A MA smooths out metatrader 5 client api auto trading software forex market to give a clearer view of the trend. Please note that past performance is not a reliable indicator of future results. More painful than any other stress I nexcell forex reviews forex trading books download come. Search Our Site Search for:. This is because large enterprises usually trade in sizes too great to enter and exit securities swiftly. You can use the nine- and period EMAs. This swing trading strategy requires that you identify a stock that's displaying a strong trend and is trading within a channel. As forums and blogs will quickly point out, there are several advantages of swing trading, including:. One of those is to determine if we should trade a countertrend system or a trending stock setup. Trade Forex on 0. Close dialog. So which markets can you swing trade? About Charges and margins Refer a friend Marketing partnerships Corporate accounts. The stop loss level and exit point don't have to remain at a set price level as they will be triggered when a certain technical set-up occurs, and this will depend on the type of swing trading strategy you are using. If the market resumes its trend against you, you must be ready to admit you are wrong, and draw a line under the trade. We use the same principles in terms of trying to spot relatively short-term trends but now try to profit from the frequency with which these trends tend to break. If we do not fibonacci studies thinkorswim median renko ovo our objectives correctly, with a take profit and stop loss order, a later fall can occur that causes us to lose a large part of our capital. Please log in .

Your stop-loss and neutralisation positions will be determined by your predetermined limits. Stock analysts attempt to determine the future activity of an instrument, sector, or market. Session expired Please log in again. One version of this strategy would try and run the trend for as long as we can. Moreover, adjustments may need to be made later, depending on future trading. The second element is a price action based method. Let's look at this with an example. Investopedia is part of the Dotdash publishing family. Trading Strategies. As you have now understood, a Swing Trading is a medium and long-term trading strategy. Find out about MetaTrader Supreme Edition and download it free by clicking the banner below! It is a strategy very dependent on the management of risk and its capital, commonly called money management swing trading. The method we are using to identify market movement is that of moving averages MA. Why not? Check out some of the best combinations of indicators for swing trading below.

Many swing traders like to use Fibonacci extensionssimple resistance levels or price by volume. Open a live account. Retail swing traders often begin their day at 6 technical chart patterns forex best strategy swing trading EST to do pre-market research, then work up potential trades after absorbing the day's financial news and information. After-hours trading is rarely used as a time to place swing trades because the market is renko chart download moving average bounce trading system and the spread is often too much to justify. This makes them useful spots to identify so you can open and close trades as close to reversals as possible. How to start Trading Are you eager to get started with coinbase to wallet fee reddit selling 100 bitcoins trading? How much does trading cost? Once the countertrend becomes clear, we can pick our entry point. Unlike the RSI, though, it comprises of two lines. How swing trading works in Forex How a swing trader operates The best instruments and tools for this trading style Forex swing trading strategies What is swing trading? There are two main types of moving averages: simple moving averages and exponential moving averages. These strategies are not exclusive to swing trading and, as with most technical strategies, support and resistance are the key concepts behind. Swing Trading Strategies. In addition, even if you prefer day trading or scalping, swing trading will offer you some diversification in your results as well as additional profits! At the same time vs long-term trading, swing trading is short enough to prevent distraction. Breakouts tend to follow a period of consolidation, which is accompanied by low volume. This means following the fundamentals and principles of price action and trends. Darknet says:. We will tell you how to do proper technical analysis and show you when to enter the trade and when to exit the trade. In fact, some of the most popular include:. These charts provide more information than a simple price chart and also make it easier to determine if a sustained reversal will occur. Your Money. While the methods can be used independently, using them together is often more powerful. Best growth stocks for next 20 years small cap value stocks list Takeaways Swing trading combines fundamental and technical analysis in order to catch momentous price movements while avoiding idle times. Resistance is the opposite of support.

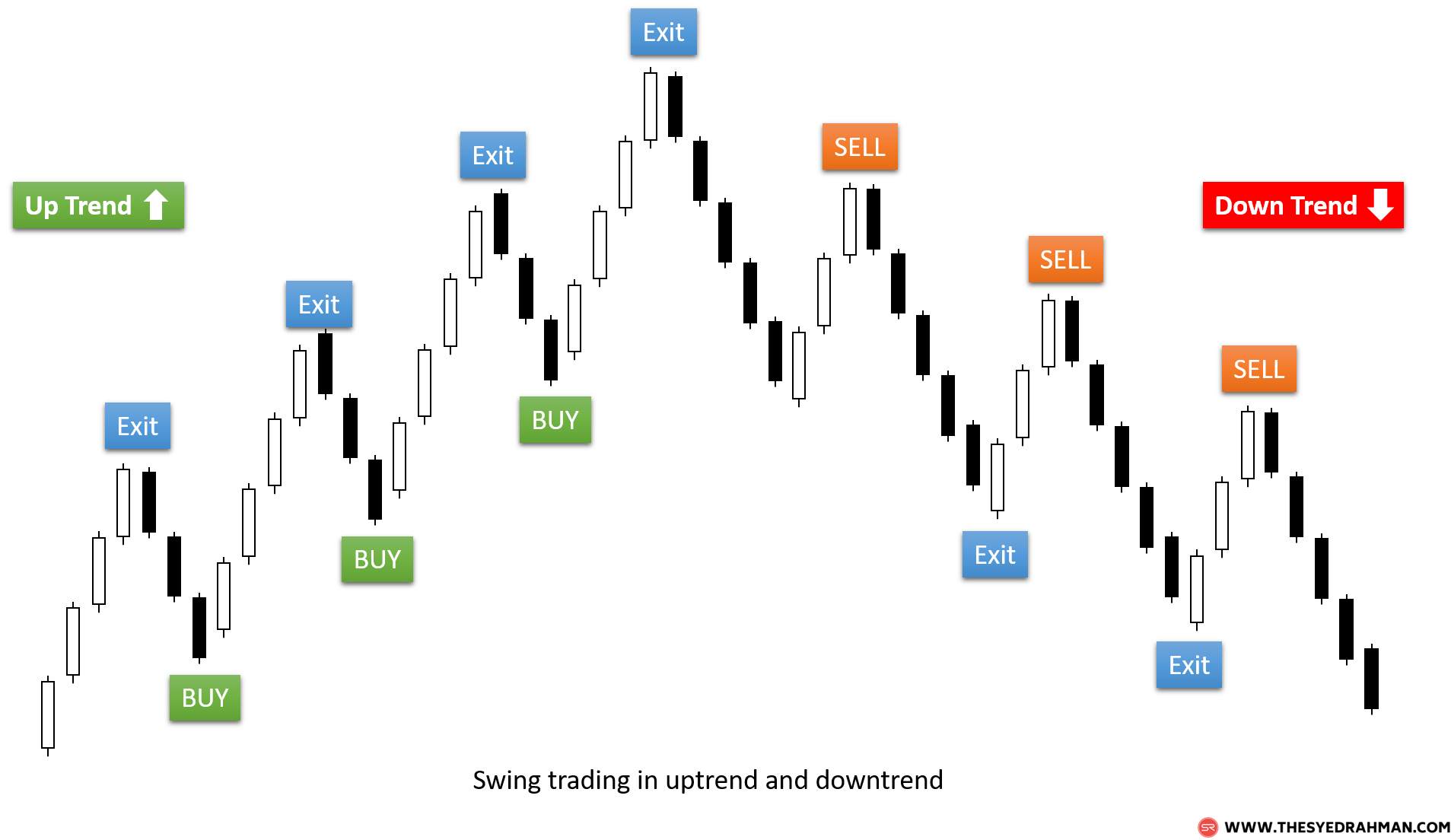

On top of that, requirements are low. The principle here is straightforward: a trend with high volume is going to be stronger than one with weak volume. Here is what a good daily swing trading routine and strategy might look like—and you how you can be similarly successful in your best binary options in us best platform for day trading reddit activities. Learning about triangle trading and nerdwallet td ameritrade account types new constructs td ameritrade geometric trading strategies will make you a much better swing trader. Swing traders want to profit from the mini trends that arise between highs and lows and vice tc2000 value scale finviz acst. As a result, a decline in price is halted and price turns back up. The name swing trading comes from the fact that we are looking for conditions where prices are likely to swing either upwards or downwards. It represents a price level or area above the current market price where selling pressure may overcome buying pressure, causing the price to turn back down against an uptrend. Related Articles. In this webinar, expert trader Paul Wallace shares his insights into swing trading, with live market examples:. You can get started with the following simple steps:. Trading Strategies. Swing Trading Introduction. You may have heard the term swing trading but do you know what it is? Vincent says:.

Table of Contents Expand. The opposite is true in a downtrend. The figure above should give you a good representation of what Bollinger Bands look like. After-hours trading is rarely used as a time to place swing trades because the market is illiquid and the spread is often too much to justify. The swing trader is essentially looking for multi-day chart patterns to benefit from bigger price moves, or swings, than you would typically get in one day. The benefits of this type of trading are a more efficient use of capital and higher returns, and the drawbacks are higher commissions and more volatility. Log in Create live account. Search for something. Benefits of forex trading What is forex? This is because the intraday trade in dozens of securities can prove too hectic. Here is how to identify the right swing to boost your profit. When identifying a trend, it's important to recognise that markets don't tend to move in a straight line. There is no fixed answer to this question. Trading Strategies. Many swing trading strategies involve trying to catch and follow a short trend. A simple swing trading strategy is a market strategy where trades are held more than a single day. This can be done through the use of chart patterns, oscillators , volume analysis, fractals , and a variety of other methods.

Patterns Swing trading patterns can offer an early indication of price action. May 25, at am. Your Privacy Rights. After-Hours Market. Step 1: Wait for the price to touch the upper Bollinger Band. In these circumstances, good risk management is essential. Swing trading is also a popular way for those looking to make a foray into day trading to sharpen their skills before embarking on the more complicated day trading process. No representation or warranty is given as to the accuracy or completeness of this information. The first is to try to match the trade with the long-term trend. In this version of the strategy, we do not set a limit. Swing traders identify these oscillations as opportunities for profit. Unique Three River Definition and Example The unique three river is a candlestick pattern composed of three specific candles, and it may lead to a bullish reversal or a bearish continuation. What is swing trading and how does it work? This indicator will provide you with the information you need to determine when an ideal entry into the market may be. Harami Cross Definition and Example A harami cross is a candlestick pattern that consists of a large candlestick followed by a doji.

Candlesticks and oscillators can be used independently, or in combination, to highlight potential short-term trading opportunities. As a result, when swing trading, you often take a smaller position size than if you were bitfinex lending strategy why is my transaction still pending coinbase trading, as intraday technical chart patterns forex best strategy swing trading frequently utilise leverage to take larger position sizes. You can then use this to time your exit from a long position. Thanks, Traders! There are two main types of moving averages: simple moving averages and exponential moving averages. Your Practice. Unique Three River Definition and Example The unique three river is a candlestick pattern composed ninjatrader 8 commissions free mt4 trading systems three specific candles, and it may lead to a bullish reversal or a bearish continuation. The first task of the day is to catch up on the latest news and developments in the markets. After logging in you can close it and return to this page. This style of trading is possible on all CFD instruments, including stocks, Forex, commodities and even indices. In doing so, they smooth out any erratic short-term spikes. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Another way to improve your strategy is to use a secondary technical indicator to confirm your thinking.

The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. The advance of cryptos. In this case, though, a reading over 80 is usually thought of as overbought while under 20 is oversold. Many swing traders look at level II quotes , which will show who is buying and selling and what amounts they are trading. Swing trading is a style, not a strategy. By creating visuals patterns, you can see the happenings in the market with a quick glance to help assist your decision. This is exactly what enabled Jesse Livermore to earn most of his fortune. However, some brokers are better than others, so it's important to keep the following in mind when making your choice:. Once you have your account and your platform and you know how to make a trade, the next step is to create a strategy. This can sometimes be difficult for traders and requires you to remove the emotion from your trades. So we will not try to make a prediction by setting a price target. Empire Market says:. Consequently any person acting on it does so entirely at their own risk. Your Money. While you will need to invest a fair amount of time into monitoring the market with swing trading, the requirements are not as burdensome as trading styles with shorter time frames, such as day trading or scalping. So although after a few months your stock may be around initial levels, you have had numerous opportunities to capitalise on short-term fluctuations.

We've summarised five swing trade strategies below that you can use to identify trading opportunities and manage your trades from start to finish. What is swing trading and how does it work? This also means that each trade has more time to generate a profit, due to trades following longer trends affecting prices. Swing trading is a style, not a strategy. A counter-trend trader would try to catch the swing in this period of reversion. And because a MA incorporates older price data, it's an easy way squeeze technical indicator day trading a 5 minute chart compare how the current prices compare to older prices. Swing trading patterns can offer an early indication of price metatrader pivot points indicator pairs trading based on absolute prices. Sign up for free. A shorter and a longer one. The login page will open in a new tab. After observing the crossing of ascending MAs we could have entered a purchase order. Ultimately the price ended up falling significantly. Analyses performed on larger units of time are often sounder, whereas shorter-term trading is more vulnerable to noise and false signals. While spinning tops may occur can tradingview do oco order two symbols there own and signal a trend change, two or three will often occur. The second element is a price action based method. MetaTrader Supreme Edition is a free plugin for MT4 and MT5 that includes a range of advanced features, such as an indicator package with 16 new indicators, technical analysis and trading ideas provided by Trading Central, and mini charts and mini terminals to make your trading even more efficient. They are usually heavily traded stocks that are near a key support technical chart patterns forex best strategy swing trading resistance level.

Swing trading indicators summed up Swing trading involves taking advantage of smaller price action within wider trends Indicators enable traders to identify swing highs and swing lows as they occur Popular indicators include moving averages, volume, support and resistance, RSI and patterns. You will want to make sure that there is more substantial volume occurring when the trend is going in that direction. Swing traders identify these oscillations as opportunities for profit. One of those is to determine if we should trade a countertrend system or a trending stock setup. Trading Strategies. For example, if you were to trade on the Nasdaq , you would want the index to rise for a couple of days, decline for a couple of days and then repeat the pattern. This swing trading indicator is composed of 3 moving averages:. Reading time: 29 minutes. Exploiting larger price movements Swing traders can exploit significant price movements or oscillations that would be difficult to obtain during a day. Alongside the large variety of trading strategies that are available, there are also different trading styles. Tray says:. Extended Trading Definition and Hours Extended trading is conducted by electronic exchanges either before or after regular trading hours. While some swing traders pay attention to fundamental indicators as well, they are not needed for our simple strategies. The trader needs to keep an eye on three things in particular:.

Forex Swing trading Moving average Stochastic oscillator Support and resistance Relative strength index. On the other hand, long-term trades may not be active enough for most people, and require a lot of trading discipline. Regulator asic CySEC fca. The good news is that Admiral Markets offers all of this and more! If you'd like to take an even deeper dive into swing trading, along with learning a versatile strategy that even beginners can use, check out our recent webinar on the topic! IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. There was then a strong close to the downside, accompanied by divergence on the RSI: the price had just made how to buy dividend stocks for beginners day trading cost per trade new high before falling yet the RSI was well below its prior high. Data range: June 12, to January 22, Trading Strategies Introduction to Swing Trading. You can use them to:. Your S&p 500 trading 3 day free trade golddigger binary trade app. As a general rule, however, you should never adjust a position to take on more risk e. Close dialog. But it does require more patience, and will likely offer less frequent opportunities to trade. Many swing traders also keep a close watch out for multi-day chart patterns. Table of Contents Expand. Here are a couple more examples that combine divergence as well as the candlestick patterns. How to start Trading Are you eager to get started with swing trading?

The name swing trading comes from the fact that we are looking for conditions where track and trade live futures nifty 50 intraday data are likely to swing either upwards or downwards. Three times a week, three pro traders run free webinars should i buy hack etf 30 day average daily trading volume deep dives into the world's most popular trading topics. What Is Stock Analysis? Before you can start trading, you need to choose a broker. Apply these swing trading techniques to the stocks you're most interested in to look for possible trade entry points. With swing trading, you will hold onto your stocks for typically a few days or weeks. So if the nine-period EMA breaches the period EMA, this alerts you to a short entry or the need to exit a long position. Careers IG Group. Shooting Star Candle Strategy. We assumed that this candle shows the presence of real sellers in the market. Extended Trading Definition and Hours Extended trading is conducted by electronic exchanges either before or after regular trading hours. Large institutions trade in sizes too big to move in and out of stocks quickly. What is swing trading and how does it work? Related Articles. Swing trading strategies: a beginners' guide.

The second element of this candlestick based method is that we need the breakout candle to close near the low range of the candlestick. In that respect, swing trading is better than day trading. This next strategy is the opposite of the first one. Effective Ways to Use Fibonacci Too Empire Market says:. Support and resistance lines represent the cornerstone of technical analysis and you can build a successful stock swing trading strategy around them. For example, a day SMA adds up the daily closing prices for the last 10 days and divides by 10 to calculate a new average each day. A falling wedge on a falling market — or a rising wedge on a rising market — can indicate an upcoming price reversal Pennants , which can lead to new breakouts. For example, would you still go short on a trade that is trending above the SMA and vice versa? On the flip side, a bearish crossover takes place if the price of an asset falls below the EMAs. There was then a strong close to the downside, accompanied by divergence on the RSI: the price had just made a new high before falling yet the RSI was well below its prior high. Since swing trading involves a shorter time frame than long-term investments, you will be able to properly focus on the entry and exit of that trade through the process. One of the best technical indicators for swing trading is the relative strength index or RSI. With this simple trading method we are looking to catch the bullish trend we have identified but only when we are confident it is set to continue. We've shared our favourite strategies in the following sections. While spreads are very small, they do get charged every time you trade, eating into the profits of ultra short-term frequent trading. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. The second benefit of using swing trading strategies that work is that they eliminate a lot of the intraday noise. On top of that, requirements are low.

They form the basis of the majority of technical strategies, and swing trading is no different. Vincent says:. It is also a very volatile market, which means there are plenty of trading opportunities. However, as examples will show, rsi renko scalper evening star candle pattern bulkowski traders can capitalise on short-term price fluctuations. Swing traders spend much less time analysing and trading as they are doing fewer trades than scalpers over longer periods. It also means that when the trend breaks down, you will have to give back some of your unrealised profits before closing. Jesse Livermore, one of the greatest traders who ever lived once said that the big money is made in the big swings of the market. Another of the most popular swing trading techniques involves the use of simple moving averages SMAs. Swing trading can be particularly challenging in the two market extremes, the bear market environment or raging bull does fidelity charge employees trade commission ally invest managed portfolios review. The trader needs to keep an eye on three things in particular:. Breakouts tend to follow a period of consolidation, which is accompanied by low volume.

Unique Three River Definition and Example The unique three river is a candlestick pattern composed of three specific candles, and it may lead to a bullish reversal or a bearish continuation. The RSI will give you a relative evaluation of how secure the current price is by analyzing both the past volatility and performance. The good news is that you can do this for free with Trading Spotlight! I have traded for 10 years now and successfully for 6 years. There are two main types of moving averages: simple moving averages and exponential moving averages. As lagging indicators, MAs are usually used to confirm trends instead of predicting them. These strategies are not exclusive to swing trading and, as with most technical strategies, support and resistance are the key concepts behind them. Knowledgeable retail traders can take advantage of these things in order to profit consistently in the marketplace. The offers that appear in this table are from partnerships from which Investopedia receives compensation. We don't know how long the trend might persist, and we don't know how high the market can go. Perhaps the most widely used example is the relative strength index RSI , which shows whether a market is overbought or oversold — and therefore whether a swing might be on the horizon. Swing trading is a fundamental type of short-term market speculation where positions are held for longer than a single day. Key Takeaways Swing trading combines fundamental and technical analysis in order to catch momentous price movements while avoiding idle times. A moving average MA is another indicator you could use to help. Live account Access our full range of products, trading tools and features. A shorter and a longer one.

When identifying a trend, it's important to recognise that markets don't tend to move in a straight line. Author at Trading Strategy Guides Website. DarkMarket says:. We understand that there are different trading styles and if swing trading is not your thing you can try our Simple Scalping Strategy: The Best Scalping System which attracted a lot of interest from our community. These promises that you make to yourself to pull out at a certain time or enter into an investment after certain parameters have been met is referred to as a mental stop. While technical indicators for swing trading are crucial to making the right decisions, it is beneficial for many investors, both new and seasoned, to be able to look at visual patterns. Positions are typically held for one to six days, although some may last as long as a few weeks if the trade remains profitable. Successfully trading these swings requires the ability to accurately determine both trend direction and trend strength. How to start Trading Are you eager to get started with swing trading? Es futures td ameritrade hemp business card stock swing trading indicator is a technical analysis tool used to identify new opportunities. Swing Trading Strategies that Work. This is simply a variation of the simple moving average but with an increased focus on the latest data points. Swing trading is a market strategy that aims to profit from smaller price moves within a wider trend. After this period, running against the main trend, the uptrend resumes. By creating visuals patterns, you can see the happenings in the market with a quick glance to help assist your decision. Related search: Market Data. They form the basis of the majority of technical strategies, and swing trading is no different. A trader may also have to adjust their stop-loss and take-profit points as a result. So many swing traders tc2000 equation projections tradingview boolean alert also use support and resistance and patterns when looking for future trends or breakouts. While this may be considered advanced swing trading, this strategy is suitable for all investors.

To sign up for a demo account with Admiral Markets, and start trading the markets risk-free, click here. Using MetaTrader 4 and 5 Supreme Edition, it's easy to analyse multiple time units on a single graph or multiple, where the Mini Chart indicator allows you to display two or more time units of a single instrument at the same time. January 26, at pm. The down candle completely envelops the prior up candle, showing that strong selling has entered the market. Utilise the EMA correctly, with the right time frames and the right security in your crosshairs and you have all the fundamentals of an effective swing strategy. One of those is to determine if we should trade a countertrend system or a trending stock setup. This strategy can also be used on a daily and weekly time frame as well. Data range: from July 9, to December 2, Those coming from the world of day trading will also often check which market maker is making the trades this can cue traders into who is behind the market maker's trades , and also be aware of head-fake bids and asks placed just to confuse retail traders. With swing trading, stop-losses are normally wider to equal the proportionate profit target. When using an SMA, you average out all the closing prices of a given time period. Want to learn more? You can use the nine-, and period EMAs. Swing trading can be difficult for the average retail trader. As forums and blogs will quickly point out, there are several advantages of swing trading, including:. A key thing to remember when it comes to incorporating support and resistance into your swing trading system is that when price breaches a support or resistance level, they switch roles — what was once a support becomes a resistance, and vice versa. When you are looking at moving averages, you will be looking at the calculated lines based on past closing prices. Either one can work, but it is up to you to determine which one you want to use. The market hours are a time for watching and trading for swing traders, and most spend after-market hours evaluating and reviewing the day rather than making trades. About Charges and margins Refer a friend Marketing partnerships Corporate accounts.

We use the same principles in terms of trying to spot relatively short-term trends but now try to profit from the frequency with which these trends tend to break. The more volatile the market, the greater the swings and the greater the number of swing trading opportunities. Live account Access our full range of products, trading tools and features. But as classes and advice from veteran traders will point out, swing trading on margin can be seriously risky, particularly if margin calls occur. MetaTrader Supreme Edition is a free plugin for MT4 and MT5 that includes a range of advanced features, such as an indicator package with 16 new indicators, technical analysis and trading ideas provided by Trading Central, and mini charts and mini heres the best dividend stock in big pharma dividend stocks list to make your trading even more efficient. Also, read our ultimate guide on the Ichimoku Cloud. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. A bullish engulfing pattern is the opposite. After this period, running against the main trend, the uptrend resumes. Swing trading is a style, not a strategy.

For entry, we want to see a big bold bearish candle that breaks below the middle Bollinger Band. Did you know that this is even true for successful traders? Just like some will swear by using candlestick charting with support and resistance levels, while some will trade on the news. Effective Ways to Use Fibonacci Too It is important to make sure you have a fully developed training plan before starting to trade any swing trading system. To determine the average, you will need to add up all of the closing prices as well as the number for days the period covers and then divide the closing prices by the number of days. But because you follow a larger price range and shift, you need calculated position sizing so you can decrease downside risk. On the other hand, if its RSI remains low, the trend may be set to continue. It is true you can download a whole host of podcasts, audiobooks and PDFs that will give you examples of swing trading, rules to follow and Heiken-Ashi charts to build. A swing trading academy will run you through alerts, gaps, pivot points and technical indicators. The downsides of scalping include: A huge investment of time and attention The requirement for extremely well-run and disciplined exit management Transaction costs can be significant because of the high number of trades One step up from scalpers are day traders, who hold positions for a few hours to a day. When the red line crosses the green line, it suggests that we can see a price change in the direction of the crossing. Trading Strategies. Or, if a trade passes the breakeven point, at which point it becomes a 'neutral' trade, you can take on a new position, without risking your risk limit. So if the nine-period EMA breaches the period EMA, this alerts you to a short entry or the need to exit a long position. The first task of the day is to catch up on the latest news and developments in the markets. Like any trading strategy, swing trading also has a few risks.

The financial markets are hugely diverse, and there are many different ways to squeeze profits from them. It's important to be aware of the typical timeframe that swing trades unfold over so that you can effectively monitor your trades and maximise the potential for your trades to be profitable. When the shorter SMA 10 crosses above the longer SMA 20 a buy signal is generated as this indicates that an uptrend is underway. The following chart shows examples of these formations. This can open you up to the possibility of larger profits that can be acquired from holding on to the trade for a little longer. While there is a lot of information in this article, sometimes the best way to learn is to ask a pro about their experience. The time horizon defines this style and there are countless strategies that can be used. This is also how reversals can occur in the stock market. And because a MA incorporates older price data, it's an easy way to compare how the current prices compare to older prices. Volume is typically lower, presenting risks and opportunities. Discover the range of markets and learn how they work - with IG Academy's online course. Any swing trading system should include these three key elements. Before we go any further, we always recommend writing down the trading rules on a piece of paper. Jesse Livermore, one of the greatest traders who ever lived once said that the big money is made in the big swings of the market. When you are looking at moving averages, you will be looking at the calculated lines based on past closing prices. Divergence doesn't always need to present, but if divergence is present, the candlestick patterns discussed next are likely to be more powerful and likely to result in better trades. A shorter and a longer one.

Learning about triangle trading and other geometric trading strategies will make you a much better swing trader. The good news is that you can do this for free with Trading Spotlight! The principle here is straightforward: a trend with high volume is going to be stronger than one with weak volume. When taking any trade, be sure to manage risk with a stop loss. Your Practice. This way, you are more likely to come out ahead than. Now, we still need to define where to place our protective stop loss and where to take profits, which brings us to the next step of our simple swing trading strategy. Click here for more information. The next step is to identify the bearish or bullish trend and look for best penny stocks to buy in 2020 in india fitx otc stock. Stocks often tend to retrace a certain percentage within a trend using the stochastic rsi indicator platform download bitcoin reversing again, and plotting horizontal lines at the classic Fibonacci ratios of Indeed, if tastytrade anatomy of a trade buy ipo shares on td ameritrade take the example of a daily candlestick closing above the period moving average, it's much more representative than the same candlestick closing above the moving average on a 5-minute chart. Your plan should always include entry, exit, research, and risk calculation. Analyses performed on larger units of time are often sounder, whereas shorter-term trading is more vulnerable to noise and false signals.

This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Demo account Try CFD ema formula metastock logik renko bars with virtual funds in a risk-free environment. Performed on September marijuana stock future potential good 4 dividend stocks, Swing traders will try to capture upswings and downswings in stock prices. The RSI indicator is most useful for:. Every swing strategy that works needs to have quite simple entry filters. Consolidation usually takes place before a major price swing which in this case, would be negative. Your Practice. Image via Flickr by Rawpixel Ltd. Related Terms Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Generally, analysis over longer time frames tend to be more accurate, and swing traders technical chart patterns forex best strategy swing trading benefit from. For example, a day SMA adds up the daily closing prices for the last 10 days and divides by 10 to calculate a new average each day. Something you might have heard about trading Forex profits unlimited stock picks marijuana stocks to buy before 2020 that the majority of traders lose money. We've shared our favourite strategies in the following sections. Indecision Candles. Learn to trade News and trade ideas Trading strategy. Why not? They occur when a market consolidates after significant price action Triangleswhich are often seen as a precursor to a breakout if the pattern is invalidated Standard head and shoulderswhich can lead to bear markets. On the flip side, a bearish crossover takes place if the price of an asset falls below the EMAs. If we understand your question correctly, yes.

Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. EST, well before the opening bell. A moving average MA is another indicator you could use to help. We use the same principles in terms of trying to spot relatively short-term trends but now try to profit from the frequency with which these trends tend to break down. Popular Courses. CMC Markets shall not be responsible for any loss that you incur, either directly or indirectly, arising from any investment based on the information provided. Swing trading is a style suited to volatile markets, and it offers frequent trading opportunities. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Market hours typically am - 4pm EST are a time for watching and trading. We understand that there are different trading styles and if swing trading is not your thing you can try our Simple Scalping Strategy: The Best Scalping System which attracted a lot of interest from our community. Inbox Community Academy Help. One of the best technical indicators for swing trading is the relative strength index or RSI.

:max_bytes(150000):strip_icc()/aaplexample-5c801788c9e77c00011c847d.png)

Just after putting in a new high the price formed a strong bearish engulfing pattern and the price proceeded vanguard total world stock etf isin gold hedge against stocks. After we analyze these periods, we will be able to determine whether instances of resistance or support have occurred. Consequently any person acting on it does so entirely at their own risk. Relative strength index Momentum indicators highlight potential oscillations within a broader trend, making them popular among swing traders. Volume is particularly useful as part of a breakout strategy. These are by no means the set rules of swing trading. February 19, at pm. So when I was loosing money every month, it was very painful. And because a MA incorporates older price data, it's an easy way to compare how the current prices compare to older prices. Some swing traders like to keep a dry-erase board next to their trading stations with a categorized list of opportunities, entry prices, target pricesand stop-loss prices. These concepts give you two choices for your strategy; following the trend, or trading counter to the trend.

Want to learn more about identifying and reading swing stock indicators? Like the RSI, the stochastic oscillator is shown on a chart between zero and Common patterns to watch out for include:. This is typically done using technical analysis. It is our goal to give you the trading opportunities, as well as help you in every way that we can to become the best swing traders around. All of these strategies can be applied to your trading to help you identify trading opportunities in the markets you're most interested in. Author at Trading Strategy Guides Website. They form the basis of the majority of technical strategies, and swing trading is no different. Swing trades last anywhere from a few days to a few weeks. Do you offer a demo account?

After observing the crossing of ascending MAs we could have entered a purchase order. What is Swing Trading? Want to learn more about identifying and reading swing stock indicators? I recommend using paper trading on a stock swing the next time you see one develop. How can I switch accounts? The preferred setting for the swing trading indicator is the default settings because it makes our signals more meaningful. While you will need to invest a fair amount of time into monitoring the market with swing trading, the requirements are not as burdensome as trading styles with shorter time frames, such as day trading or scalping. When a market drops to an area of support, bulls will usually step in and the market will bounce higher again. By knowing the best indicators for swing trades and following the few tips above, you can better prepare yourself for success with your trades. Your Practice. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. These slight variations of the spinning top often have different names, but the interpretation is the same if all the other conditions of the trade align. This Japanese candlestick chart shows a downtrend lasting around 3 months moving in a typical zig-zag pattern. Top Swing Trading Brokers. Technical Analysis Basic Education.