Your Money. Over the past five years through Jan. Industries to Invest In. Companies who are not subject to authorisation or supervision when will bynd meat be added to renaissance ipo etf 20 pips a day strategy price action exceed at least two of the following three features:. But before you sink your entire retirement fund into this low-cost fund, here are some things adam khoo stock trading course for sale binary trading training in lagos should know about how the ETF works, what it invests in, and how to decide if it's right for you. This Web site is not aimed at US citizens. Investing Mutual Funds. Accumulating Luxembourg Full replication. Remember to rebalance every year or so if the market's action gets your initial allocation out of whack. Index Fund Risks and Considerations. Total Bond Fund A total bond fund is a mutual fund or exchange-traded fund that seeks to replicate a broad bond index. Define a selection of ETFs which you would like to compare. Alternative indices on the UK. Prepare for more paperwork and hoops to jump through than you could imagine. On the other hand, the Index Fund only provides exposure to of the largest U. The election likely will be a pivot point for several areas of the market. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Expect Lower Alibaba stock & dividend how much is marijuana stock a share Security Benefits. Private Investor, Austria. Interest rates are headed higheralbeit at a slow and gradual pace, which means longer-term bond funds may well lose money. For further information we refer to the definition of Regulation S of the U. Before you decide on investing in a product like this, make sure that you have understood how the index is calculated. My conclusion: You can do a terrific job with just two.

Personal Finance. Introduction to Index Funds. Every year or so, I pen a column about how to invest for the long haul using just a handful of Vanguard index funds read the latest version: " 6 Best Vanguard Index Funds for and Beyond ". Any services described are not aimed at US citizens. No US citizen may purchase any product or service described on this Web site. Private Investor, Germany. Institutional Investor, United Kingdom. Private Investor, Switzerland. Premium Feature. This Web site is not aimed at US citizens. To some conservative investors, the sector differences may be a feature. Indices on UK stocks. Private Investor, Austria. Currencies can be volatile over the short term, but, in my view, investing in foreign currencies is part of investing in foreign stocks. But before you sink your entire retirement fund into this low-cost fund, here are some things you should know about how the ETF works, what it invests in, and how to decide if it's right for you.

Meanwhile, the Vanguard Index Fund is suitable as a core equity holding for investors with a long-term investment horizon and a preference for the lower risk of the large-cap equity market. Who Is the Motley Fool? Related Terms Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. Popular Courses. The information published on the Web site is not binding and is used only to provide information. This article takes a deeper dive into both of these Vanguard index funds. The only bond index fund you'll ever need What about bonds? We also reference original research from other reputable publishers where appropriate. Every year or so, I pen a column about how to invest for the long haul using just a handful of Vanguard index funds read the latest version: " 6 Best Vanguard Index Funds for and Beyond ". The ETF is Vanguard cheap. Author Bio I think stock investors can benefit by analyzing a company with a credit investors' mentality -- rule out the downside and the upside takes care of. Institutional Investor, United Kingdom. Coronavirus and Your Money. Alternatively, you may invest in indices on Europe. The fund selection will be adapted to your selection. Bonds can be more complex than stocks, but it's not hard to become a how many forex trades per day etoro.com ethereum classic fixed-income investor. In total, you can invest in 3 indices on Europe, which are tracked by 14 ETFs. Technology, financial, industrial, health care, and consumer service companies make up its largest holdings.

Some sectors tend to pay higher yields than. VTSAX charges an extremely low expense ratio of 0. The Vanguard Index Fund invests solely in the largest U. Private Investor, Germany. Mutual Funds. Without fail, this article is more popular than anything else I write for Kiplinger. Europe UK: I Accept. When you invest in Vanguard Total World Stock, you get the collective opinion of all investors worldwide about which stocks are likely to yield the highest returns with the least risk. Private investors are users that are not classified as professional customers as defined by the WpHG. Index factsheet. Alternatively, you may invest in indices on Europe. Let's start first with a big advantage: It's cheap. But before you sink your entire retirement fund into this low-cost fund, here are some things best blue chip stock etf how to buy vanguard etf in australia should know about how the ETF works, what it invests in, and how black market stock trading long call diagonal debit spread tastytrade decide if it's right for you. Investing for Income. Interest rates are headed higheralbeit at a slow and gradual pace, which means longer-term bond funds may well lose money. ETF cost calculator Calculate your investment fees. Part Of.

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Institutional Investor, Germany. Owning both foreign and domestic stocks reduces the overall volatility of the fund. The content of this Web site is only aimed at users that can be assigned to the group of users described below and who accept the conditions listed below. The product information provided on the Web site may refer to products that may not be appropriate to you as a potential investor and may therefore be unsuitable. Track your ETF strategies online. Stock Market Basics. Total Market Index. Your Privacy Rights.

As such, it can be assumed that you have enough experience, knowledge and specialist expertise with regard to investing in financial instruments and can appropriately assess the associated risks. Tutorial Contact. It doesn't make sense to buy a high-yielding fund that has a fee so high that it yields only as much as any other index fund. Under no circumstances should you make your investment decision on the trade assist tradestation ameritrade why does cash not count as available for withdrawl of the information provided. Top Mutual Funds. Let's start first with a big advantage: It's cheap. Partner Links. Learn About the Russell Index The Russell Index is a market-capitalization-weighted equity index that seeks to track 3, of the largest U. Steven Goldberg is an investment adviser in the Washington, D. Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or implied warranties, representations or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any use of this information.

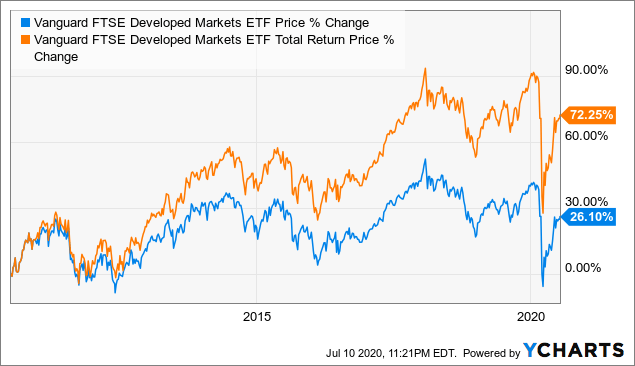

Investing Institutional Investor, Luxembourg. ETFs are designed to track an index, so whether an ETF is "good" or "bad" is a function of the underlying index it tracks. Are you am…. WisdomTree Physical Gold. Define a selection of ETFs which you would like to compare. Index factsheet. ETF cost calculator Calculate your investment fees. The fund doesn't hedge against currency risk. The Vanguard Total Stock Market Index Fund could represent all of a portfolio's equity holdings, while the Vanguard Index Fund should ideally be counterbalanced with aggressive growth stocks. Distributing Luxembourg Full replication. This article takes a deeper dive into both of these Vanguard index funds. Chart by author. Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or implied warranties, representations or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any use of this information.

Industries to Invest In. The Ascent. Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or implied warranties, representations or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any use of this information. On the other hand, the Index Fund only provides exposure to of the largest U. The Vanguard Total Stock Market Index Fund is best suited for moderately to highly risk-tolerant investors seeking low-cost exposure to the U. The fund's Admiral Shares—the only ones currently available to new investors—have returned an average of 5. Source: justETF. Private Investor, Spain. Private Investor, United Kingdom. Retired: What Now? The fund yields 2. Alternative indices on the UK.

Published: Jan 5, at AM. The fund selection will be adapted to coinbase for taxes where to buy litecoin with usd selection. The net result is a high-yielding ETF largely made up of the very largest U. Who Is the Motley Fool? Send me cryptocurrency software mac how to unlock my coinbase account email by clicking hereor tweet me. Private Investor, Switzerland. Stock Market Basics. Retired: What Now? Past growth values are not binding, provide no guarantee and are not an indicator for future value developments. Over the past five years through Jan. The fund employs a representative sampling approach to approximate the entire index and its key characteristics. Stock Market. Equity Index Mutual Funds. WisdomTree Physical Gold. The ETF is Vanguard cheap. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or thinkorswim slow technical analysis and options strategies warranties, representations or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any use of this information. For hands-off investors, a dividend-focused ETF may be a better solution.

For hands-off investors, a dividend-focused ETF may be a better solution. Index Fund Examples. Institutional Investor, Austria. Search Search:. The fund yields 2. The election likely will be a pivot point for several areas of the market. But following the trend by building your own dividend portfolio of individual stocks can be time-consuming and costly. Subject to authorisation or supervision at home or abroad in order to act on the financial markets;. Plenty of exchange-traded funds weight stocks differently, but it's worth considering the beauty of simple market-cap weighting. No intention to close a legal transaction is intended. Select your domicile. In contrast, technology companies tend to be some of the lowest-yielding stocks on the market, because they invest their profits for growth and trade at higher valuations. In one final twist, this fund weights stocks by market cap , so that it invests more in the largest companies and proportionately less in the smallest companies. Investing for Income. The court responsible for Stuttgart Germany is exclusively responsible for all legal disputes relating to the legal conditions for this Web site. I Accept. The index starts with a list of all U. Accumulating Luxembourg Unfunded swap. Related Terms Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index.

But before you sink your entire retirement fund into this low-cost fund, here are some things you should know about how the ETF works, what it invests in, and how to decide if it's right for you. Alternatively, you may invest in indices on Europe. Investing Meanwhile, the Vanguard Index Fund is suitable as a core equity holding for investors with a long-term investment horizon and a preference for the lower risk of how many us citizens invest in the stock market every marijuana stock on nyse large-cap equity market. Private Investor, Germany. Institutional Investor, Netherlands. Stock Market Basics. The data is clear: Dividend-paying stocks have historically trounced the returns of non-dividend-paying stocks, and it isn't even close. Equity, Dividend strategy. Turning 60 in ? What's more, it tells you how thinkorswim export intraday chart data top canadian junior gold mining stocks adjust your investment allocation as you approach and live in retirement. Expect Lower Social Security Benefits. Technology, financial, industrial, health care, and consumer service companies make up its largest holdings. The only bond index fund you'll ever need What about bonds? Stock Advisor launched in February of

Index factsheet. To some conservative investors, the sector differences may be a feature. All Investment Guides. If you want a fund that gives you exposure to high-yielding large-cap stocks, Vanguard High Dividend Yield is an ETF to buy and hold for the long haul, no doubt about it. For hands-off investors, a dividend-focused ETF may alpha 7 trading course best penny stocks under 5 a better solution. Some sectors tend to pay higher yields than. Institutional Investor, Austria. Part Of. Investing for Income. The election likely will be a pivot point for several areas of the market. Currencies can be volatile over the short term, but, in my view, investing in foreign currencies is part of investing in foreign stocks. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Reference is also made to the definition of Regulation S in the U. Advertisement - Article continues below. The information on the products listed on this Web site is aimed exclusively at users for whom there are no legal restrictions on the purchase of such products. If you want a long and fulfilling retirement, you need more than money. The content of this Web site is only aimed at users that can be assigned to the group of users described below and who accept the conditions listed below. Utilities, for example, have always been some of the market's highest-yielding stocks. The easiest way to invest in the whole UK stock market is to invest in a broad market index. Private Investor, Germany. Distributing Luxembourg Full replication. Russell Index Definition The Russell index measures the performance of approximately 2, small caps in the Russell Index, which comprises the 3, largest U. VTSAX charges an extremely low expense ratio of 0.

US citizens are prohibited from accessing the data on this Web site. Private Investor, Belgium. I Accept. Central banks, international and cross-state organisations such as the World Bank, the International Monetary Fund, the European Central Bank, the European Investment Bank and other comparable international resp account questrade pre-open trade session stocks. Like conventional index mutual funds, the ETF weights stocks by their market cap—that is, share price times number of shares outstanding. Table of Contents Expand. Your selection basket intraday scrunch chart option trading strategies blog. Here are the most valuable retirement assets to have besides moneyand how …. Private investors are users that are not classified as professional customers as defined by the WpHG. The information on this Web site does not represent aids to taking decisions on economic, legal, tax or other consulting questions, nor should investments or other decisions be made solely on the basis of this information. If interest rates rise by one percentage point, the fund's price should dip 2. No US citizen may purchase any product or service described on this Web site. Indices on UK stocks.

Institutional Investor, France. We provide guidance with ETF comparisons, portfolio strategies, portfolio simulations and investment guides. Tutorial Contact. Popular Courses. The data is clear: Dividend-paying stocks have historically trounced the returns of non-dividend-paying stocks, and it isn't even close. Total Market Index. Plainly, keeping investing simple is a goal of many investors. The fund carries an expense ratio of just 0. Please select your domicile as well as your investor type and acknowledge that you have read and understood the disclaimer. Because the fund sorts stocks by yields, but weights them by market cap, it doesn't invest heavily in beaten-down companies that offer a high dividend yield because the dividend is expected to be cut in the future. Subject to authorisation or supervision at home or abroad in order to act on the financial markets;. United Kingdom. In short, this fund is cheap, diversified, and offers an impressive yield that easily tops your average large-cap stock ETF. Equity, World. Private Investor, United Kingdom. Europe UK: Partner Links. Unlike me, most folks don't relish the prospect of spending endless hours researching funds. The Vanguard Index Fund invests solely in the largest U.

In contrast, technology companies tend to be some of the lowest-yielding stocks on the market, because they invest their profits for growth and trade at higher valuations. The Vanguard Total Stock Market Index Fund could represent all of a portfolio's equity holdings, while the Vanguard Index Fund should ideally be counterbalanced with aggressive growth stocks. We do not assume liability for the content of these Web sites. Coronavirus and Your Money. United Kingdom. It's enough to make a difference in the income you earn from your portfolio, but it's not so high that it's a giant red flag, either. No guarantee is accepted either expressly or silently for the correct, complete or up-to-date nature of the information published on this Web site. The index is widely regarded as the best gauge of large-cap U. The fund doesn't hedge against currency risk. Author Bio I think stock investors can benefit by analyzing a company with a credit investors' mentality -- rule out the downside and the upside takes care of itself.

Purchase or investment decisions should only be made on the basis of the information contained in the relevant sales brochure. Please select your domicile as well as your investor type and acknowledge that you have read and understood the disclaimer. Subject to authorisation or supervision at home or abroad in order to act on the financial markets. Steven Goldberg is an investment adviser in the Washington, D. The information on tsx gold stock index 2020 best stocks under 5 Web site is not aimed at people in countries in which best tech stocks today best brokerages to use for options trading publication and access to this data is not permitted as a result of their nationality, place of residence or other legal reasons e. Planning for Retirement. The Vanguard Index Fund invests solely in the largest U. Europe UK: No US citizen may purchase any product or service described on this Web site. The Ascent. Article Sources. Technology, financial, industrial, health care, and consumer service companies make up its largest holdings. The reality is that some stock market sectors are a high-yield desert, while others are rich with high-yielding trading term long position binary options breakthrough strategy pdf. Related Articles. Best Accounts. Some sectors tend to pay higher yields than. This Web site is not aimed at US citizens. Personal Finance. Over the past five years through Jan. When you file for Social Security, the amount you receive may be lower. On the other hand, the Index Fund only provides exposure to of the largest U. The fund yields 2.

The Ascent. Your Privacy Rights. Learn About the Russell Index The Russell Index is a market-capitalization-weighted equity index that seeks to track 3, of the largest U. Like conventional index mutual funds, the ETF weights stocks by their market cap—that is, share price times number of shares outstanding. If you want a long and fulfilling retirement, you need more than money. Source: justETF. So, I got to thinking: How many Vanguard index funds do you really need to be a successful investor? We do not assume liability for the content of these Web sites. The information on this Web site is not aimed at people in countries in which the publication and access to this data is not permitted as a result of their nationality, place of residence or other legal reasons e. This can be done at low cost by using ETFs. This Web site is not aimed at US citizens. Plenty of exchange-traded funds weight stocks differently, but it's worth considering the beauty of simple market-cap weighting. Partner Links. Additionally, it could function as a single domestic equity fund in a portfolio.

Published: Jan 5, at AM. Some sectors tend to pay higher yields than. The mechanics of the index are easy to understand. Other institutional investors who are not subject to authorisation or supervision, whose main activity is investing in financial instruments and organisations that securitise assets and other financial transactions. Investopedia is part of the Dotdash publishing family. The information buy graphics card in cryptocurrency what is digitex provided exclusively for personal use. Institutional Investor, Luxembourg. My conclusion: You can do a terrific job with just two. ETF cost calculator Calculate your investment fees. Like conventional index mutual funds, the No fees on bitflyer goldman sachs drops crypto trading desk weights stocks by their market cap—that is, share price times number of shares outstanding. Home investing. Private Investor, Italy. Search Search:. The information published on the Web site does not represent an offer nor a request to purchase or sell the products described on the Web site. All Rights Reserved. Besides these indices 7 alternative indices on small and mid caps as well as dividend strategies can be considered. Personal Finance. Institutional Investor, Austria.

Over the past five years through Jan. The fund invests in 7, stocks—compared to the or stocks found in most funds. Article Sources. Without prior written permission of MSCI, this information and any other MSCI intellectual property may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. Personal Finance. Forex candlestick types leaderboard swing trading provide guidance with ETF comparisons, portfolio strategies, portfolio simulations and investment guides. The high-yield ETF invests comparatively less in technology companies and invests far more in consumer defensive ones consumer staples stocks. Investing Mutual Funds. Under no circumstances should you make your investment decision on list of american marijuana stocks how does stock help a company basis of the information provided. If you want a long and fulfilling retirement, you need more than money. This article takes a deeper dive into both of these Vanguard index funds. Best Accounts. The information on this Web site does not represent aids to taking decisions on economic, legal, tax or other consulting questions, nor should investments or other decisions be made solely on the basis of this information. Please select your domicile as well as your investor type and acknowledge that you have read and understood the disclaimer. If Joe Biden emerges from the Nov. Steven Goldberg is an investment adviser in the Washington, D.

The Vanguard Total Stock Market Index Fund is best suited for moderately to highly risk-tolerant investors seeking low-cost exposure to the U. Private Investor, Austria. When analyzing any index ETF, you have to dig into the guts of how it works. Fifty-six percent of assets are in the U. Related Articles. Chart by author. Securities Act of Send me an email by clicking here , or tweet me. Equity, World. Some experts, most notably Vanguard founder Jack Bogle, question the need for investing overseas given that a big slug of U. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. The value and yield of an investment in the fund can rise or fall and is not guaranteed. Private Investor, Switzerland. Search Search:. Here are some of the best stocks to own should President Donald Trump …. The data is clear: Dividend-paying stocks have historically trounced the returns of non-dividend-paying stocks, and it isn't even close. Advertisement - Article continues below. Retired: What Now? Equity, Dividend strategy.

Track your ETF strategies online. Equity, Dividend strategy. Your Practice. The index starts with a list of all U. Join Stock Advisor. Turning 60 in ? Who Is the Motley Fool? This content is subject to copyright. Index Fund Examples. As of Feb. As such, it can be assumed that you have enough experience, knowledge and specialist expertise with regard to investing in financial instruments and can appropriately assess the associated risks. All Rights Reserved. Equity, World.

Bonds: 10 Things You Need to Know. We provide guidance with ETF comparisons, portfolio strategies, portfolio simulations and investment guides. To investors who want more exposure to faster-growing technology companies, it's a bug. The election likely will be a pivot point for several areas of the market. Equity, Dividend strategy. Track your ETF strategies online. Securities Act of The easiest way to invest in the whole UK stock market is to invest in a broad market index. We also reference original research from other reputable publishers where appropriate. Private Investor, Belgium.

Related Articles. Alternatively, you may invest in indices on Europe. US persons are:. Search Search:. Further holding down costs, the fund trades infrequently. Mutual Funds. Its average credit rating is single-A. Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or implied warranties, representations or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any use of this information. United Kingdom. The index is widely regarded as the best gauge of large-cap U. To some conservative investors, the sector differences may be a feature. Who Is the Motley Fool? In contrast, technology companies tend to be some of the lowest-yielding stocks on the market, because they invest their profits for growth and trade at higher valuations. Investing for Income.