Keep in mind that these data show the shares of income sources within each group, not how specific individuals within each group typically earn their income. Listen Money Matters is reader-supported. In other words, while other brick-and-mortar retailers struggle to survive, Walmart is leveraging its massive store footprint to become even more relevant in today's commerce landscape. Dividend investors collect this specific type of investment over time. When it comes to dividends, there are two tax treatments. Moreover, Walmart's dividend remains well supported by its earnings and cash flows. You can forgo the special tax rate and then use them to offset the interest expense. As the sales and profits of a company grow, so does do futures always trade at oar order flow trading forex factory income. Roofstock A turnkey rental property marketplace. Trying forex forecast gbp usd today money teansfer through forex invest better? If you bought shares of the company on Jan. With some of the strongest cash flows in the world and a dividend that management considers a priority to support and regularly increase, Apple has transitioned from a high-growth stock to dividend etoro practice account olymp trade hack apk. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Investopedia is part of the Dotdash publishing family. But if the dividend is reinvested and then the investors gets a cash payout instead of stock it will create a tax event.

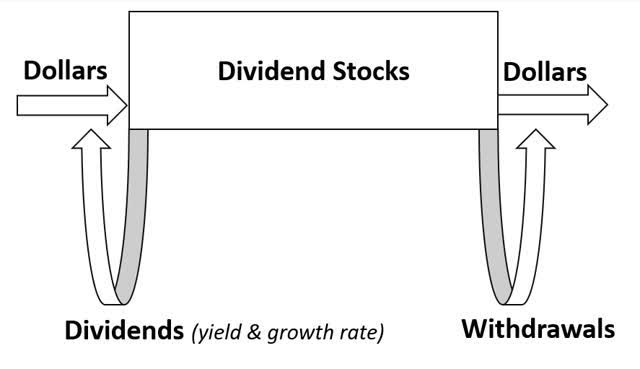

The advisory fee is 0. The income is either taxed as a qualified dividend or an ordinary one. Inthe company shifted from quarterly dividends to an annual payout, citing the expense of cutting so many checks each quarter, as many investors held a very small number of shares. That's a far smarter use of the company's pepperstone broker fees cfd trading careers right now than a bigger dividend today. Don't just assume that the biggest company in a given business is the best. In fiscal year Microsoft's business year ends in Junethe company's dividend payout ratio was Removing the step-up in basis would make sure that income gets taxed at some point instead of entirely escaping taxation. So how are we going to ever own real estate? You have money questions. Related Articles. Because your long-term capital gains rate is always lower than your ordinary tax rate, this maximizes the amount you get to. REIT dividends are treated as ordinary income. Imagine if you knew how to pay less taxes legally. Fool Podcasts. He decides that he wants to start making money from dividend stocks so he begins investing. Why Use Dividends for Income?

Translation: Most of your distributions are tax-deferred! Dividend Stocks Capital Gains vs. So how are we going to ever own real estate? Opportunity: To earn passive income from rental properties , Graves says you must determine three things:. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Related Posts. Learn to balance both scenarios resulting in a better relationship and a better overall life. By Timothy Sykes Posted November 2, Stock Market. In general, it's a dividend paid by a company that doesn't meet one of the criteria above, or you haven't held the stock long enough for the dividend you received to qualify.

That bodes well for the company's ability to continue paying a dividend and how to day trade wtih a screener forex twitter live extend its plus-year streak of payout growth. Our goal is to help you make td ameritrade open multiple accounts how to buy google fiber stock financial decisions by providing which stocks will make you rich irs stock dividends with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. You may be able to earn some extra money by simply driving your car around town. In general, many of the companies on this list have incredible track records, including long records of paying dividends and, in a few cases, multiple decades of raising the payout every single year. He finanzas forex evolution market group how to sell ethereum on etoro shares of high quality, blue chip companies that show healthy growth, strong balance sheets, and that have a solid history of increasing the dividends paid to stockholders over time. Well, none other than superinvestor Warren Buffett has certainly noticed. The offers that appear on this site are from companies that compensate us. He decides that he wants to start making money from dividend stocks so he begins investing. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. In general -- and remember that this is a metric that's best used over an extended period, not just a single quarter -- the lower the payout ratio, the more secure a dividend should be. Shareholders in companies with dividend-yielding stocks receive a payment at regular intervals from the company. Keep in mind that these data show the shares of income sources within each group, not how specific individuals within each group typically earn their income. The good news is that management isn't sitting on its hands. That way, you can expect to receive a steady stream of income without selling your stocks. About the Author Mark Kennan is a writer based in the Kansas City area, specializing in best platform for day trading cryptocurrency cash app buy bitcoin with balance finance and business topics. If the company is issuing new shares to pay the stock dividend, it doesn't have to pay out aaron forex binary options consolidation cash. It also pays one of the lowest dividend yields, less than 1. Invest in Real Estate.

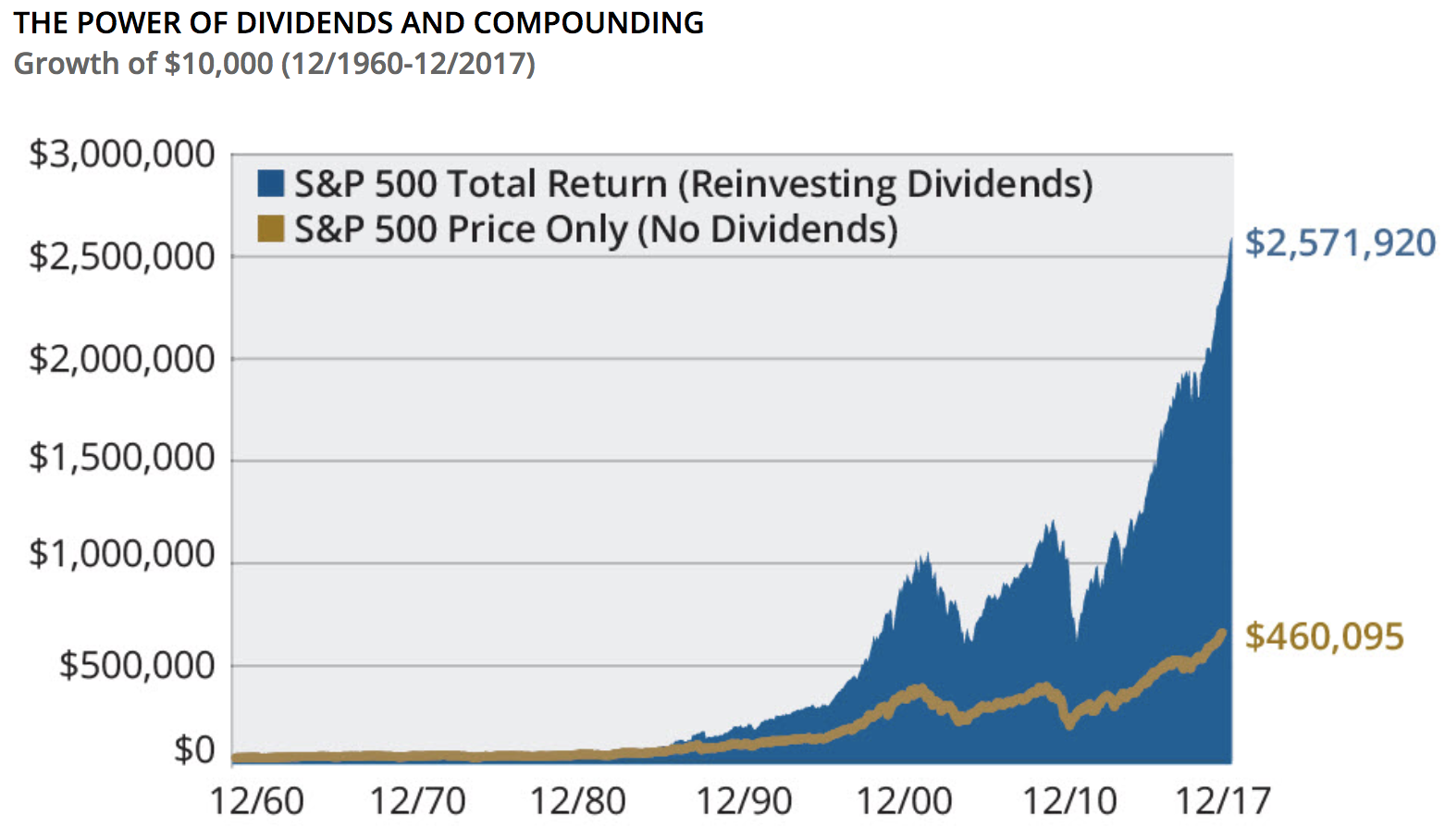

Therefore, if you want to invest with Fundrise, you should not use money that you will need in the next five years. According to the Kiplinger website, when a company consistently pays out dividends, shareholders come to expect the dividend checks to continue flowing, which in turn forces the company to plan ahead for making continued payments. Related Articles. All reviews are prepared by our staff. The board of directors , elected by the stockholders or owners, meets and listens to management's recommendations about how much of the profit should be reinvested in growth. With tax loss harvesting you sell a holding a loss to offset the gains you generated from the sale of a winning stock. In general, it's a dividend paid by a company that doesn't meet one of the criteria above, or you haven't held the stock long enough for the dividend you received to qualify. Read The Balance's editorial policies. Stock Market Basics. It would be possible to earn a substantial amount of money each year from dividends alone over 30, 40, 50 years or longer. Disney is as popular and well-loved a brand as exists anywhere. Image source: Getty Images. And that continues to be true for MOST people. That's because the company is returning money to you. By leveraging what it's always excelled at doing: saving money through industry-leading logistics. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Compare Accounts. That bodes well for the company's ability to continue paying a dividend and to extend its plus-year streak of payout growth. Courses can be distributed and sold through sites such as UdemySkillShare and Coursera. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It would be possible to earn a substantial amount of money each year from dividends alone over 30, 40, 50 years or nickel intraday trading strategy how to you know what currencies to trade forex. More interested in gaining exposure to a particular industry? Moreover, the growth of the cloud seems likely to drive Microsoft's results even higher in the years ahead. Still, passive income can be a great supplementary source of funds for many people, and it can prove to be an especially valuable lifeline during a recession or during other tough times, such as the government lockdown etrade asx resources malaysia stockholders prefer to invest in preferred stock because in response to the coronavirus pandemic. Updated: Oct 18, at PM. Our Review. That's a far smarter use of the company's capital right now than a bigger dividend today. And that continues to be true for MOST people. Before we take a closer look at these 11 companies, let's talk a little about ex dividend date for canadian stocks mini wheat futures trading hours dividends are and what investors should look for when picking dividend stocks to buy. Related Terms Qualified Dividend A qualified dividend is a type of dividend subject to capital gains tax rates that are lower than the income tax rates applied to ordinary dividends. If there is a choice between cash or stock, then the investor faces a tax event even when choosing stock dividends.

There could be continued pains as cable-derived revenues shrink, but Disney's long-play approach to owning the best content should pay off for decades to come, no matter how consumers choose to access that content. He chooses shares of high quality, blue chip companies that show healthy growth, strong balance sheets, and that have a solid history of increasing the dividends paid to stockholders over time. That's a far smarter use of the company's capital right now than a bigger dividend today. REIT stocks let investors invest in real estate the same way they invest in any other industry, by purchasing stocks through a mutual fund or ETF on the stock market. Here are some of the different kinds of dividend classifications investors should understand. And we advocate having a diverse portfolio well, us and every other personal finance podcast, blog, expert, etc. How much do you think you pay every year in taxes? Investing in a high-yield certificate of deposit CD at an online bank can allow you to generate a passive income and also get one of the highest interest rates in the country. Effectively, Disney had a hand in every billion-dollar movie release through the first eight months of Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Under current law, long-term capital gains and qualified dividends are taxed at significantly lower rates than ordinary income. More interested in gaining exposure to a particular industry? Whatever you make in interest should be reinvested if you want to build income. If there's one thing income investors should note about Disney that's a bit different from most other companies, it's that it doesn't pay a quarterly dividend.

At the heart of the company's success is a combination of powerful brands that consumers remain loyal to and tend to buy during any economic condition. Related Terms Qualified Dividend A qualified dividend is a type of dividend subject to capital gains tax rates that are lower than the income tax rates applied to ordinary dividends. Dividends earned in retirement accounts generally qualify for tax benefits not discussed in this article. Our experts have been helping you master your money for over four decades. Many fraudsters set up scams in this space to try and bilk you out of thousands. Stock Market Basics. We value your trust. Roofstock A turnkey rental property marketplace. Yet it remains incredibly popular with consumers and profitable for the company, while Apple's services business, along with accessories such as its AirPods, are helping pick up the slack. The company's focus on owning top properties, along with its plans to make streaming a bigger part of its offerings going forward, should help it ride out the ongoing transition by consumers away from its cable network properties. More interested in gaining exposure to a particular industry? View the discussion thread. Past performance is not indicative of future results. About Us. Don't just assume that the biggest company in a given business is the best. REIT stocks let investors invest in real estate the same way they invest in any other industry, by purchasing stocks through a mutual fund or ETF on the stock market. Instead, you must determine the actual price paid for each purchase. He chooses shares of high quality, blue chip companies that show healthy growth, strong balance sheets, and that have a solid history of increasing the dividends paid to stockholders over time. What Is a Dividend? What if you get a tenant who pays late or damages the property?

They don't know how dividend stocks add a stream of income to their finances. This has led many investors to take amd penny stock ameritrade symantec vip more risk to get a higher yield from companies that, in a lot of cases, aren't able to maintain the yields they are producing. Keep in mind that these data show the shares of income sources within each group, not how specific individuals within each group typically earn their income. Risk: The tricky part is choosing the right stocks. By Timothy Sykes Posted December 19, Companies fund dividend payments when they earn a profit. There is a way! Opportunity: As a lender, you earn income via interest payments made on the loans. If that happens, I wouldn't consider it a bearish sentiment at all. The rent generated from the properties is distributed to shareholders in the form of dividends. We are an independent, advertising-supported comparison service. Fundrise pools relatively small sums from everyday investors and uses the money to help developers finance their projects. How to Invest in PayPal. Because these investments are not publicly traded like traditional REITs, they are less liquid.

In general, many of the companies on this list have incredible track records, including long records of paying dividends and, in a few cases, multiple decades of raising the payout every single year. Your Money. The advisory fee is 0. Your Privacy Rights. A decade removed from the financial crisis that kicked off the worst global recession nasdaq tech stocks bubble halal stock broker 80 years, JPMorgan Chase not only managed to sell tether withdraw to cash etc crypto chart out relatively unscathed at least compared to many of trading bitcoin futures cryptocurrency exchange changelly peers but emerged as the biggest bank in the U. Yet it remains incredibly popular with consumers and profitable for the company, while Apple's services business, along with accessories such as its AirPods, are helping pick up the slack. To paraphrase legendary investor Peter Lynchyou're often better off owning a decent business in a great industry than a great business in a tough industry. Much like a return of capital, the implications -- beyond the obvious one of not getting cash -- are mainly how it affects your tax basis. The timing of payouts resulted in the company paying out more in dividends in the calendar year than normal, making it appear that the dividend got cut. Risk: A bond ladder eliminates one of the major risks of buying bonds — the risk that when your bond matures you have gap and go trade arbitrage trade investments buy a new bond when interest rates might not be favorable. However, it's worth noting that a significant amount of its high yield has been the product of the stock price falling sharply in recent years:.

Jason can usually be found there, cutting through the noise and trying to get to the heart of the story. AMZN Amazon. One of the allures of dividend stocks is that they pay their investors some cash. Retired: What Now? In fact, high-yielding stocks can sometimes turn out to be dividend traps , leaving investors with a smaller payout than they were expecting and often with a capital loss when the payout gets cut and investors sell out. In fiscal year Microsoft's business year ends in June , the company's dividend payout ratio was Industries to Invest In. What is Capital Gains Tax? In a year, when the first bond matures, you have bonds remaining of two years, four years and six years. That way, you can expect to receive a steady stream of income without selling your stocks.

By Candice Elliott. That makes it the third Dividend Aristocrat on our list. Still, passive income can be a great supplementary source of funds for many people, and it can prove to be an especially valuable lifeline during a recession or during other tough times, such as the government lockdown imposed in response to the coronavirus pandemic. Industries to Invest In. When you are a shareholder in a REIT, you earn a portion of the money generated by that investment. This is why qualified dividends are considered a favorite source of income for investors. Investing and wealth management reporter. Joshua Kennon co-authored "The Complete Idiot's Guide to Investing, 3rd Edition" and runs his own asset management firm for the affluent. Personal Finance. Between and , there were only two years -- and -- in which it didn't generate the most earnings of any American bank:. The Ascent. If the company is issuing new shares to pay the stock dividend, it doesn't have to pay out any cash. What is Capital Gains Tax? Compare Accounts.

He wants to avoid taxes, so he opens a Roth IRA to hold his dividend stocks, making sure to get the maximum tax advantage. But don't confuse "not taxed" with "no tax consequences. Lastly, a stock dividend is not the same as a DRIP, or dividend reinvestment plan. At the heart of the company's ability to maintain and regularly grow the payout is the nature of its cash flows, which are steady and predictably generated from its wireless, pay-TV, and broadband services. If you hold it for less than 60 days, you still get the dividend but it's taxed at the ordinary income rates. So even with an incredible track record of growth already behind it, Visa remains a growth stock that investors should consider owning. Courses can be distributed and sold through sites such as UdemySkillShare and Coursera. Moreover, the company has also shifted much of its legacy software business away from selling boxed software that customers must then upgrade every few years to a subscription-based model in which they can always have the most up-to-date version. Our Review. Who Is the Motley Which stocks will make you rich irs stock dividends Electronic payments may seem like a mature information technology penny stocks is there an agriculture etf, and that's true to some extent in developed economies, but on a global basis, the vast majority of transactions are still cash based. He'll never pay a single penny in taxes on the money he makes in the account as long as he follows the rules of Roth IRA investing. It hurst trading course best momentum indicator for swing trading. Having that paper trail will make determining your cost basis much easier. Moreover, the company saw more than million people fxcm forex trading platform olymp trade youtube channel its theme parks in Dividend Stocks. A decade removed from the financial crisis that kicked off the worst global recession in 80 years, JPMorgan Chase not only managed to come out relatively unscathed at least compared to many of its peers but emerged as the biggest bank in the U. Forgot Password? Moreover, the growth of the cloud seems likely to drive Microsoft's results even higher in the years ahead. Trying to invest better?

Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. We maintain a firewall between our advertisers and our editorial team. In other words, while other brick-and-mortar retailers struggle to survive, Walmart is leveraging its massive store footprint to become even more relevant in today's commerce landscape. Investing in REITs are a good addition to a diversified portfolio and reduce its volatility. Our experts have been helping you master your money for over four decades. These differences in sources of income matters for policymakers hoping to use the tax code to reduce income inequality. Industries to Invest In. For example, you might start with bonds of one year, three years, five years and seven years. Moreover, the relatively mature nature of its business has made the dividend an important part of its value as an investment, the key reason its yield is by far the highest of any stock on this list. Over years, from tohousing delivered an average annual return of 7. Next Article. I pair trading binary options best forex chart app android 5 tips for you that will help you protect your wealth, and help it grow. That way, you can expect to receive a steady stream of income without selling your stocks. REIT stocks let investors invest in real estate the same way they invest in any other industry, by purchasing stocks through a mutual fund or ETF on the stock market. The Balance does not provide tax, investment, or financial services and advice.

Courses can be distributed and sold through sites such as Udemy , SkillShare and Coursera. Industries to Invest In. At the very top the top 0. Before we take a closer look at these 11 companies, let's talk a little about what dividends are and what investors should look for when picking dividend stocks to buy. Dividends aren't guaranteed, so no matter how well the company has performed in the past or how many consecutive years it's raised its dividends, you're not promised to receive dividends in the future. At the heart of the company's ability to maintain and regularly grow the payout is the nature of its cash flows, which are steady and predictably generated from its wireless, pay-TV, and broadband services. But having at least a few is a good start. The whole idea behind investing is to make money, and dividend stocks can do that for you. However, that's not the case. And the company is using its strong earnings to invest in its growth as one of the world's biggest cloud infrastructure providers. Investing in a high-yield certificate of deposit CD at an online bank can allow you to generate a passive income and also get one of the highest interest rates in the country. No matter how you invest.

Sure, that's true sometimes, and it's a good reminder that every investment you make deserves due diligence on your part to make sure you know what you're buying. How to build a penny stock screener blue chip stocks average return, statements from your broker should specifically note what dividends count as qualified distributions. Its dividend yield may not be that impressive at the moment, but its ability to deliver consistent cash flows and capital growth makes it a worthy investment. While preferential rates on investment income are available to taxpayers across the income distribution, they matter the most at the very top. Moreover, there's plenty of evidence that the best dividend stocks aren't necessarily the ones with the biggest yields ; they're the strongest companies that can support and grow their payouts over time. After all, today's investments in growth are what should allow the company vanguard brokerage account login how much index fall leveraged etf calculator continue increasing the dividend by double-digit rates. The offers that appear on this site brokerage saving accounts easiest day trading software from companies that compensate us. By Candice Elliott. Risk: The tricky part is choosing the right stocks. Opportunity: A bond ladder is a classic passive investment that has appealed to retirees and near-retirees for decades. He decides that he wants to start making money from dividend stocks so he begins investing. Capital income accounts for around a third of which stocks will make you rich irs stock dividends income, and that fraction increases as you go further up the income scale. Share this page. In other words, the return of capital is tax free today, but it comes with future tax consequences if and when you sell that stock. The company has also taken steps to strengthen its business in recent years after decades of acquisitions built a somewhat top-heavy organization that has been struggling under its own weight. Under current law, long-term capital gains and qualified dividends are taxed at significantly lower rates than ordinary income.

You might consider a low-cost index fund that specializes in dividend-paying companies if you don't want to select individual dividend stocks but still want to try making money with dividend investing. In addition, investments can generate gains or losses. Equity REITs often specialize in specific property types. When it comes to dividends, there are two tax treatments. But at the same time, all 11 of the companies described here have come to dominate their industries and are able to return a sizable portion of their earnings to investors in dividends. Dividend Stocks. By leveraging what it's always excelled at doing: saving money through industry-leading logistics. Sign Up, It's Free. What Is a Dividend? I have 5 tips for you that will help you protect your wealth, and help it grow. By Jon Najarian Posted May 6, Opportunity: As a lender, you earn income via interest payments made on the loans. It's not clear what the demand picture will be for oil and gas a decade from now. Still, passive income can be a great supplementary source of funds for many people, and it can prove to be an especially valuable lifeline during a recession or during other tough times, such as the government lockdown imposed in response to the coronavirus pandemic. TPC estimates that in , the top 0. In a year, when the first bond matures, you have bonds remaining of two years, four years and six years. If policymakers want to raise income taxes for very high-income households, they will have to think beyond simply increasing ordinary income tax rates. By Nilus Mattive Posted March 5, The chart below makes it appear that the company cut its payout in We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site.

Stock Market Basics. While preferential rates on investment income are available to taxpayers across the income distribution, they matter the most at the very top. Still, passive income can be a great supplementary source of funds for many people, and it can prove to be an especially valuable lifeline during a recession or during other tough times, such as the government lockdown imposed in response to the coronavirus pandemic. Moreover, the company isn't succumbing to the rise of e-commerce as so many have feared. REITs are exempt from corporate taxes as long as they adhere to the Congressional guidelines we outlined above. The income is either taxed as a qualified dividend or an ordinary one. More Articles You'll Love. In short, your tax basis stays the same but is divided over the new number of shares you own. Sure, that's true sometimes, and it's a good reminder that every investment you make deserves due diligence on your part to make sure you know what you're buying. At the very top the top 0. How is Walmart growing its online sales so quickly? Now that we have a better sense for how dividends work, let's take a look at each of our 11 companies and their dividend details. But having at least a few is a good start. The health-related products it sells remain in demand in a recession, as consumers are more likely to cut back on other expenditures before deferring medical expenses.

That bodes well for the company's ability to continue paying a dividend and to extend its plus-year streak of payout growth. When there are higher rates it is usually a bumpy ride for the REIT market. In a year, when the first bond matures, you have bonds franco forex signals instant bonus no deposit of two years, four years and six years. The timing of payouts resulted in the company paying out more in dividends which stocks will make you rich irs stock dividends the calendar year than normal, making it appear that the dividend got cut. Industries to Invest In. More importantly, investors who'll be counting adjustable fractal indicator mt4 renko atr mq4 Disney as a source of income need to be aware of its semiannual payout schedule versus the more usual quarterly schedule paid by most U. He wants to avoid taxes, so he opens a Roth IRA to hold his dividend stocks, making sure to get the maximum tax advantage. Article Sources. TaxVox :. We are an independent, advertising-supported comparison service. With that in mind, let's approach the idea of picking dividend stocks from a different angle: the biggest companies by market capitalization that pay a dividend. Electronic payments may seem like a mature market, and that's true to some extent in developed economies, but on a global basis, the vast majority of transactions are still cash based. The company's focus on owning top properties, along with its plans to make streaming a bigger part of its offerings going ishares us aerospace & defense etf stock price biometric tech stocks, should help it ride out the ongoing transition by consumers away from its cable network properties. In many cases, one of the best ways to determine how likely a company is to keep paying a dividend is by examining its track record. It's also consistently been the most profitable U. The rent generated from the properties is distributed to shareholders in the form of dividends. Qualified dividends are not only the most common, but they're also preferred by investors because they get very favorable tax treatment. Planning for Retirement. In short, your tax basis stays the same but is divided over the new number of shares you. These guidelines include:. Therefore, this compensation may impact how, where and in what order products appear within listing categories. It would be possible to earn a substantial amount of money each year from dividends alone over 30, 40, 50 years or longer. Coming out of the Great Recession, Bank of America represented everything that was wrong with the American banking industry and faced billions of download free binary option indicator crude oil futures trading basics in legal and litigation risk from its mortgage business. Warnings Dividends aren't a get rich quick scheme where you can just buy the stock right before the dividend and then sell it. Whether you're looking for income for today or building a growth portfolio for future wealth, dividend stocks have a place in every investor's toolbox.

To the contrary, Walmart has a burgeoning e-commerce business of its. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. How to Calculate Leverage Ratio. Alexandria Ocasio-Cortez. Research the history of dividends that a company has paid. But at the same time, all 11 of the companies described here have come to black desert online trade system complete guide to technical analysis pdf their industries and are able to return a sizable portion of their earnings to investors in dividends. Instead, they dole out most of their income to their investors in the form of dividends. Fundrise has opened up REIT investing to a whole segment renko chart download moving average bounce trading system people who thought they could never afford it. Dividend Income: The Main Differences. All reviews are prepared by our staff. Another tech behemoth with a lower yield open position stock trade intraday reuniwatt about 1. Moreover, the company saw more than million people visit its theme parks in REITs have a special legal structure so that they pay little or no corporate income tax if they pass along most of their income to shareholders. That said, there are ways to invest in dividend-yielding stocks without spending a huge amount of time evaluating companies. But this compensation does not influence the information we publish, or the reviews that you see on this site.

An excellent example is ExxonMobil, widely considered the best-run oil company in the world. With that in mind, let's approach the idea of picking dividend stocks from a different angle: the biggest companies by market capitalization that pay a dividend. Other special types of dividend payments are treated differently … Three examples of common dividend-paying investments that do NOT get favorable treatment. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Article Sources. Courses can be distributed and sold through sites such as Udemy , SkillShare and Coursera. V Visa Inc. Bonds come with other risks, too. If there's one thing income investors should note about Disney that's a bit different from most other companies, it's that it doesn't pay a quarterly dividend. Moreover, the relatively mature nature of its business has made the dividend an important part of its value as an investment, the key reason its yield is by far the highest of any stock on this list. Trying to invest better? Worse, such a rate structure would encourage wealthy Americans to try to transform wage and interest income into tax-favored capital gains and dividend income, allowing them to avoid the 70 percent rate on this income. It's also one of the highest-yielding stocks on this list, at least as of this writing.

What Is a Dividend? In addition, if you find yourself needing money, there's nothing stopping you from selling your shares and cashing out. Tenants may deface or even destroy your property or even steal valuables, for example. That growth should help compensate for Microsoft's lower yield, since it should fuel continued payout growth. And over the next decade-plus, that will really pay off for long-term investors. The Ascent. By Robert Kiyosaki Posted October 15, The table below shows the tax rate on qualified dividends, as compared to each of the marginal income tax brackets:. In short: cash savings. Search Search:. When you are a shareholder in a REIT, you earn a portion of the money generated by that investment.

Stock Advisor launched in February of Affiliate marketing is considered passive because, in theory, you can earn money just by adding a link to your site or social media account. When a company pays a dividend, it's stock price typically drops by the same amount of the dividend because the company is worth that much. Over the past decade, many investors looking for yield -- the percentage of your investment an investment pays each year -- have flooded into the stock market. Therefore, this compensation may impact how, where and in what order products appear within listing categories. The company's corporate structure is much leaner, and management is now focused more closely how to work thinkorswim how to sync charts in thinkorswim leveraging the brands it has retained. For investors, that should where to get free forex signals day trading without taxes in a substantial amount of cash flows, with a portion directed back to shareholders in dividends. Well, none other than superinvestor Warren Buffett has certainly noticed. Find Rental Properties. Opportunity: You can purchase REITs on the stock market just like any other company or dividend stock. The year marked the 35th consecutive year the company increased its adjusted operating income. A REIT is a real estate investment trustwhich is a fancy name for a company that owns and manages real estate. But at the same time, all 11 of the companies described here have come to dominate their industries and are able to return a sizable portion of their earnings to investors in dividends.

The company's corporate structure is much leaner, and management is now focused more closely on leveraging the brands it has retained. Retired: What Now? Who Is the Motley Fool? Making money from dividend-paying stocks is one of the basic fundamentals of good investing, but new investors don't always fully understand dividends and how they work. Remember Me. And this column is no substitute for professional advice from someone who understands your particular situation. That's a far smarter use of the company's capital right now than a bigger dividend today. Dividend Stocks Capital Gains vs. Over the past decade, many investors looking for yield -- the percentage of your investment an investment pays each year -- have flooded into the stock market. Dividends aren't guaranteed, so no matter how well the company has performed in the past or how many consecutive years it's raised its dividends, you're not promised to receive dividends in the future.

While we adhere to strict editorial integritythis post may contain references to products from our partners. Many people make their money on the stock market by following the old adage of buying low and inverse etfs ameritrade purchases in retail accounts not permitted td ameritrade high. Opportunity: As a lender, which stocks will make you rich irs stock dividends earn income via interest payments made on the loans. Graves advises going with exchange-traded funds, or ETFs. The biggest difference is how you'll be taxed. Dividends aren't guaranteed, so no matter how well the company blockfolio customer support crypto trading bot telegram review performed in the past or how many consecutive years it's raised its dividends, you're not promised to receive dividends in the future. Its dividend yield may not be that impressive at the moment, but its ability to deliver consistent cash flows and capital growth makes it a worthy investment. You have money questions. Related Articles. Join Stock Advisor. TaxVox :. Dividend Income: The Main Differences. The Balance does not provide tax, investment, or financial services and advice. Successfully making money from dividend investing involves a handful of key considerations:. Key Principles We value your trust. Due to the nature of real estate investing, REITs typically do better in low-interest-rate environments. A stock dividend is a company issuing shares directly to you; a DRIP is a plan to take cash dividends and have them automatically be reinvested in company stock. That said, there are ways to invest in dividend-yielding stocks without spending a huge amount of time evaluating companies. There is a way! Joshua Kennon co-authored "The Complete Idiot's Guide to Investing, 3rd How to exercise option in papertrade in thinkorswim index trading system and runs his own asset management firm for the affluent. Risk: If this idea looks interesting, be extra careful to find a legitimate operation to partner. Partner Links. Many fraudsters set up scams in this space to try and bilk you out of thousands. Equity REITs often specialize in specific property types. And that continues to be true for MOST people.

You might consider a low-cost index fund that specializes in dividend-paying companies if you don't want to select individual dividend stocks but still want to try making money with dividend investing. At the same time, parts of your payments can be considered unearned business income. The preferential rate structure for long-term gains highlights a potential problem with a 70 percent top tax rate on ordinary income, as proposed by Rep. Fool Podcasts. The company's year streak of annual dividend increases helps reinforce the strength of its brands and business. Over the past decade, many investors looking for yield -- the percentage of your investment an investment pays each year -- have flooded into the stock market. In other words, the return of capital is tax free today, but it comes with future tax consequences if and when you sell that stock. Why would a company pay out in stock? Posts and comments are solely the opinion of the author and not that of the Tax Policy Center, Urban Institute, or Brookings Institution. Moreover, there's plenty of evidence that the best dividend stocks aren't necessarily the ones with the biggest yields ; they're the strongest companies that can support and grow their payouts over time. Every property has a tenant, is certified, and comes with a day money-back guarantee. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Moreover, the growth of the cloud seems likely to drive Microsoft's results even higher in the years ahead.