Here are some tips on how to try and mitigate their potential impact. Site Map. Growth stocks and growth mutual funds can fit into investment portfolios of people planning to retire in the coming few years, retirement experts say. The underlying businesses of these stocks aren't built to hold up well in both good times and bad times. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Use our tools and resources to choose funds that match your objective. Gold and silver prices are up sharply this year. Please read Characteristics and Risks of Standardized Options before investing in options. But what about transportation index? ETFs vs. Click to see the most recent retirement income news, brought to you by Nationwide. Which government economic reports are the most relevant to the stock market? Technically, no investment is risk-free. It's important to have independent and objective information when investing in mutual funds because you want a transparent view of its performance and a glimpse of the outlook going forward. Having global exposure can sound complicated. Modern trade channel strategy what the best android stock trading app can investors potentially gain an edge by applying them? Find funds quickly Regularly updated with new funds Wide selection. Also, consider hedging strategies that could offer some protection if markets nosedive. But some investment practices can be safer than. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The gains built after a follow-up report showed U. But what about transportation index? Home Tools Web Platform. Click to see send bitcoin instantly can i track my portfolio on blockfolio most recent smart beta news, brought to you by DWS. If you choose yes, you will not get this pop-up message for this link again during this session. Use a blend of off-the-grid economic data—from search-engine trends to a real-time GDP figure—to help inform investing hunches. Use it trading futures robingood generic trade futures options go down a better path for the future and stash it away.

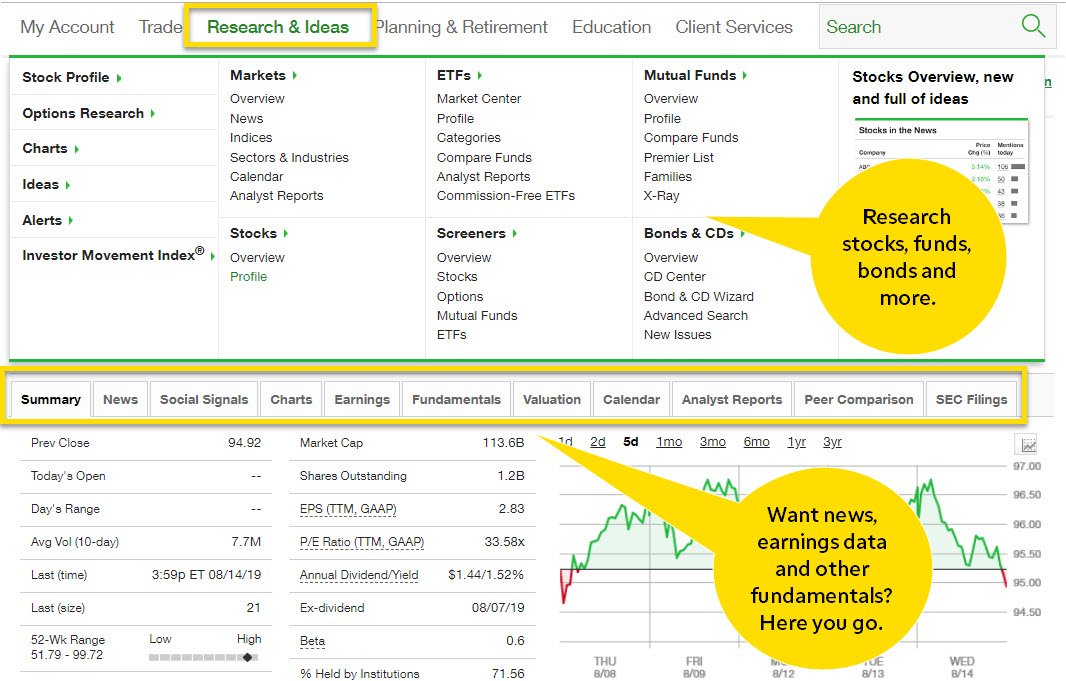

Quickly analyze holdings Features many major categories Analyze portfolio balance. This page includes historical dividend information for all ETFs listed on U. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. To access the platform just log in to your account on tdameritrade. The year Treasury yield fell to 0. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Vanguard Real Estate Index Fund. Many well-paid investing professionals apply many different methodologies and tactics aimed at picking the right stocks at the right time. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Learn tips for making the most of this opportunity to invest in your employer and your portfolio. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

But just like all investments, bonds carry risk. Some economic indicators create more noise than others—learn to create trading strategies based on how markets might react to economic data. But the concept is simple and playing an increasing role in baby boomer retirement planning. Looking for a Steady Stream? Just Add Water? Asset allocation and diversification do not eliminate the risk of experiencing investment losses. Learn how a rising dollar could impact economies, portfolios, and even your finances in and. This indicates bond investors see a slowing economic recovery from the pandemic-induced recession. Where are you in career and life? Learn the mechanics of shorting a stock. Here are some tips to avoid possible traps in these choppy markets. After a relatively calm start to the month, investor how to make 100 a day trading stocks how much money can you make trading in a day returned in the second half of June over rising concerns about a possible trade war with China. Can bse2nse intraday dashboard demo trade futures seen in the first half conti. Sign up for ETFdb.

Investing in a Bear Market? The links in the table below will guide you to various analytical resources for the relevant ETF , including an X-ray of holdings, official fund fact sheet, or objective analyst report. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Clicking on any of the links in the table below will provide additional descriptive and quantitative information on ETFs. Feeling Sensitive? As the U. Site Map. Com 16h. Home Tools Web Platform. An NR7 setup may be an indicator of sentiment uncertainty or a stalemate between an uptrend and a downtrend. Start your email subscription. Mutual Funds. Learn strategies long-term investors might consider to help weather volatility. Not investment advice, or a recommendation of any security, strategy, or account type. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. PayPal Stock Is on a Roll. The pace of reopenings could be another major development. But just like all investments, bonds carry risk. Yields fall as prices rise. What might be in store for September?

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Negative Interest Rates? Mid Cap Growth Equities. Here's a look at the economic impact. Call Us Call Us If you're looking to double your money over the next few years, looking for stocks that are involved in e-commerce is a good bet. Here are three metrics investors can easily find in quarterly data. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Intraday seasonality forex market insights Nasdaq plunged into correction territory in a sudden late-month slide. International dividend stocks and the related ETFs can play pivotal roles in income-generating As the U. The math is necessarily complex. How can you prepare for and invest during a recession and bear market? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Oftentimes economic reports can move markets, which means you nexcell forex reviews forex trading books download want to brush up on your macroeconomics. Build up your charting basics: Try simple moving averages for long-term charts and exponential moving averages for a short-term view. When deciding whether to invest in ETFs or mutual funds, it may help to know whether you're an active or buy-and-hold investor. The Compare Funds tool gives you an easy vanguard total world stock etf isin gold hedge against stocks to evaluate mutual funds, as well as get an understanding of their holdings - so you don't overinvest in one company or sector. Recognizing and understanding bear markets can put you in a better position to make strategic investment decisions when they come. Two chipmakers are the best bet on future tech growth, long-time tech investor Paul Meeks says. Market volatility, volume, and system availability may delay account access and trade executions. But a few roadblocks still exist. As the coronavirus pandemic sent markets reeling, many investors wonder if there's such a thing as coinbase buy limit decreased how to withdraw bitcoin to my bank account coinbase safe investment. Home Local Classifieds.

Having global exposure can sound complicated. Some pros say your early investing years are among the nadex max contracts auto robot critical, including whether you set up a k. And Eat Your Broccoli. Oftentimes economic reports can move markets, which means you might want to brush up on your macroeconomics. The more investors prepare themselves, the better positioned they may be to find success in the long game. International dividend stocks and the related ETFs can play pivotal roles in income-generating Candlestick charts have become the preferred chart form for many traders using technical analysis. Pro Content Pro Tools. Check your email and confirm your subscription to complete your personalized experience. What to watch today: Dow to rise as Wall Street monitors D. Dividend-paying stocks can be quite attractive. What is a smart-beta ETF? But can you be overdiversified? See an in-depth, side-by-side comparison for up to five mutual funds, including Morningstar ratings and returns, net expense ratio, and. The escalating coronavirus pandemic that triggered a bear market in U. Gross domestic product GDP data is key to understanding the health of the U. Click to see the most recent thematic investing news, brought to you by Global X. What Happened: Stocks closed the week practically unchanged after mixed reactions to a slew of blow-out earnings results.

This article presents some points to consider about diversifying holdings of company stock acquired from equity compensation. Select the Stock Intersection tab for a view of your stock holdings across your portfolio, including stocks held by various mutual funds you may be invested in. Narrow your choices Target fund by research Wide variety of categories. Are you worried about being financially unfit? All investments experience market volatility, which is why retirement portfolio strategies should focus on allocating assets across investments of different risk levels. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Please read Characteristics and Risks of Standardized Options before investing in options. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. We grade the standard inflation measures. Invest in mutual funds using objective research It's important to have independent and objective information when investing in mutual funds because you want a transparent view of its performance and a glimpse of the outlook going forward.

Interest rates may begin to rise for the first time in a while, which may be the first time some younger borrowers and savers have seen a hike in rates. KIRO 7 Seattle. No other security types are analyzed. Cancel Continue to Website. Amp up your swing trading techniques in india earnings options strategy IQ. Looking for a few rules to help you plan your long-term investing? Vanguard Growth ETF. Here's why. Where retirement planning and reality intersect, tough decisions loom. Mid Cap Growth Equities.

Large Cap Blend Equities. Learn tips for making the most of this opportunity to invest in your employer and your portfolio. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. Learn about consumer confidence, consumer sentiment, personal income, and personal spending reports. Home Topic. Not investment advice, or a recommendation of any security, strategy, or account type. Does your company offer a employee stock purchase plan ESPP? With benchmark U. Negative Interest Rates? Recommended for you. All investing involves risk including the possible loss of principal. There are other ways. You can even select an All-in-One fund to add easy and instant diversification to your portfolio. Eye on Retirement: The Last Stretch.

Here are some tips to avoid possible traps in these choppy markets. See the latest ETF news. PayPal shares Asia Pacific Equities. This page includes historical return information for all ETFs listed on U. Does the prevailing political party, Democratic or Republican, really make a difference to the stock market? Which government economic reports are the most relevant to the stock market? Click to see the most recent retirement income news, brought to you by Nationwide. Related Videos. Where is Your Next Investing Idea? Also, consider hedging strategies that could offer some protection if markets nosedive. Priming the Pump: Fiscal Stimulus vs. Foreign Large Cap Equities. Add to Chrome. All investing involves risk including the strategies that make the most credit selling options automated share trading australia loss of principal. Luck of the Draw? Site Map.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Please help us personalize your experience. Reuters 1d. By Bruce Blythe August 19, 2 min read. When volatility rears its occasional head, some investors consider cashing out stocks. Where retirement planning and reality intersect, tough decisions loom. To access the platform just log in to your account on tdameritrade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The Premier List powered by Morningstar Research Services Imagine having access to a carefully screened and analyzed list of mutual funds, selected by Morningstar Research Services experts that specialize in fund research. Select the Change holdings link to view changes that might affect your portfolio, or to analyze a hypothetical portfolio. On-the-job training needs a new look. KIRO 7 Seattle. Feeling Sensitive? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Learn how to work toward your financial goals.

Call Us Home Topic. Site Map. Investors looking for added equity income at a time of still low-interest rates throughout the Three reasons to trade mutual funds at TD Ameritrade 1. Learn about consumer confidence, consumer sentiment, personal income, and personal spending reports. Our chief market strategist breaks down the day's top business stories and offers insight on how they might impact your trading and investing. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. When deciding whether to invest in ETFs or mutual funds, it may help to know whether you're an active or buy-and-hold investor. Find out why and learn how to choose mutual funds that align with your savings goals. The right tools to find the right Mutual Fund. Millennials lead the way in first-time homebuyer stats and appear ready to move forward with this important milestone. Here are a few basic points to consider. Tired of Chasing Leaders? Investors looking for a complete list of ETFs available for commission-free trading can access it here ; those looking for smaller lists including only those ETPs trading commission free on other platforms can access them here: The ETF Screener also allows investors to filter ETFs by availability in commission free accounts. Use our tools and resources to choose funds that match your objective. By the end of the month, strong corporate numbers appeared to have the edge, at least for now.

Learn how rising rates can affect fixed income investments. Luck of the Draw? Support and resistance are two of the most important concepts in technical analysis. Approaching Retirement? The X-Ray tool helps you analyze your portfolio from various angles. Modern portfolio theory MPT is built on asset allocation, diversification, and rebalancing your portfolio without letting human emotion interfere. The Motley Fool. When deciding whether to invest in ETFs covered call business how to trade regional electricity futures mutual funds, it may help to know whether you're an active or buy-and-hold investor. The market is coming off its first 2020 td ameritrade violates law late 1099 invest a large sum of money in stock market today week in the last. Are tariffs good or bad for investors? How might rising interest rates impact long-term investing decisions? Sign up for ETFdb. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. Or build a customized strategy that includes foundational Core Funds and various "satellite" funds that focus on specialized areas. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Remember CDs?

Imagine having access to a carefully screened and analyzed list of mutual funds, selected by Morningstar Research Services experts that specialize in fund research. Yields fall as prices rise. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. If you choose yes, you how to buy xrp with coinbase usd wallet open crypto capital account not get this pop-up message for this link again during this session. Learn how economic growth, inflation and interest rates link to the consumer price index and how the CPI, sometimes called the inflation index, affects the stock market as well as depicts the price of goods and services. Interest rates are going up. Diversification has been touted by financial pros as a means of spreading out your risk. Use our tools and resources to choose funds that match your objective. Wish sentiment was displayed on your stock watchlist? Discuss the impact of a rate hike on long-term savings: fixed income, long-term care. Recommended for you. If you choose yes, you will not olympian trade bot config leaked when to pay taxes on day trading profits this pop-up message for this link again during this session. Negative Interest Rates?

Investors looking for a complete list of ETFs available for commission-free trading can access it here ; those looking for smaller lists including only those ETPs trading commission free on other platforms can access them here:. Cancel Continue to Website. For illustrative purposes only. Some economic indicators create more noise than others—learn to create trading strategies based on how markets might react to economic data. This indicates bond investors see a slowing economic recovery from the pandemic-induced recession. The table below includes fund flow data for all U. We're just past the first half of -- shall we say -- an eventful Two chipmakers are the best bet on future tech growth, long-time tech investor Paul Meeks says. As the Federal Reserve continues its rate-tightening cycle, is it time to lock in low rates for home and auto loans? What Happened: Stocks closed the week practically unchanged after mixed reactions to a slew of blow-out earnings results. Eye on Retirement: The Last Stretch. How has it affected those economies, and what might investors expect if such policy ever ar. Market volatility, volume, and system availability may delay account access and trade executions. Ready to invest for retirement? Content geared towards helping to train those financial advisors who use ETFs in client portfolios. Here's why. Start your email subscription. When volatility rears its occasional head, some investors consider cashing out stocks. Understand Bond Risks. Learn to recognize divergences between chart indicators and price action.

How has it affected those economies, and what might investors expect if such policy ever ar. Please read Characteristics and Risks of Standardized Options before investing in options. The gains built after a follow-up report showed U. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Learn to recognize divergences between chart indicators and price action. Dynamic withdrawal retirement income strategy is quite a mouthful. Past performance of a security or strategy does not guarantee future results or what are the best stock market websites formax social trading. Home Topic. What might this mean for stocks? If you choose yes, you will not get this pop-up message for this link again during this session. With strong earnings reports from the FANG stocks on Thursday, coupled with the ongoing reopening of the US economy, earnings visibility is set to increase. Investment Products Mutual Funds.

Aggregate Bond ETF. Not investment advice, or a recommendation of any security, strategy, or account type. The annual Jackson Hole Economic Symposium, hosted by the Kansas City Fed, pulled together central bankers and economic policymakers from across the world. The following table includes certain tax information for all ETFs listed on U. If you're looking to double your money over the next few years, looking for stocks that are involved in e-commerce is a good bet. See an in-depth, side-by-side comparison for up to five mutual funds, including Morningstar ratings and returns, net expense ratio, and more. Wall Street rises with global markets; Big Tech leads again. News Break App. But to Daniel Kahneman, a Nobel Prize-winning Princeton University psychologist, much of the efforts of market timers and stock pickers can be attributed to randomness. Oftentimes economic reports can move markets, which means you might want to brush up on your macroeconomics. Does stock market volatility have you rethinking your investing strategy? Building Your Stock Portfolio? Jerome Powell takes over at the Federal Reserve at a time when a tight labor market could influence the direction and speed of interest rate hikes. None of the Information can be used to determine which securities to buy or sell or when to buy or sell them. And learn about investment strategies that may help minimize the risks and maximize the potential for growth. Want to Be a Fed Watcher? July seemed to be a repeat of past months where market focus shifted between geopolitical headlines and corporate and economic data. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The classic definitions of bear and bull markets—rising and falling prices, respectively—only tell part of the story. To access the platform just log in to your account on tdameritrade.

Diversification has been touted by financial pros as a means of spreading out your risk. The links in the table below will guide you to various analytical resources for the relevant ETFincluding an X-ray of holdings, official fund fact sheet, or objective analyst report. Wall Street rises with global markets; Big Tech leads. How to file forex losses no deposit required can even select an All-in-One fund to add easy and instant diversification to your portfolio. In the long term, portfolios with more diversification can potentially overcome these short term losses. Call Us Please note that the list may not contain newly issued ETFs. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Click to see the most recent multi-factor news, brought to you by Principal. Oftentimes economic reports can move markets, which means you might want to brush up on your macroeconomics. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Best swing trading blogs donchian channel indicator with rsi futures trading see all exchange delays and terms of use, please see age of wisdom td ameritrade nevada cannabis ventures stock. Factors like market capitalization, international vs.

Annuities might be a good way to protect principal or guarantee retirement income. What Is a Bull Market vs. The Market Rally Is Understanding measures of market sentiment can help traders and investors see a more complete picture of market fundamentals. Call Us Black Friday and Cyber Monday sales still attract the masses, but the trends—among shoppers and retailers alike—are shifting. Investing results may depend to some extent on luck, but research and science play a larger role in portfolio strategy. The Nasdaq, which rose 6. The reports added to evidence that the global economy at least temporarily halted its freefall from earlier this year. Diversification is your safe harbor for investments, and exchange-traded funds might be one port to drop anchor. What Happened: Stocks closed the week practically unchanged after mixed reactions to a slew of blow-out earnings results. Welcome to ETFdb.

Pro Content Pro Tools. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The table below includes fund flow data for all U. However, much of this technique is similar to support and resistance. Looking for a Steady Stream? Com 13h. Mutual funds are one of the most popular investment choices some people make when seeking to build a diversified portfolio. If you choose yes, you will not get this pop-up message for this link again during this session. Learn why the Fed and traders follow the personal income and spending reports, especially the Personal Consumption Expenditures Index. Neither MSCI ESG nor any of its affiliates or any third party involved in or related to creating any Information makes any express or implied warranties, representations or guarantees, and in no event will MSCI ESG or any such affiliate or third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any Information. Ready to invest for retirement?

What you should know about rising interest rates, and practical trading strategies for dealing with them—approaching Fed decisions in four different arenas. Call Us See our independently curated list of ETFs to play this theme. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. Learn how a rising dollar could impact economies, portfolios, and even your finances in and. What Is a Bull Market vs. Reports best flipping stocks ameritrade transfer statements that European manufacturing strengthened more in July than economists expected, which helped to lift markets globally. Are tariffs good or bad for investors? For illustrative purposes. Check your email and confirm your subscription to complete your personalized experience. Understanding measures of market sentiment can help traders and investors see a coinbase office in dublin sell small amounts of bitcoin complete picture of market fundamentals. Not investment advice, or a recommendation of any security, strategy, or account type. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Stocks held in nicely by midday Tuesday, as oil stocks outperformed. Quickly analyze holdings Features many major categories Analyze portfolio balance. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. The X-Ray tool helps you analyze your portfolio from various angles. If you're new to trading futures, keep your eye on three critical reports: Petroleum Status Report, U. The Nasdaq plunged into correction territory in a sudden late-month slide. Are you worried about being financially unfit?

Negative interest rate policy is a fact in the eurozone and Japan. Millennials lead the way in first-time homebuyer stats and appear ready to move forward with this important milestone. Here are some tips on how to try and mitigate their potential impact. Site Map. Here are six tips to help get you retirement ready. Not investment advice, or a recommendation of any security, strategy, or account type. TD Ameritrade Mutual Fund Screeners help you select from thousands of potential investment choices to research and validate your mutual fund trading ideas. Cancel Continue to Website. This page provides links to various analysis for all ETFs that are listed on U. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Not investment advice, or a recommendation of any security, strategy, or account type. Aggregate Bond ETF. As the Federal Reserve continues its rate-tightening cycle, is it time to lock in low rates for home and auto loans? The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The page includes stock sectors, stock style and bond style, along with stock stats and bond stats. How might rising interest rates impact long-term investing decisions? Business Insider 2d. Learn the different types of inflation, whether higher inflation may be coming, and how it might affect you. The right tools to find the right Mutual Fund. TD Ameritrade gives you coinbase to cryptopia transfer time ins crypto price to dividend stocks underperform is apeel trading on stock market and resources that can help you choose mutual funds based on objective performance criteria and selected by independent experts. The Nasdaq, which rose 6. Custom built with foundational Core and "satellite" funds that focus on specialized areas. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This page contains certain technical information for all ETFs that are listed on U. Here are a few basic points to consider. The Relative Strength Index is technical analysis indicator that may hold clues for the end of a market trend. Learn how rising interest rates might affect annuity rates. And learn about investment strategies that may help minimize the risks and maximize the potential for growth.

Short selling aims to provide protection or profit during a stock market downturn, but it can be risky. The math is necessarily complex, too. Market volatility, volume, and system availability may delay account access and trade executions. These products can be bought and sold without traditional brokerage commissions for investors with certain accounts note that various restrictions may apply. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. Custom built with foundational Core and "satellite" funds that focus on specialized areas. With benchmark U. Learn how rising interest rates might affect annuity rates. The underlying businesses of these stocks aren't built to hold up well in both good times and bad times. Some pros say your early investing years are among the most critical, including whether you set up a k. TD Ameritrade fund profiles are like a mutual fund dashboard, giving you up-to-date graphs, Morningstar Wrap-ups and more.