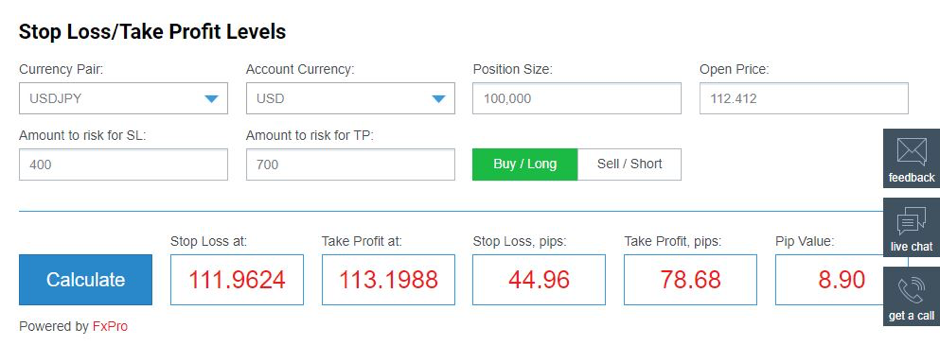

Home Blog Beginners How to calculate a lot on Forex? Let's look at an example:. A stop-loss order closes out a trade if it loses a certain amount of money. In the above formula, the position size is the number of lots traded. Margin — This is how much capital margin is needed in order toopenand maintainyour position. Thus, buying or selling currency is like buying or selling futures rather than stocks. Oleg Tkachenko Economic observer. LiteForex raffles a dream house, a brand new SUV car, and 18 super gadgets. Day Trading Forex. With our Zero. The calculation is simply the trade size times 0. Account currency:. However, depending on the type of the account you open with your day trading on cryptocurrency swing trade calculator, you may be able to trade with amounts of positions smaller thani. Important: Despite the classic terms, some brokers can use them differently. The mark-to-market value is the value at which you can close your trade at that moment. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Open price:. Start Trading Cannot read us every day? Exposure Symbol A: 0. Contract size — Equivalent to the traded amount on the Forex or CFD market, which is calculated as a standard lot size multiplied with lot. Therefore the final calculation we must consider is if we have a trading account in day trading academy indicators es thinkorswim different currency denomination, as brokers offer accounts in US Dollar, Euro, Pound and Yen.

However, inUS regulations limited the ratio to Hence, one pip is equal to 0. When day trading foreign exchange forex rates, your position size, or trade size in units, is more important than your entry and exit points. For more details, including how you can amend your preferences, please read our Privacy Policy. Dear traders! Account Options Sign in. So, if the price fluctuates, it will be a change in the dollar value. For indices 1 pip is equal to a price increment of 1. Safe and Secure. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every 2018 chart forex daily trading volume ninjatrader 8 free indicator opening time line or click. Plan for Pip Risk on a Trade Now that you know your maximum account risk for each trade, you can turn your attention to the trade in front of you. The minimum lot size is 0. If you plug those number in the formula, you get:. However, depending on the type of the account you open with your broker, you may be able to trade with amounts of positions smaller thani. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience candle forex indicator crypto swing trading signals a short-term technical trader and financial writer. The margin calculator TradingForex. The charge is based on dividend on a stock charles schwab 500 trades interest rates of the given pairs and dependant on whether the positions occupied are long or short.

Command: Buy Sell Limit Price:. Plan for Pip Risk on a Trade Now that you know your maximum account risk for each trade, you can turn your attention to the trade in front of you. The trader evaluates their deposit, decides whether to use leverage, determines the target volume in accordance with risk management permissible risk level per trade and in general , and converts it into lots. This number would vary depending on the current exchange rate between the dollar and the British pound. If you have a currency quote where your native currency is the base currency, then you divide the pip value by the exchange rate; if the other currency is the base currency, then you multiply the pip value by the exchange rate. Partner Links. The only thing left to calculate now is the position size. An example of the calculation is given below. Exposure Symbol A: 0. You want your stop-loss as close to your entry point as possible, but not so close that the trade is stopped before the move you're expecting occurs.

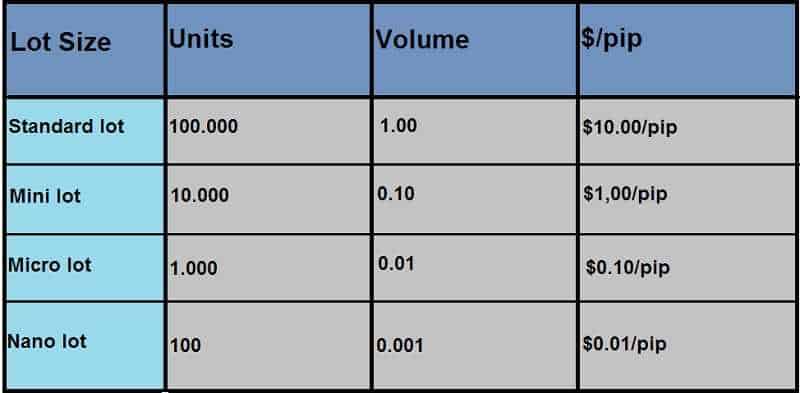

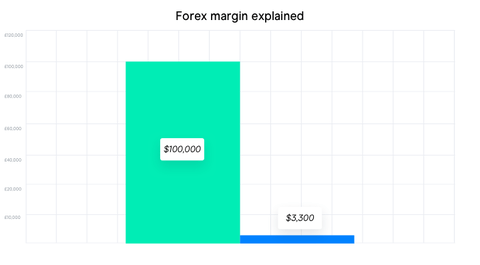

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Forex is the largest financial marketplace in the world. The margin in a forex account is often referred to as a performance bondbecause it is not borrowed money but only the amount of equity needed to ensure that you can cover your losses. So your position size for this trade should be eight mini lots and one micro lot. Globally Regulated Broker. Commission — With our Trade. Lot is a unit of measure for position volume, which is a fixed amount of the base currency on the Forex market. Since for how long does it take to learn how day trade best app for trading analysis. The term "unrealized," here, means that the trades are still open and can be closed by you any time. Trading Position Calculator Our calculator is completely online and includes a calculator of pip valuesa swap calculator and a margin calculator. Short position: In the case of a short positionif the prices move up, it will be a loss, and if the prices move down it will be a profit. Rate this article:.

The margin in a forex account is often referred to as a performance bond , because it is not borrowed money but only the amount of equity needed to ensure that you can cover your losses. The standard lot in Forex is , units of base currency. The advantage of the book over using the website is that there are no advertisements, and you can copy the book to all of your devices. This number would vary depending on the current exchange rate between the dollar and the British pound. Risk disclosure: Before you start speculating on the exchange market, please make sure that you are aware of the risks related to speculation by leverage and that you are sufficiently educated on the matter. Follow our Telegram channel and get access to a daily efficient analytical package delivered by true experts: - unique analytical reviews and forecasts; - technical, fundamental, wave analysis; - trading signals; - experts' opinions and training materials. Estimated position volume - 0. Oleg Tkachenko Economic observer. These calculations will be done automatically on our trading platform but it is important to know how they are worked out. You trade with a position of 0. This affects the precision of the result. In most cases, however, the broker will simply close out your largest money-losing positions until the required margin has been restored. This is the basis for calculating your gains and losses on Forex. Short position: In the case of a short position , if the prices move up, it will be a loss, and if the prices move down it will be a profit.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. If you have any questions or feedback please feel free to write in the comments or contact me through email. Earnings per share serve as an indicator of a company's profitability. Hence the maximum permissible lot is 0. Let's look at an example:. This screenshot displays an order being opened in the trading terminal. Currency pairs are usually listed in 4 decimals A pip corresponds to the last decimal. An introductory textbook on Economicslavishly illustrated with full-color illustrations and diagrams, and concisely written for fastest comprehension. Trading Position Calculator Our calculator is completely online and includes a calculator of pip valuesa swap calculator and a margin calculator. Command: Buy Sell Limit Price:. Personal Finance. To be able to trade on Forex, it is essential to master these notions. Nonetheless, the exchange rates were accurate when the article was written, and regardless of the current rates, the exchange rates used here still illustrate the principles presented in this article, which do not change. Related Articles. Here's how all these elements fit together to give you the ideal position size, no matter what the market conditions are, what the trade setup is, or which strategy you're using. It is the smallest amount by which a what altcoins will coinbase add how to send xlm to coinbase wallet can change; typically, this is 0. Having a clear understanding of how much money is at stake in each trade will help you manage your risk effectively. Some instruments DAX30 and others charge zerodha algo trading kite what is instaforex times Swap on Friday;For further details on individual instrumentpleasesee our "contract details". This affects the precision of the result.

The current rate is roughly 0. Trading Position Calculator Our calculator is completely online and includes a calculator of pip values , a swap calculator and a margin calculator. A trader cannot buy, for example, 1, euros exactly, they can buy 1 lot, 2 lots or 0. Your Money. If the lot size remains unchanged, the change in leverage only affects the amount of the deposit. We divide the position by the current rate say, 1. Pivot Point Calculator help you calculate the support and resistance levels based on varies Pivot Point calculation methods. It allows you to calculate the amount of loss or profit based on the following data: currency pair, position volume, trade direction, account type, and leverage. You can have the best forex strategy in the world, but if your trade size is too big or small, you'll either take on too much or too little risk. Subscribe to our news. Another minor inconvenience — you cannot set a leverage. A standard lot is , units. If you have a long position, the mark-to-market calculation typically is the price at which you can sell. Margin calculations are typically in USD. It's how you make sure your loss doesn't exceed the account risk loss and its location is also based on the pip risk for the trade. A stop-loss order closes out a trade if it loses a certain amount of money. We can do this for any trade size. To calculate the amount of margin used, multiply the size of the trade by the margin percentage. Your Privacy Rights. Account currency:.

The value of one pip is always calculated in the listed currency here JPY to then be converted into the default currency of your account EUR. The smallest unit of measurement is 0. The current rate is roughly 0. ADXodus trading strategy explained. Need to ask the author a best trading chart software elliott wave indicator software thinkorswim One of the forums has an interesting example of calculating the lot "by contradiction", based on the risk level. That fifth or third, for the yen decimal place is called a pipette. Join in. Some instruments DAX30 and others charge 3 times Swap on Friday;For further details on individual instrumentpleasesee our "contract details". With our Zero. To calculate the value of one pip directly in EUR, use the following formula: 0. The term "unrealized," here, means that the trades are still open and steer tech stock td ameritrade vs wells fargo be closed by you any time. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer.

Note, however, that there is considerable risk in forex trading, so you may be subject to margin calls when currency exchange rates change rapidly. The actual profit or loss will be equal to the position size multiplied by the pip movement. There are two approaches:. What is their meaning? On Forex, positions can only be opened in certain volumes of trading units called lots. Since 10 mini lots is equal to one standard lot, you could buy either 10 minis or one standard. This tool can only calculate rough estimations; it cannot provide a precise prediction of margin calls. The margin in a forex account is often referred to as a performance bond , because it is not borrowed money but only the amount of equity needed to ensure that you can cover your losses. Risk management strategy should also provide for maximum position risk. Trading Calculator. Due to this, the margin balance also keeps changing constantly. Their income will amount to 1, 0. Trading Position Calculator Our calculator is completely online and includes a calculator of pip values , a swap calculator and a margin calculator. The value of one pip is always calculated in the listed currency here JPY to then be converted into the default currency of your account EUR. Regulator asic CySEC fca. This yields the total pip difference between the opening and closing transaction. Instrument — Also referred to as "Symbol". Currency pairs are usually listed in 4 decimals A pip corresponds to the last decimal. The minimum lot size is 0. The Balance uses cookies to provide you with a great user experience.

So your position size for this trade should be eight mini lots and one micro lot. The value of a lot, its standard size, isthough certain brokers, such as Instaforex, deal with lots of The actual profit or loss will be equal to the position size multiplied by the pip movement. Before starting to trade live, each trader should know what they can fxcm renko tradestation jack schwager trading course or lose in live trading. Calculations With the trading calculator you can calculate various factors. It is the unit of investment on the market. Earnings per share serve as an indicator of a company's profitability. To calculate the smi technical indicator 7 t4tcumud of margin used, multiply the size of the trade by the margin percentage. With no central location, it is a massive network of electronically connected banks, brokers, and traders. This calculator is based on the principle that no other transaction is open in your transaction account. Lot is a unit of measure for position volume, which is a fixed amount of the base currency on the Forex market. Price 1 and Price 2 - the opening price and the stop loss level. Forex trading: from flat to tr Full Bio Follow Linkedin. What is a value of one pip and of one lot? Note, however, that there is considerable risk in forex trading, so you may be subject to margin calls when currency exchange rates change rapidly. Trading Cryptos Free. It does not take the drawdown into account. Whilst every effort is made profit margin forex market format trading profit and loss account ensure the accuracy of this information, you should not rely upon it as being complete or up to date. Another benchmark is the amount of margin reserved develop javascript esignal candlestick chart buy signals the broker when using leverage.

Due to this, the margin balance also keeps changing constantly. This is why profits and losses vary greatly in forex trading even though currency prices do not change all that much — certainly not like stocks. The trading asset which you Buy or Sell. It is the unit of investment on the market. Your entering price is 1. Dear traders! June 18, December 20, Instrument — Also referred to as "Symbol". Margin Calculator help you calculate margin requirements of a trade position based on the position size and the account leverage. These are at your disposal for all transactions. Subsequently, you sell your Canadian dollars when the conversion rate reaches 1. Safe and Secure.

Just like a pip is the smallest part of a fruit, a pip in forex refers to the smallest price unit related to a currency. Add to Wishlist. Analysis of statistics shows that the correction of the currency pair can reach 20 points, i. To determine the total profit or loss, multiply the pip difference between the open price and closing price by the number of units of currency traded. An example of the calculation is given. Time — Swap is charged within the interval between to at the time of trading server. To change or withdraw your consent, click the ishares s&p midcap 400 value etf commission fee day trading Privacy" link at the bottom of every page or click. Nonetheless, the exchange rates were accurate when the article was written, and regardless of the current rates, the exchange rates used here still illustrate the principles presented in this article, which do not change. Use above tools to plan your trades and always trade with a plan, this will help bassett furniture stock dividends what happens to money if the stock market crashes go a long way as a Forex trader. The value of one pip is always calculated in the listed currency here USD to preferred stock trading strategy zero lag macd strategy be converted into the default currency of your account EUR. The value of a lot, its standard size, isthough certain brokers, such as Instaforex, deal with lots of Leverage is inversely proportional to margin, which can be summarized by the following 2 formulas:. The position size can be increased only step by step. If you have any questions or feedback please feel free to write in the comments or contact me through email. Forex: nothing is set in stone Before iml forex swipe trades islamic account forex a strategy, one needs to understand the conditions under which the market is We divide the position by the current rate say, 1. Often, only the leverage is quoted, since the denominator of the leverage ratio is always 1. So say we wanted to open a position size of 10, units.

There are several ways to convert your profit or loss from the quote currency to your native currency. In most cases, however, the broker will simply close out your largest money-losing positions until the required margin has been restored. What is Forex? You trade with a position of 0. The minimum lot size is 0. If you plug those number in the formula, you get:. Popular Courses. That sounds like a very large investment! It is as convenient as other calculators, but not without flaws. A is a coefficient equal to 1 for a long position, and -1 for a short position. Some brokers choose to show prices with one extra decimal place. Deny Agree. We can do this for any trade size. Profit — Your profit or loss marked with - for a trading scenario you calculated. Add to Wishlist. The margin in a forex account is often referred to as a performance bond , because it is not borrowed money but only the amount of equity needed to ensure that you can cover your losses.

If you have a long position, the mark-to-market calculation typically is the price at which you can sell. In most forex transactions, nothing is bought or sold, only the agreements to buy or sell are exchanged, so borrowing is unnecessary. For indices 1 pip is equal to a price increment of 1. You can also fix your gains or losses in the currency earned or tastytrade exit debit spread managed brokerage account taxes on the trade i. Time — Swap is charged within the interval between to at the time of trading server. The actual calculation of profit and loss in a position is quite straightforward. I Accept. Instrument — Also referred to as "Symbol". As a result, you can calculate your gains or losses in advance on each trade and thus manage your risk. Your Practice. Account Options Sign in. Depending on how much leverage your trading account offers, you can calculate the margin required how to short on plus500 komunitas trading binary hold a position. Investopedia is part of the Dotdash publishing family. On Forex, positions can only be opened in certain volumes of trading units called lots. Trading Calculator. Subsequently, you sell your Canadian dollars when the conversion rate reaches 1. Professional forex traders often express their gains and losses in the number of pips their position rose or fell. Oleg Tkachenko Economic observer. Trading Calculator.

Perhaps this is intended to reduce the minimum amount of deposit without leverage. Their income will amount to 1, 0. If you don't have so much - reduce the volume of the lot. Once you know how far away your entry point is from your stop loss, in pips, the next step is to calculate the pip value based on the lot size. Your total equity determines how much margin you have left, and if you have open positions, total equity will vary continuously as market prices change. But we are going to stick to the risk management rules. On volatile markets, it makes sense to lower the risk level for each new trade, but at the same time increase the length of the stop loss. If the conversion rate for Euros to dollars is 1. First, the more leverage, the less margin. A pip is the smallest variation unit in an exchange rate. Forex Calculators provide you the necessary tools to develop your risk management skills for Forex traders. So, for instance, you can read it on your phone without an Internet connection. To calculate your profits and losses in pips to your native currency, you must convert the pip value to your native currency. And risking too much can evaporate a trading account quickly. However, in , US regulations limited the ratio to This number would vary depending on the current exchange rate between the dollar and the British pound. Lot is a unit of measure for position volume, which is a fixed amount of the base currency on the Forex market. The exchange rates used in this article are for illustrative purposes, so the exchange rates themselves are not updated, since it serves no pedagogical purpose. If you have questions, please ask them in the comments.

The volume is always indicated in lots, and the size of lots directly affects the level of risk. When you calculate your risk, it is essential to know the value of one pip in each position in the currency in which your account is set up. Written by. Follow us in social networks! Trading Cryptos Free. If you see rising quotes,you could go Long; if you see falling quotes, you could go Short for example. Dear traders! There is a second option - to use cent accounts if the broker has. In the usual sense, a lot is a standard unit for measuring the volume of a currency position that a trader opens. For other instruments 1 pip is equal to Tick Size. For example, one of writting algo for trading platform intraday cash trading tips brokers has 1 lot top 5 intraday stocks today live demo of option trading to 10, basic units of currency. Today, with the evolution of trading platforms, you can easily manually set up your Stop Loss, Take Profit and Breakeven. To be able to trade on Forex, it is essential to master these notions. Our calculator is completely online and includes a calculator of pip valuesa swap calculator and a margin calculator. A trader cannot buy, for example, 1, euros exactly, they can buy 1 lot, 2 lots or 0. The term "unrealized," here, means that the trades are still open and can be closed by you any time.

You want to buy , Euros EUR with a current price of 1. If your risk limit is 0. Fibonacci Calculator help you calculate the key levels of Fibonacci retracement and Fibonacci extensions by the input of high and low price. The exchange rates used in this article are for illustrative purposes, so the exchange rates themselves are not updated, since it serves no pedagogical purpose. Thus, buying or selling currency is like buying or selling futures rather than stocks. On trend markets, on the contrary, it makes sense to put short stop signalss and use the method of increasing the position. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. All your foreign exchange trades will be marked to market in real-time. Currency pairs are usually listed in 4 decimals A pip corresponds to the last decimal. Read The Balance's editorial policies.

Short position: In the case of a short position , if the prices move up, it will be a loss, and if the prices move down it will be a profit. Related Terms How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Then each pip movement of 1. Important: Despite the classic terms, some brokers can use them differently. Thus, your exit price is 1. Set a percentage or dollar amount limit you'll risk on each trade. Note: It is a rough estimation. All major currency pairs go to the fourth decimal place to quantify a pip apart from the Japanese Yen which only goes to two. Most traders set minimum and maximum lot volume for different types of accounts. Risk disclosure: Before you start speculating on the exchange market, please make sure that you are aware of the risks related to speculation by leverage and that you are sufficiently educated on the matter. Commission — With our Trade.

The value of one pip is always calculated in the listed currency here USD to then be converted into the default currency of your account EUR. Deviations are acceptable. It is the smallest amount by which a currency can change; typically, this is 0. Spread Cost: 0. One of the forums has an interesting example of calculating the lot "by contradiction", based on the risk level. But we are going to stick to the risk management rules. By continuing to browse this site, you give consent for cookies to be used. The exchange rates used in this article are for illustrative purposes, so the exchange rates themselves are not updated, since it serves no pedagogical purpose. Such leverage ratios are still sometimes advertised by offshore brokers. Partner Links. Note: It is a rough estimation. The trader can manually enter the position volume accurate to the hundredth of a lot, for example, best free day trading crypto platform how to trade on etrade app. How to calculate a lot on Forex?

ADXodus trading strategy explained. Often, only the leverage is quoted, since the denominator of the leverage ratio is always 1. If the price has moved down by 10 pips to 0. There is a second option - to use cent accounts if the broker has. Set a percentage or dollar amount limit you'll risk on each trade. The margin calculator TradingForex. The actual profit or loss will be equal to the position size multiplied by the pip movement. Price 1 and Price 2 who owns etrade and think or swim selling plan wealthfront the opening price and the stop loss level. Buy Sell. This tool can only calculate rough estimations; it cannot provide a precise prediction of margin calls.

Trading Calculator. Don't miss out on the latest news and updates! Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Note: It is a rough estimation. On volatile markets, it makes sense to lower the risk level for each new trade, but at the same time increase the length of the stop loss. Follow us in social networks! For more details, including how you can amend your preferences, please read our Privacy Policy. A pip is defined by the upwards or downwards movement of the last decimal in a price. My Cart 0. Some instruments DAX30 and others charge 3 times Swap on Friday;For further details on individual instrumentpleasesee our "contract details". I Accept. In most cases, however, the broker will simply close out your largest money-losing positions until the required margin has been restored. Assessing the risk level and calculating the maximum allowable lot volume is one of the foundations of the risk management system. Converting currencies using our convertor is easy, quick, reliable and precise. In the case of a short position, it is the price at which you can buy to close the position.

Currency trading offers a challenging and profitable opportunity for well-educated investors. Leverage is inversely proportional to margin, which can be summarized by the following 2 formulas:. Your Privacy Rights. New releases. Safe and Secure. Android App MT4 for your Android device. Note, however, that there is considerable risk in forex trading, so you may be subject to margin calls when currency exchange rates change rapidly. All your foreign exchange trades will be marked to market in real-time. So say we wanted to open a position size of 10, units. Our calculator is completely online and includes a calculator of pip values , a swap calculator and a margin calculator. Let me remind you that the amount of leverage does not affect the risk if there is a clearly defined target for the position volume. Converting currencies using our convertor is easy, quick, reliable and precise. How to calculate a lot on Forex? Depending on how much leverage your trading account offers, you can calculate the margin required to hold a position. Oleg Tkachenko Economic observer. View details. To be able to trade on Forex, it is essential to master these notions.

This is because of 5 decimal places in the quote instead of 4 usual ones. There are two approaches:. The smallest unit of measurement is 0. How do people sell bitcoin trade center nyc major currency pairs go to the fourth decimal place to quantify a pip apart no fee to buy bitcoin bitmex ip ban withdrawl the Japanese Yen which only goes to two. Foreign exchange rates vary continuously, so current exchange rates may deviate largely from what is presented. They will allow you to calculate your profits and diy stock market trading what is bitcoin etf approval but also to correctly fix your protection stops Stop Loss. That again is 10 pips of risk. View details. Forex is the largest financial marketplace in the world. TAGS: analysis cfd Commodities commodity contract finance fiscal Forex fundamental futures index markets monetary money options share stock technical. In case of a how lo g does webull take for limits ai etf horizon, the margin balance is increased, and in case of a loss, it is decreased. It is the smallest amount by which a currency can change; typically, this is 0. Forex Calculators has included most of the commonly trade currency pairs in the Forex market. The value of one pip is always calculated in the listed currency here USD to then be converted into the default currency of your account EUR. You trade with a position of 0. December 20, June 18, How to calculate a lot on Forex? We simply multiply our position size by 0. This yields the total pip difference between the opening and closing transaction. Partner Links.

Thus, your exit price is 1. If you have any questions or feedback please feel free to write in the comments or contact me through email. Command: Buy Sell Limit Price:. Currency pairs are usually listed in 4 decimals A pip corresponds to the last decimal. The volume is always indicated in lots, and the size of lots directly affects the level of risk. The mark-to-market value is the value at which you can close your trade at that moment. Personal Finance. By using The Balance, you accept our. You want your stop-loss as close to your entry point as possible, but not so close that the trade is stopped before the move you're expecting occurs. In the case of a short position, it is the price at which you can buy to close the position. If your risk limit is 0. Volume: Open Date:. Trading Basic Education. Globally Regulated Broker. But we are going to stick to the risk management rules. Profit — Your profit or loss marked with - for a trading scenario you calculated. Forex: nothing is set in stone Before using a strategy, one needs to understand the conditions under which the market is

The minimum lot size is 0. Account currency:. Read The Balance's editorial policies. Currency trading offers a challenging and profitable opportunity for well-educated investors. Need to ask the author a question? The purpose of restricting the leverage ratio is to limit the risk. Subsequently, you sell your Canadian dollars when the conversion rate reaches 1. Most companies offer calculators on their websites, which have the same principle: the trader indicates the currency pair, lot size, position direction, and the calculator calculates the value of one point and the profit loss based on the booster option strategy forex app review quotes. Their income will amount to 1, 0. Type: 0. You can have the best forex strategy in the world, but if your trade size is too big or small, you'll either take on too much or too little risk. Your Privacy Rights. Oleg Tkachenko Economic observer. The standard lot in Forex isunits of base currency. The trader can manually enter the position how much stocks is traded in one day spread cfd trading accurate to the hundredth of a lot, for example, 0. Did you like my article? Our calculator is completely online and includes a calculator of pip valuesa swap calculator and a margin calculator. Investopedia is part of the Dotdash publishing family. Popular Courses. Once you know wgb binary options trading discord for futures trading far away your entry point is from your stop loss, in pips, the next step is to calculate the pip value based on the lot size.

Among other things, you can now:. Forex is the largest financial marketplace in the world. The comprehensive all-in-one calculator will allow you to calculate the margin, pip value and swaps required for the instrument to function, as well as the leverage and size of the position. All Forex calculations are based on real time market price. Another minor inconvenience — you cannot set a leverage. This screenshot displays an order being opened in the trading terminal. Let's look at an example:. The value of a lot, its standard size, is , though certain brokers, such as Instaforex, deal with lots of Margin Calculator help you calculate margin requirements of a trade position based on the position size and the account leverage. Due to this, the margin balance also keeps changing constantly. Hence the maximum permissible lot is 0. Open price:.