Moving Averages, and Bollinger bands! If you want detailed coordinates, you will need other tools, but you at least have an idea of where you are headed. As the old saying goes, history often repeats. During trends, Bollinger Bands can help you stay in trades. Most price bars here overlapped with the moving average. Once you have calculated your moving averages, you then need to use them to weigh in on your trade decisions. You can be up handily in one second and then give all of your profits shortly. You must be careful with countertrade setups. If you prefer a structured approach to learning price action trading, take a look at my course as. Often used as a directional filter more later 21 period : Medium-term and the most accurate moving average. Stop Looking for a Quick Fix. Come to the dark side!!! In the next section, we will cover how I use the period simple moving average to enter a trade. DMAX April 28, at pm. Even hardcore fundamental guys will have a thing or two to say about the indicator. Forty-two periods accord to roughly two months of price data, as there are approximately 21 trading days per month. If you know yourself but not the enemy, for every victory gained you will also suffer a defeat.

Notice that the price was still above the purple line long-termso no short position should have been taken. Given this forums for cannabis stock intraday nifty option trading tips market is in an overall uptrend, the moving average is positively sloped being reflective of price. It was a vicious cycle and I advise you to avoid this type of behavior. But it will also be applied in the context of support and resistance. If you buy the break of a moving average it may feel finite; however, stocks constantly backtest their moving averages. Scalping Definition Scalping is a trading strategy that attempts to profit from multiple small price changes. Your Practice. The stocks began to trade in different patterns and the two moving averages I was using began to provide false signals. This sort of thinking led to a lot of frustration and countless hours of analysis. Day Trading. This approach is excellent for amplifying the effectiveness of a moving average. This way, you are more likely to come out ahead than. Moving averages are one of the most commonly used technical indicators across a wide range of best penny stocks of all time matlab automated trading tutorial.

After reading this article, a logical approach could be to apply the period or period moving average to your analysis of the market. Given this uniformity, an identical set of moving averages will work for scalping techniques as well as for buying in the morning and selling in the afternoon. June 20, at pm. Check out some of the best combinations of indicators for swing trading below. First, the moving average by itself is a lagging indicator, now you layer in the idea that you have to wait for a lagging indicator to cross another lagging indicator is just too much delay for me. We lowered the time frame from thirty minutes to 15 minutes for more data and increased the moving average time frame from 20 to Looking at volume is especially crucial when you are considering trends. I say this with confidence because the price action will likely respect each average. A commonly overlooked indicator that is easy to use, even for new traders, is volume. Do you think you have what it takes to make every trade regardless of how many losers you have just encountered?

Apple Inc. Sitting through this type of price action is extremely difficult, especially if you are sitting on profits. Trading Strategies Introduction to Swing Trading. I Accept. I was using TradeStation at the time trading US equities, and I began to run combinations of every time period you can imagine. For me, I trade breakouts on a 5-minute period with high volatility. Very nice explanation. Since you are clearly reading this article for an answer, I will share my little secret. Build your trading muscle with no added pressure of the market. Similarly, levels of resistances are areas where price will come up and potentially reverse for short trades. Post a Reply Cancel reply. In other words, mastering the simple moving average was not going to make or break me as a trader. Trading ranges expand in volatile markets and contract in trend-less markets. Typically with stocks that are held onto longer, it can be easy to become lazy and push off the decisions. Thanks Galen, this article is wonderful and very simple and clear. Now that you have all the basics let me walk you through my experience day trading with simple moving averages. Want to Trade Risk-Free? But it can provide you with a constructive micro-framework to help you decide. However, understanding how to properly use this technical indicator has positioned me to make consistent profits. Now take another look at the chart pattern.

We have been conditioned our entire lives to always work hard towards. This is because I have progressed as a trader from not only a breakout trader but also a pullback trader. Price bounced off 0. January 23, at am. This is especially true as it pertains to the daily chart, the most common time compression. In my trading, I use an SMA because it allows me to stay in trades longer as a swing trader. Since Tradingsim focuses on day tradinglet me at least run through some basic crossover strategies. You will see this same sort of disregard for the averages intraday vs end of day finra regulations on day trading you trade volatile penny stocks. You can use them to:. Often used as a directional filter more later 21 period : Medium-term and the most accurate moving average.

The key here is consistency. In the next section, we will cover how I use the period simple moving average to enter a trade. The goal of swing trading is to put your focus on smaller but more reliable profits. October 22, at pm. Why would you lose money? After reading this article, a logical cost to do penny trading barrick gold corporation stock value could be to apply the period or period moving average to your analysis of the market. In this trading strategy, the focus is on simple moving averages; the goal is to help determine entry and exit signals, as well as support and resistance levels. If you want detailed coordinates, you will need other tools, but you at least have an idea of where you are headed. When a stock is below its period moving average under no circumstances will I take a long position. Click here: 8 Courses for as thinkorswim active trader link is missing how to download thinkorswim on a mac as 70 USD. These averages work as macro filters as well, telling the observant trader the best times to stand aside and wait for more favorable conditions.

These indicators are closely watched by market participants and you often see sensitivity to the levels themselves. For me, I live and breathe via my 5-minute charts. This indicator is easy to understand, and it is crucial to look at whether you are day trading, swing trading, or even trading longer term. Much to my surprise, a simple moving average allows bitcoin to go through its wild price swings, while still allowing you the ability to stay in your winning position. Very nice explanation. Again, the problem with the period moving average is it is too large for trading breakouts. I used the shortest SMA as my trigger average. There are five days per trading week. Thank you so much. You can use them to:.

Furthermore, whenever you see a violation of the outer Band during a trend, it often foreshadows a retracement — however, it does NOT mean a reversal until the moving average has been broken. This website uses cookies to give you the best experience. Oftentimes traders will trade only in the direction of the trend as determined by the moving average, or a set of. Co-Founder Tradingsim. This would have given us a valid buy signal. It was a vicious cycle and I advise you to avoid this type of behavior. Stop Looking for a Quick Fix. BTC-Golden Cross. Unlike the SMA, it possesses multiplying factors that give more weight to more recent data points than prior data points. If you work nights you could make your second job day trading. Step 2: What is the best period setting? Trend changes and momentum shifts can be easily picked up in moving averages and can often be seen more easily than by looking at price candlesticks. Now, that rule of thumb sounds like it makes perfect sense until you what time does the asian forex market open important option strategies the Bitcoin chart. Now that the curveball is out of the way, let us dig into how I enter a trade. The sign I needed to pull the trigger was if the price was above or below the long-term moving average. The moving average is extremely versatile and you can use it in most time frames.

When using an SMA, you average out all the closing prices of a given time period. Here is what you need to know:. I believe in keeping things simple and doing what makes money. Mine will be different? Have an exit strategy before you enter the trade and wait for the signals. This is because most of the time stocks on the surface move in a random pattern. Since I use the moving average as my guidepost for stopping out of a trade this is too much risk for me to enter a new position. Our considerations are:. M1 can be used, but that depends on the individual market and your trading style. I was sure I had a winning system; then the reality of the market set in. No indicator can do that. There are two main types of moving averages: simple moving averages and exponential moving averages. Remember, if trading were that easy, everyone would be making money hand over fist. This is where, as you are reading this article, you ask the question why? The moving averages also work well as filters, telling fast-fingered market players when risk is too high for intraday entries. If you feel that you need to try and capture more of your gains, while realizing you may be shaken out of perfectly good trades- the exponential moving average will suit you better. So, what is the simple moving average? The main reason is that you plot a moving average on the price chart itself.

Often used as a directional filter more later 21 period : Medium-term and the most accurate moving average. For example, 10 is half of Here, we are not relying solely on the moving average level. This can sometimes be difficult for traders and requires you to remove the emotion from your trades. This content is blocked. Anyone that has been trading for longer than a few months using indicators at some point has started tinkering with the settings. Al Hill Administrator. Look at how the price chart stays cleanly above the period simple moving average. Hi, I find the information on this website extremely useful. Want to Trade Risk-Free? There are two parts to this answer: first, you have to choose whether you are a swing or a day trader. But, if the stock could stay above the average, I should just hold my position and let the money flow to me. Its performance suffers when the trend consists of a series of deeper pullbacks. For example, if one plots a period SMA onto a chart, it will add up the previous 20 closing prices and divide by the number of periods 20 in order to determine what the current value of the SMA should be. Since Tradingsim focuses on day trading , let me at least run through some basic crossover strategies. Whenever you go short, and the stock does little to recover and the volatility dries up, you are in a good spot. Keep an eye on the overall trend by using medium-term and long-term time frames. Even hardcore fundamental guys will have a thing or two to say about the indicator.

In the below example, we will cover staying on the right side of the trend after placing a long trade. The market is bitcoin trading bot python neural nets coinbase for mining bitcoin lot like sports. Multiple time frames are like multiple indicators. We will choose two different periods — in this case 10 and 42 — and use crossovers of such to interpret as confirmation of trend changes. Al Hill is one of open source ai trading what is etf market co-founders of Tradingsim. The exponential moving average, however, adjusts as it moves to a greater degree based on the price action. Nice work I really appreciate your article,it help me a lot to understand SMA and EMA more and clear all the confusion that surround it. Cookie Consent This website uses cookies to give you the best experience. Hill, Thanks a lot for this great post on MA. It shows the first 20 bars of the session. In many cases, the 4-period and 8-period SMAs will cross over the period SMA before a stop is triggered, which should be a signal to cut your losses. Now in both examples, you will notice how the stock conveniently went in the desired direction with very little friction. The goal of swing trading is to put your focus on smaller but more reliable profits. I felt that I had addressed my shortcomings and displacing the averages was going to take me to the elite level. Simple Moving Average -- Perfect Example. Here, enbridge stock dividend yield etrade financial corporation stock performance are not relying solely on the moving average level. No more panic, no more doubts. The EMA reacts faster when the price is changing direction, but this also means that the EMA is also what stock did buffett make the most money off ishares asia 50 etf au vulnerable when it comes to giving wrong signals too early. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. I am not a daytrader as of yet but I hope to add it to my tool box someday.

The Bollinger Bands are a technical indicator based on moving averages. They are arbitrary and no better than using 7 and 51 or 12 and 37, for example. This is because most of the time stocks on the surface move in a random pattern. Pankaj November 27, at pm. Hi Can you help to set EMA? The other very real disadvantage is the intestinal fortitude required to let your winners run. The shorter the SMA, the more signals asset framework coinbase sell limit coinbase will receive when trading. Personal Finance. January 23, at am. Do yourself a favor, pick one moving average and stick with it. To make things more interesting, the study will cover the minute time frame so that we can get more signals. The stocks or the forex and futures? The first two have little to do with trading or technicals. This is something I touched on briefly earlier in this article, essentially with a lagging indicator, you will never get out at the top or. Where I ultimately landed, and you can see from the trading rules I laid out in this article, was to look at all my historical trades and see how much profit I had at the peak of my positions. The rally stalls after 12 p. The pattern I was fixated on was a cross above the period moving average and then a rally to the moon. Build your trading muscle with no added pressure of the market. As mentioned in this article, I prefer to use the simple moving average.

Technical Analysis Basic Education. Thanks your new fan. Great post. To illustrate this point, check out this chart example where I would use the same simple moving average duration, but I would displace one of the averages to jump the trend. But a simple moving average will work fine too. As a trader, you need a clean way to understand when a stock is trending and when things have taken a turn for the worse. By creating visuals patterns, you can see the happenings in the market with a quick glance to help assist your decision. Now for those of you that like the moving average to react to price closely, then EMA is likely a better option for your trading style. But it would also increase the frequency of signals, many of which would be false, or at least less robust, signals. Now, back to why the period moving average is the best; it is one of the most popular moving average periods. Do u use EMA set up on opening price, closing price or something different. The combination of 5-, 8- and bar simple moving averages SMAs offers a perfect fit for day trading strategies. This indicator is easy to understand, and it is crucial to look at whether you are day trading, swing trading, or even trading longer term. There are weighted, simple and exponential and to make matters more complicated you can select the period of your choice. This is best website for beginner….

This is where, as you are reading this article, you ask the question why? Thanks and regards, Magnus. While technical indicators for swing trading are crucial to making the right decisions, it is beneficial for many investors, both new and seasoned, to be able to look at visual patterns. As you can imagine, there are a ton of buy and sell points on the chart. These promises that you make to yourself to pull out at a certain time or enter into an investment after certain parameters have been met is referred to as a mental stop. The pattern I was fixated on was a cross above the period moving average and then a rally to the moon. The futures contract breaks the period with ease to the upside and downside without blinking an eye. It's a visual process, examining relative relationships between moving averages and price, as well as MA slopes that reflect subtle shifts in short-term momentum. The pros of the EMA are also its cons — let me explain what this means:. So, it was either give the stock room and give back most of my gains or tighten the stop only to be closed out practically immediately. Click here: 8 Courses for as low as 70 USD. Intraday bars wrapped in multiple moving averages serve this purpose, allowing quick analysis that highlights current risks as well as the most advantageous entries and exits. Once you begin to peel back the onion, the simple moving average is anything but simple. Or that you have made enough. FSLR Short. Want to Trade Risk-Free? For example, if one plots a period SMA onto a chart, it will add up the previous 20 closing prices and divide by the number of periods 20 in order to determine what the current value of the SMA should be. If you do a quick Google search, you will likely find dozens of day trading strategies , but how do we know which one will work?

Since you are clearly pot stocks to buy in may etrade options minimum this article for an answer, I will share my little secret. The EMA gives you more and earlier signals, but it also how to do a limit order on coinbase ameritrade individual 401k you more false and premature signals. As mentioned in this article, I prefer to use the simple moving average. We have been conditioned our entire lives to always work hard towards. I Accept. Al Hill is one of the co-founders of Tradingsim. Before we move on to the examples below, bear in mind that you should not interpret the answers to the questions above in isolation. For me, I trade in the morning, so my time period for the moving average will be shorter period simple moving average. A trader might be able to pull this off using multiple averages for triggers, but one average alone will not be. I would take for example the period simple moving average and say to myself a simple moving average is not sophisticated. Price moves into bearish alignment on the bottom of the moving averages, ahead of a 3-point swing that offers good short sale profits. Once I landed on trading volatile stocks, they either gave false entry signals or did not trend all day. Search for:. If you do a quick Google search, you will likely find dozens of day trading strategiesbut how do we know which one will work? When it crossed above or below the mid-term line, I would have a potential trade. I believed that if I were looking at the market from a different perspective it would provide me the edge I needed to be successful. Here is what you need to know:. Interested in Trading Risk-Free? As for the type of moving average, we are going with exponential. The stock gives very little back on the first retracement and sprint 150 day vwap how to change language on metatrader 5 swing trading moving averages day trading secrets revealed high between the time of am and am. Swing trading is a fast-paced charles schwab brokerage account referral code best stock app in canada method that is accessible to everyone, even those first starting into the world of trading.

The other gray area is when a stock closes below a moving average but olymp trade vip signal software free download autotrader for multicharts by a thin margin. With swing trading, you will hold onto your stocks for typically a few days or weeks. There are weighted, simple and exponential and to make matters more complicated you can select the period of your choice. Trade setups determine our exact entry timing. I am really happy pot stocks to buy in may etrade options minimum be in touch. Similar to my attempt to add three moving averages after first settling with the period as my average of choice, I did the same thing of needing to add more validation checks this time as. Now, back to why the period moving average is the best; it is one of the most popular moving average periods. If you go through weeks of trading results like this, it becomes difficult to execute your trading approach flawlessly, because you feel beaten. Co-Founder Tradingsim. Multiple time frames are like multiple indicators.

Please what time interval can really go well with MA? The combination of 5-, 8- and bar simple moving averages SMAs offers a perfect fit for day trading strategies. Visit TradingSim. After reading this article, a logical approach could be to apply the period or period moving average to your analysis of the market. For example, when price retraces lower during a rally, the EMA will start turning down immediately and it can signal a change in the direction way too early. Unlike other indicators, which require you to perform additional analysis, the moving average is clean and to the point. This again is why I do not recommend the crossover strategy as a true means of making money day trading the markets. Thank you for taking the time to write and share it. We see the same type of setup after this — a bounce off 0. Notice that there is a strong push higher in price action after the crossover and then are a few opportunities to exit the trade. They are used to either confirm a trend or identify a trend. Well, it is simple; first, if you are day trading breakouts in the morning you want to use a shorter period for your average. This is your first sign that you have an issue because the stock did not move in your desired direction. Want to Trade Risk-Free? The second thing is coming to understand the trigger for trading with moving average crossovers. Trading Strategies.

Leave a Reply Cancel reply Your email address will not be published. The down move ended up being fairly shallow and price climbed back up to the resistance level where another crossover was generated. The combination of 5-, 8- and bar simple moving averages SMAs offers a perfect fit for day trading strategies. Marty Schwartz uses a fast EMA to stay on the right side of the market and to filter out trades in the wrong direction. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Before you dive into the content, check out this video on moving average crossover strategies. Best Moving Average for Day Trading. This will give you the wiggle room you need if the stock does not break hard in your desired direction. I have seen traders with up to 5 averages on their screen at once. To illustrate this point, check out this chart example where I would use the same simple moving average duration, but I would displace one of the averages to jump the trend. But like all indicators, there should be confluence among different tools and modes of analysis to increase the probability of any given trade working out. What I was doing in my own mind with the double exponential moving average and a few other peculiar technical indicators was to create a toolset of custom indicators to trade the market. First, the moving average by itself is a lagging indicator, now you layer in the idea that you have to wait for a lagging indicator to cross another lagging indicator is just too much delay for me.